5 Catalog Number 16728N Form 656 Offer in Compromise This Offer in Compromise Package Includes I Information You Need to Know Be

Understanding the 5 Catalog Number 16728N Form 656 Offer In Compromise

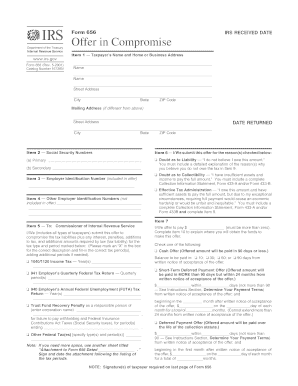

The 5 Catalog Number 16728N Form 656 Offer In Compromise is a crucial document for taxpayers seeking to settle their tax debts with the IRS. This form allows individuals to propose a settlement amount that is less than the total tax liability owed. By submitting this form, taxpayers can potentially alleviate the financial burden of their tax obligations. It is essential to understand the components of this form, including the necessary information and the specific offers that can be submitted.

Steps to Complete the 5 Catalog Number 16728N Form 656 Offer In Compromise

Completing the Form 656 involves several steps to ensure accuracy and compliance with IRS requirements. First, gather all pertinent financial information, including income, expenses, and assets. Next, accurately fill out the form, providing details about your tax situation and the offer you are proposing. It is important to attach Form 433-A, which provides a comprehensive overview of your financial status. Finally, review the completed form for any errors before submitting it to the IRS.

Required Documents for Submission

When submitting the Form 656 Offer In Compromise, several supporting documents are necessary to validate your offer. These documents typically include:

- Form 433-A, Collection Information Statement

- Proof of income, such as pay stubs or bank statements

- Documentation of monthly expenses

- Asset information, including real estate and personal property

Providing complete and accurate documentation is crucial for the IRS to evaluate your offer effectively.

Eligibility Criteria for the 5 Catalog Number 16728N Form 656 Offer In Compromise

To qualify for an Offer In Compromise, taxpayers must meet specific eligibility criteria established by the IRS. Generally, you must demonstrate an inability to pay the full tax liability, which can be assessed through your financial situation. The IRS considers factors such as income, expenses, asset equity, and overall ability to pay. Additionally, you must be compliant with all filing and payment requirements to be eligible for consideration.

Filing Deadlines and Important Dates

Timeliness is critical when submitting the Form 656 Offer In Compromise. While there are no strict deadlines for submitting an offer, it is advisable to file as soon as possible, especially if you are facing collection actions. The IRS typically takes several months to process offers, so submitting early can help alleviate immediate financial pressures. Keep track of any correspondence from the IRS regarding your offer to ensure compliance with any deadlines they may set.

Form Submission Methods

The Form 656 can be submitted to the IRS through various methods. Taxpayers have the option to file the form by mail, ensuring that it is sent to the correct IRS address based on their location. Additionally, some taxpayers may have the ability to submit their offer electronically, depending on their specific circumstances. It is important to check the IRS guidelines for the most current submission methods available.

Quick guide on how to complete 5 catalog number 16728n form 656 offer in compromise this offer in compromise package includes i information you need to know

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the relevant form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without setbacks. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign [SKS] and promote excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 5 Catalog Number 16728N Form 656 Offer In Compromise This Offer In Compromise Package Includes I Information You Need To Know Be

Create this form in 5 minutes!

How to create an eSignature for the 5 catalog number 16728n form 656 offer in compromise this offer in compromise package includes i information you need to know

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5 Catalog Number 16728N Form 656 Offer In Compromise?

The 5 Catalog Number 16728N Form 656 Offer In Compromise is a crucial document used for submitting an Offer in Compromise to the IRS. This Offer in Compromise package includes all the information you need to know before submitting an Offer in Compromise, as well as detailed instructions on the types of offers you can submit, including Form 433 A.

-

What information is included in the Offer In Compromise package?

The Offer In Compromise package includes key information you need to know before submitting your application. You will find instructions on the types of offers you can submit, including guidelines for completing Form 433 A to support your offer, ensuring you have all necessary details covered.

-

How much does the Offer In Compromise package cost?

The cost of obtaining the 5 Catalog Number 16728N Form 656 Offer In Compromise package typically involves fees for professional assistance or preparation services. It's important to compare options to find a cost-effective solution that meets your needs while delivering the necessary support for the submission of your Offer in Compromise.

-

What are the benefits of using the 5 Catalog Number 16728N Form 656?

Using the 5 Catalog Number 16728N Form 656 Offer In Compromise can provide signNow benefits, such as potential tax relief from your IRS obligations. This package equips you with complete information and instructions, streamlining the complex process of submitting an offer and enabling you to better navigate the requirements.

-

Can I submit an Offer In Compromise without professional help?

Yes, you can submit an Offer In Compromise on your own using the 5 Catalog Number 16728N Form 656, but professional help may enhance the success rate of your submission. The package includes all necessary information and instructions, making it possible to complete without an advisor; however, an expert can provide valuable insight and support.

-

What types of offers can I submit with the Offer In Compromise package?

The 5 Catalog Number 16728N Form 656 Offer In Compromise package outlines specific types of offers you can submit based on your financial situation. These typically include lump-sum offers and periodic payment offers, along with detailed instructions on how to complete and present your offer to the IRS.

-

Is the Offer In Compromise package suitable for businesses?

Yes, the 5 Catalog Number 16728N Form 656 Offer In Compromise package is suitable for both individual taxpayers and businesses seeking relief from tax debts. The materials provided include information relevant to various scenarios, making it a versatile option for users with different financial challenges.

Get more for 5 Catalog Number 16728N Form 656 Offer In Compromise This Offer In Compromise Package Includes I Information You Need To Know Be

- Maryland unclaimed property form

- Haj bhawan post matric scholarship forn form

- Application for admission application form himalayan institute

- Ameriprise financial durable power of attorney form

- 1040 quickfinder handbook pdf form

- Chronic low back pain questionnaire images form

- Composer biography worksheet form

- Nwmls rescission form

Find out other 5 Catalog Number 16728N Form 656 Offer In Compromise This Offer In Compromise Package Includes I Information You Need To Know Be

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT