Form 706 D Rev October United States Additional Estate Tax Return under Code Section 2057

What is the Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

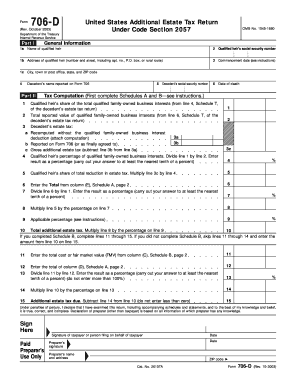

The Form 706 D Rev October is a specific tax form used in the United States for reporting additional estate tax under Section 2057 of the Internal Revenue Code. This form is typically required when an estate has a qualified family-owned business interest. It allows the executor of the estate to claim a deduction for the value of the business interest, which can significantly reduce the estate tax liability. Understanding this form is crucial for ensuring compliance with federal tax regulations and for optimizing the tax responsibilities of the estate.

How to use the Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

Using the Form 706 D Rev October involves several steps to ensure accurate completion and submission. Executors must first gather all necessary documentation related to the estate and the family-owned business interest. The form requires detailed information about the decedent, the estate, and the business, including its value and the nature of the business operations. After filling out the form, it must be signed by the executor and filed with the IRS, typically alongside other estate tax forms. Proper use of this form can help in claiming deductions and ensuring compliance with tax obligations.

Steps to complete the Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

Completing the Form 706 D Rev October involves a systematic approach:

- Gather all required documentation, including the decedent's financial records and details about the family-owned business.

- Fill in the decedent's information, including name, date of death, and Social Security number.

- Provide details about the estate, including total assets and liabilities.

- Detail the family-owned business interest, including its valuation and how it qualifies under Section 2057.

- Complete any additional schedules as required, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before signing it.

- Submit the form to the IRS by the designated filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706 D Rev October are critical for compliance. Generally, the form must be filed within nine months of the decedent's date of death. Extensions may be available, but they must be requested in advance. It is essential to keep track of these deadlines to avoid penalties and ensure that the estate's tax matters are handled promptly. Executors should also be aware of any state-specific deadlines that may apply.

Required Documents

To complete the Form 706 D Rev October, several documents are necessary:

- The decedent's death certificate.

- Financial statements for the family-owned business.

- Appraisals or valuations of the business interest.

- Records of any debts or liabilities associated with the estate.

- Previous tax returns of the decedent, if applicable.

Having these documents ready will facilitate a smoother completion process and ensure that all required information is accurately reported.

Penalties for Non-Compliance

Failure to file the Form 706 D Rev October by the deadline can result in significant penalties. The IRS may impose a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent. Additionally, interest may accrue on any unpaid tax from the due date until the tax is paid in full. Executors should be diligent in meeting filing requirements to avoid these financial repercussions.

Quick guide on how to complete form 706 d rev october united states additional estate tax return under code section 2057

Complete [SKS] effortlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all details carefully and click on the Done button to preserve your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign [SKS] and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

Create this form in 5 minutes!

How to create an eSignature for the form 706 d rev october united states additional estate tax return under code section 2057

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057?

Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057 is a tax form used to report additional estate taxes owed by the estate of a deceased individual. It helps ensure compliance with the Internal Revenue Code, specifically section 2057, concerning tax obligations on certain inherited properties.

-

How can airSlate SignNow help with the submission of Form 706 D Rev October?

airSlate SignNow offers an efficient platform for eSigning and sending Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057. Its user-friendly interface simplifies the process, ensuring that your tax documents are completed and submitted securely and quickly.

-

What are the pricing options for using airSlate SignNow for Form 706 D Rev October?

airSlate SignNow provides cost-effective pricing plans tailored to suit various business needs, including those needing to manage Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057. You can choose from monthly or annual subscriptions to find the plan that best fits your budget.

-

Are there any integrations available for managing Form 706 D Rev October?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057 alongside your other business tools. This integration enhances productivity by streamlining your document workflow and ensuring that everything is in one place.

-

What features does airSlate SignNow offer for eSigning documents like Form 706 D Rev October?

airSlate SignNow provides robust eSigning features designed to enhance your experience with documents such as Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057. This includes multi-party signing, customizable templates, and secure storage, all aimed at simplifying your document management process.

-

Can I track the status of my submitted Form 706 D Rev October with airSlate SignNow?

Absolutely! airSlate SignNow allows users to track the status of their documents, including Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057. This feature provides peace of mind, ensuring that you are informed about when your forms are signed and when they are sent to the IRS.

-

Is airSlate SignNow secure for handling sensitive documents like Form 706 D Rev October?

Yes, airSlate SignNow prioritizes the security of your information. When handling sensitive documents such as Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057, the platform employs advanced encryption and security measures to protect your data against unauthorized access.

Get more for Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

Find out other Form 706 D Rev October United States Additional Estate Tax Return Under Code Section 2057

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement