Form 990 Fill in Version Return of Organization Exempt from Income Tax

What is the Form 990 Fill in Version Return Of Organization Exempt From Income Tax

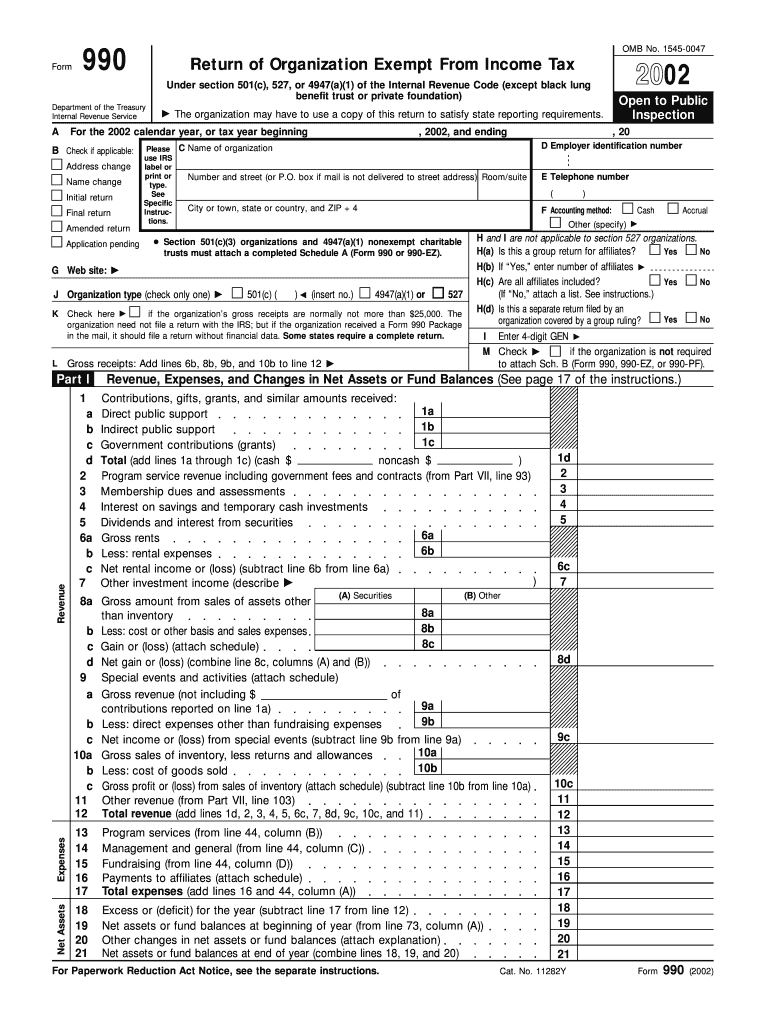

The Form 990 Fill in Version Return Of Organization Exempt From Income Tax is a crucial document for tax-exempt organizations in the United States. It provides the Internal Revenue Service (IRS) with essential information about the organization’s financial activities, governance, and compliance with tax regulations. This form is designed for organizations that are exempt from income tax under Section 501(c)(3) and other sections of the Internal Revenue Code. By filing Form 990, organizations demonstrate transparency and accountability, which is vital for maintaining their tax-exempt status.

How to use the Form 990 Fill in Version Return Of Organization Exempt From Income Tax

Using the Form 990 Fill in Version involves several steps to ensure accurate reporting. Organizations must gather financial data, including revenue, expenses, and assets. The form consists of multiple sections that require detailed information about the organization’s mission, programs, and governance. Each section must be completed thoroughly, as incomplete forms may lead to penalties or delays in processing. Organizations can fill out the form digitally, which simplifies the process and allows for easy corrections if needed.

Steps to complete the Form 990 Fill in Version Return Of Organization Exempt From Income Tax

Completing the Form 990 Fill in Version requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Review the organization’s mission and program descriptions to ensure accurate representation.

- Fill out each section of the form, providing all required information, including revenue sources and expenses.

- Include any supplementary schedules that may apply to your organization, such as Schedule A for public charities.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Form 990 Fill in Version Return Of Organization Exempt From Income Tax

The Form 990 contains several key elements that organizations must address. These include:

- Basic Information: This section includes the organization’s name, address, and Employer Identification Number (EIN).

- Financial Statements: Organizations must report their revenue, expenses, and changes in net assets.

- Program Service Accomplishments: This section highlights the organization’s mission and the impact of its programs.

- Governance: Information about the board of directors and governance policies is required.

- Disclosure Requirements: Organizations must disclose any relationships with related organizations or individuals.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Fill in Version are critical for compliance. Generally, organizations must file their Form 990 by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the filing deadline would be May 15 of the following year. Extensions may be available, but they must be requested before the original deadline. It is essential for organizations to keep track of these dates to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 990 Fill in Version can result in significant penalties for organizations. The IRS imposes fines for late filings, which can accumulate over time. Additionally, organizations that fail to file for three consecutive years may automatically lose their tax-exempt status. It is crucial for organizations to understand these penalties and prioritize timely and accurate submissions to maintain compliance and protect their status.

Quick guide on how to complete form 990 fill in version return of organization exempt from income tax

Prepare [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Fill in Version Return Of Organization Exempt From Income Tax

Create this form in 5 minutes!

How to create an eSignature for the form 990 fill in version return of organization exempt from income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

The Form 990 Fill in Version Return Of Organization Exempt From Income Tax is a tax return used by tax-exempt organizations to provide information about their activities, governance, and financial data. This form helps organizations comply with IRS requirements and maintain their tax-exempt status.

-

How can airSlate SignNow assist with the Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

airSlate SignNow offers a user-friendly platform for preparing, signing, and submitting the Form 990 Fill in Version Return Of Organization Exempt From Income Tax. Our solution streamlines the process, allowing organizations to efficiently manage their paperwork and ensure compliance.

-

Is there a cost associated with using airSlate SignNow for Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

Yes, airSlate SignNow provides affordable pricing options tailored to the needs of organizations handling the Form 990 Fill in Version Return Of Organization Exempt From Income Tax. We offer various plans that cater to different organizational sizes and requirements, ensuring a cost-effective solution.

-

What features does airSlate SignNow offer for managing Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

airSlate SignNow includes features such as document templates, eSigning, and secure storage, specifically designed for the Form 990 Fill in Version Return Of Organization Exempt From Income Tax. These tools help simplify the filing process and improve operational efficiency.

-

Can I integrate airSlate SignNow with other software for handling Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

Absolutely! airSlate SignNow supports various integrations with leading software solutions, enhancing your ability to handle the Form 990 Fill in Version Return Of Organization Exempt From Income Tax. This allows for seamless data transfer and improved workflow management.

-

What are the benefits of using airSlate SignNow for Form 990 Fill in Version Return Of Organization Exempt From Income Tax?

Using airSlate SignNow for the Form 990 Fill in Version Return Of Organization Exempt From Income Tax ensures easy document management, reduced processing time, and enhanced compliance. Our platform is designed to empower organizations, enabling them to focus on their mission rather than paperwork.

-

How secure is airSlate SignNow when handling Form 990 Fill in Version Return Of Organization Exempt From Income Tax documents?

Security is a priority at airSlate SignNow. We implement advanced security measures, including encryption and secure access controls, to protect your Form 990 Fill in Version Return Of Organization Exempt From Income Tax documents, ensuring confidentiality and compliance with relevant regulations.

Get more for Form 990 Fill in Version Return Of Organization Exempt From Income Tax

Find out other Form 990 Fill in Version Return Of Organization Exempt From Income Tax

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document