Form 1120 F Fill in Version U S Income Tax Return of a Foreign Corporation

What is the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

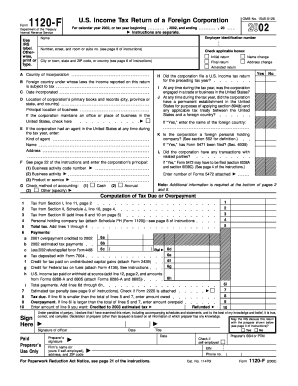

The Form 1120 F is a U.S. income tax return specifically designed for foreign corporations operating within the United States. This form allows foreign entities to report their income, gains, losses, deductions, and credits, ensuring compliance with U.S. tax laws. It is essential for foreign corporations to file this form if they have income that is effectively connected with a trade or business in the U.S. Additionally, the form helps determine the corporation's tax liability and eligibility for any applicable tax treaties.

How to use the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

Using the Form 1120 F involves several steps to ensure accurate reporting of a foreign corporation's income. First, the corporation must gather all necessary financial documents, including income statements and balance sheets. Next, the entity should carefully fill out the form, providing detailed information about income sources, deductions, and credits. It is crucial to follow the IRS guidelines closely to avoid errors that could lead to penalties. Finally, once the form is completed, it must be submitted to the IRS by the designated deadline, either electronically or by mail.

Steps to complete the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

Completing the Form 1120 F involves a systematic approach:

- Gather all relevant financial documents, including income, expenses, and deductions.

- Begin filling out the form by entering the corporation's identifying information, such as name and address.

- Report all effectively connected income, including gross receipts and other income sources.

- Detail any deductions the corporation is eligible for, which may include operating expenses and depreciation.

- Calculate the corporation's tax liability based on the reported income and deductions.

- Review the completed form for accuracy, ensuring all required fields are filled in correctly.

- Submit the form to the IRS by the appropriate deadline.

Key elements of the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

The Form 1120 F consists of several key elements that are essential for accurate reporting:

- Identification Section: This includes the corporation's name, address, and Employer Identification Number (EIN).

- Income Section: Report all effectively connected income, including gross receipts and other income sources.

- Deductions Section: Detail all allowable deductions, such as business expenses and depreciation.

- Tax Calculation: Calculate the total tax liability based on the net income after deductions.

- Signature Section: An authorized officer must sign the form to certify its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 F are critical to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is typically due by April 15. Extensions may be available, but they must be requested prior to the original deadline. It is important to stay informed about any changes to filing dates or requirements from the IRS.

Penalties for Non-Compliance

Failure to file the Form 1120 F on time can result in significant penalties for foreign corporations. The IRS imposes a penalty for late filing, which can accumulate daily until the form is submitted. Additionally, if the corporation fails to pay any taxes owed, interest will accrue on the unpaid amount. Non-compliance can also lead to further scrutiny from the IRS, potentially resulting in audits or additional legal consequences. It is crucial for foreign corporations to adhere to all filing requirements to avoid these penalties.

Quick guide on how to complete form 1120 f fill in version u s income tax return of a foreign corporation 1662514

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details carefully and then click the Done button to finalize your changes.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your selected device. Modify and eSign [SKS] while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

Create this form in 5 minutes!

How to create an eSignature for the form 1120 f fill in version u s income tax return of a foreign corporation 1662514

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

The Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation is a tax form used by foreign corporations to report their income, gains, losses, deductions, and credits. This form helps ensure that foreign entities comply with U.S. tax regulations. Completing this form accurately is crucial for avoiding penalties and maintaining compliance.

-

How does airSlate SignNow simplify the signing process for the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow streamlines the signing process by allowing users to electronically sign the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation quickly and securely. The platform’s intuitive design ensures that users can easily navigate through the form, adding signatures and required information in just a few clicks. This efficiency helps save time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of various users, whether individuals or businesses. Plans start with a basic tier providing essential features, with premium options that include advanced functionalities for handling forms like the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation. It’s best to check the website for the latest pricing details and promotions.

-

Can I integrate airSlate SignNow with other software for handling the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing the functionality for managing the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation. This integration allows users to sync their documents across platforms, improving collaboration and workflow efficiency. You can connect with CRM, cloud storage, and other tools to optimize your filing process.

-

What are the benefits of using airSlate SignNow for the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

Using airSlate SignNow to complete the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation can signNowly reduce processing time and ensure accuracy. The platform’s electronic signature capabilities offer legal compliance while making it easy to collect and manage signatures from multiple parties. Additionally, users benefit from enhanced security measures that protect sensitive information.

-

Is airSlate SignNow compliant with IRS regulations for the Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation?

Absolutely! airSlate SignNow is designed to comply with IRS regulations, ensuring that your Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation is handled in accordance with the law. The platform’s security measures protect both data integrity and user privacy, making it a trusted choice for tax forms and other sensitive documents.

-

How can I track the status of my Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation in airSlate SignNow?

airSlate SignNow provides real-time tracking features that allow users to monitor the status of their Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation. You can see who has accessed or signed the document, and receive notifications for any changes or updates. This tracking capability enhances your workflow by keeping you informed throughout the process.

Get more for Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

Find out other Form 1120 F Fill in Version U S Income Tax Return Of A Foreign Corporation

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF