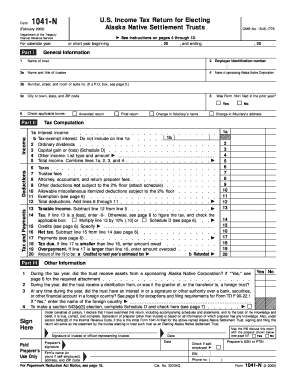

Form 1041 N February Department of the Treasury Internal Revenue Service U

What is the Form 1041 N February Department Of The Treasury Internal Revenue Service U

The Form 1041 N is a tax form used by estates and trusts to report income, deductions, gains, and losses. This form is specifically designed for fiduciaries managing estates or trusts that are required to file income tax returns. The "N" designation indicates that it is a state-specific version, which may include unique requirements based on the regulations of the state in which the estate or trust operates.

How to use the Form 1041 N February Department Of The Treasury Internal Revenue Service U

To utilize the Form 1041 N effectively, fiduciaries must gather all necessary financial information related to the estate or trust. This includes income from various sources, deductions for expenses, and any applicable credits. The form must be filled out accurately, reflecting the financial activities of the estate or trust during the tax year. Once completed, the form should be submitted to the appropriate tax authority as specified by state regulations.

Steps to complete the Form 1041 N February Department Of The Treasury Internal Revenue Service U

Completing the Form 1041 N involves several key steps:

- Gather all financial documents related to the estate or trust.

- Fill in the identifying information, including the name and taxpayer identification number.

- Report all income earned by the estate or trust during the tax year.

- Detail any deductions that are applicable, such as administrative expenses or distributions to beneficiaries.

- Calculate the total tax liability based on the reported income and deductions.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 N can vary based on the tax year and specific state requirements. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. It is essential for fiduciaries to be aware of these deadlines to avoid penalties and ensure compliance with tax regulations.

Required Documents

To complete the Form 1041 N, fiduciaries must have several documents on hand, including:

- Financial statements for the estate or trust.

- Records of income received, such as interest, dividends, and rental income.

- Documentation of expenses incurred, including receipts for administrative costs.

- Information on distributions made to beneficiaries.

Penalties for Non-Compliance

Failure to file the Form 1041 N on time or inaccuracies in reporting can lead to significant penalties. These may include fines and interest on unpaid taxes. It is crucial for fiduciaries to ensure that the form is completed accurately and submitted by the deadline to avoid these consequences.

Quick guide on how to complete form 1041 n february department of the treasury internal revenue service u

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-driven process today.

The Simplest Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Mark important parts of the documents or conceal sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require reprinting new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 N February Department Of The Treasury Internal Revenue Service U

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n february department of the treasury internal revenue service u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 N February Department Of The Treasury Internal Revenue Service U?

Form 1041 N February Department Of The Treasury Internal Revenue Service U is used by estates and trusts to report income, deductions, and other tax-related information to the IRS. Understanding this form is crucial for accurate tax reporting and compliance for fiduciaries. Using airSlate SignNow can streamline the process of completing and submitting this form.

-

How can airSlate SignNow help with Form 1041 N February Department Of The Treasury Internal Revenue Service U?

airSlate SignNow offers a user-friendly platform to electronically sign and submit Form 1041 N February Department Of The Treasury Internal Revenue Service U. Our solutions simplify the document management process, ensuring that your forms are completed accurately and efficiently. You can streamline your workflow and save time while staying compliant.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides various pricing plans tailored to meet the needs of different users. Each plan is designed to offer flexibility and value, ensuring access to features that can assist in handling Form 1041 N February Department Of The Treasury Internal Revenue Service U effectively. Please visit our pricing page for detailed information on each option.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes with a range of features including eSignature capabilities, document templates, and automated workflows. These features can be invaluable when dealing with Form 1041 N February Department Of The Treasury Internal Revenue Service U, allowing for easy customization and efficient handling of documents. Our platform also ensures security and compliance with industry standards.

-

How does airSlate SignNow ensure security for my documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage to protect all documents, including those related to Form 1041 N February Department Of The Treasury Internal Revenue Service U. Our compliance with industry regulations ensures that your sensitive information remains confidential and protected.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow can be integrated with various applications to enhance your workflow. This includes accounting software and cloud storage services, making it easier to manage your Form 1041 N February Department Of The Treasury Internal Revenue Service U documents. Seamless integration means you can work with your existing tools without disruption.

-

What are the benefits of using airSlate SignNow for Form 1041 N?

Using airSlate SignNow for Form 1041 N February Department Of The Treasury Internal Revenue Service U comes with numerous benefits. You gain access to an efficient platform that boosts productivity, reduces manual errors, and enhances the speed of document processing. Our solutions simplify compliance, ensuring you meet deadlines effectively.

Get more for Form 1041 N February Department Of The Treasury Internal Revenue Service U

- Georgia immunization form

- Claim voucher town of brookhaven brookhaven form

- Credit bureau business plan ukraine source pdf usaid pdf usaid form

- Referral form trilogy health insurance

- Rosa and blanca trifold scottsboro scottsboro form

- The guest list pdf form

- English literature from 1550 to 1798 notes form

- Chinese sentences pdf form

Find out other Form 1041 N February Department Of The Treasury Internal Revenue Service U

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer