Form 1098 T Fill in Version Tuition Payments Statement

What is the Form 1098-T Fill in Version Tuition Payments Statement

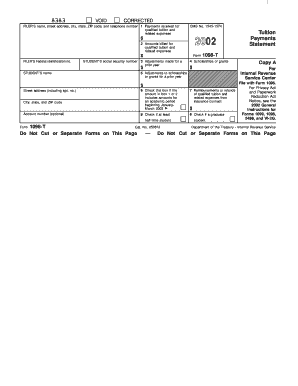

The Form 1098-T, officially known as the Tuition Payments Statement, is a tax form used by eligible educational institutions in the United States to report information about qualified tuition and related expenses. This form is essential for students and their families as it helps in claiming education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit. The fill-in version of the form allows institutions to provide detailed information about the tuition payments made on behalf of students, including amounts billed and any scholarships or grants received.

How to use the Form 1098-T Fill in Version Tuition Payments Statement

The Form 1098-T is primarily used by students and their families to determine eligibility for tax credits related to education expenses. To utilize the form effectively, individuals should review the information provided, including tuition amounts and any financial aid received. When preparing tax returns, taxpayers can refer to the form to accurately report educational expenses and maximize potential tax benefits. It is advisable to keep the form with other tax documents for easy reference during tax season.

Steps to complete the Form 1098-T Fill in Version Tuition Payments Statement

Completing the Form 1098-T involves several steps:

- Gather necessary information, including student details, tuition amounts, and any scholarships or grants.

- Fill in the student’s name, address, and taxpayer identification number.

- Report the amounts billed for qualified tuition and related expenses in the appropriate boxes.

- Include any adjustments made for prior years, if applicable.

- Verify all information for accuracy before submission.

Key elements of the Form 1098-T Fill in Version Tuition Payments Statement

The Form 1098-T contains several key elements that are crucial for both educational institutions and students:

- Box 1: Reports the total payments received for qualified tuition and related expenses.

- Box 2: Previously used to report amounts billed, now generally left blank.

- Box 5: Shows the total amount of scholarships or grants received.

- Box 4: Indicates any adjustments made for prior years.

- Box 6: Reflects any adjustments to scholarships or grants for prior years.

Legal use of the Form 1098-T Fill in Version Tuition Payments Statement

The Form 1098-T is legally required for educational institutions to report tuition payments to the IRS. Students must receive this form to claim education tax credits accurately. Failure to provide accurate information on the form can lead to penalties for both the institution and the taxpayer. It is important for students to ensure that the information reported aligns with their financial records to avoid discrepancies during tax filing.

Who Issues the Form 1098-T Fill in Version Tuition Payments Statement

The Form 1098-T is issued by eligible educational institutions, including colleges, universities, and vocational schools, that participate in federal student aid programs. These institutions are responsible for providing the form to students by January 31 of the following tax year. It is essential for students to verify that they receive this form to ensure they can take advantage of available tax benefits related to their education expenses.

Quick guide on how to complete form 1098 t fill in version tuition payments statement

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can acquire the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1098 T Fill in Version Tuition Payments Statement

Create this form in 5 minutes!

How to create an eSignature for the form 1098 t fill in version tuition payments statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1098 T Fill in Version Tuition Payments Statement?

The Form 1098 T Fill in Version Tuition Payments Statement is a tax form used by educational institutions to report tuition payments received from students. This form can help students and their families identify potential tax credits, making it a crucial document for tax reporting. Understanding its contents and how to fill it correctly can signNowly ease the tax filing process.

-

How can airSlate SignNow help with the Form 1098 T Fill in Version Tuition Payments Statement?

With airSlate SignNow, you can easily create, fill, and eSign the Form 1098 T Fill in Version Tuition Payments Statement. Our platform simplifies the process of managing tax documents, ensuring accuracy and compliance. You can streamline your workflow by utilizing templates dedicated to tax forms, making it straightforward to generate completed statements quickly.

-

Is there a cost associated with using airSlate SignNow for the Form 1098 T Fill in Version Tuition Payments Statement?

AirSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for managing the Form 1098 T Fill in Version Tuition Payments Statement. Our plans include essential features for businesses, allowing you to choose one that fits your budget. For specific details about pricing, you can visit our website or signNow out to our sales team.

-

What features does airSlate SignNow offer for handling the Form 1098 T Fill in Version Tuition Payments Statement?

AirSlate SignNow provides features like customizable templates, electronic signatures, and secure document storage for the Form 1098 T Fill in Version Tuition Payments Statement. You can also collaborate in real-time with others and track document status easily. These features ensure that your process is efficient and compliant with legal standards.

-

Can I use airSlate SignNow to integrate with other software for the Form 1098 T Fill in Version Tuition Payments Statement?

Yes, airSlate SignNow offers numerous integrations with popular software solutions to enhance your experience with the Form 1098 T Fill in Version Tuition Payments Statement. You can easily connect with accounting and tax software, CRM systems, and more to streamline your document management process. This integration capability allows for seamless data flow across platforms.

-

What are the benefits of using airSlate SignNow for the Form 1098 T Fill in Version Tuition Payments Statement?

Using airSlate SignNow for the Form 1098 T Fill in Version Tuition Payments Statement offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround with eSigning, saving you time. Additionally, all transactions are securely stored and compliant, safeguarding your sensitive information.

-

Is there customer support available for assistance with the Form 1098 T Fill in Version Tuition Payments Statement?

Absolutely! AirSlate SignNow provides comprehensive customer support to assist you with any questions or issues related to the Form 1098 T Fill in Version Tuition Payments Statement. Our support team is available via chat, email, and phone, ensuring you have the guidance you need. Whether it's about features or a specific document, we're here to help.

Get more for Form 1098 T Fill in Version Tuition Payments Statement

Find out other Form 1098 T Fill in Version Tuition Payments Statement

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document