Form 2210 Fill in Version Underpayment of Estimated Tax by Individuals, Estates and Trusts

What is the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

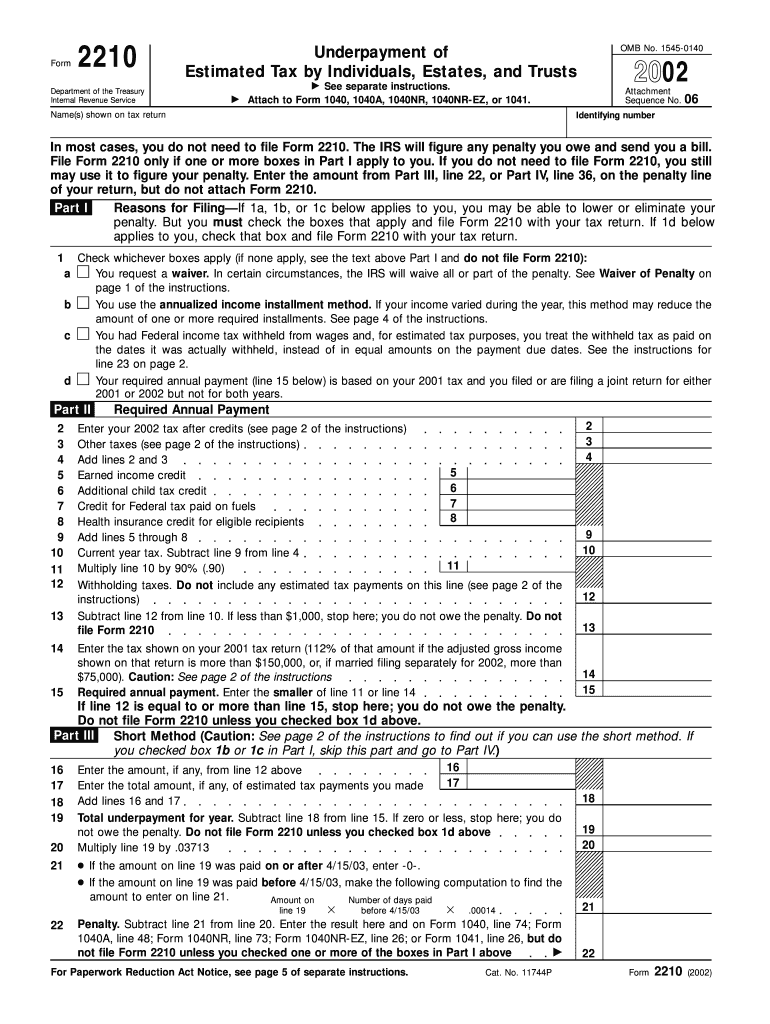

The Form 2210 Fill in Version is a tax form used by individuals, estates, and trusts to calculate any underpayment of estimated tax. This form is crucial for taxpayers who may not have paid enough tax throughout the year, which can result in penalties. It helps determine whether an underpayment exists and the amount owed. Understanding this form is essential for compliance with IRS regulations and for avoiding additional financial liabilities.

How to use the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Using the Form 2210 Fill in Version involves several steps to ensure accurate completion. Taxpayers must first gather their income information and any previous tax payments made during the year. The form guides users through calculating the required estimated tax payments based on their income. It also provides a way to indicate any exceptions that may apply, helping to clarify whether penalties for underpayment are applicable. Proper use of the form can significantly ease the tax filing process.

Steps to complete the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Completing the Form 2210 involves a systematic approach:

- Begin by entering personal information, including your name and Social Security number.

- Calculate your total tax liability for the year using your income and deductions.

- Determine the total amount of estimated tax payments made during the year.

- Use the provided calculations to assess if an underpayment has occurred.

- Complete any applicable sections regarding exceptions to the penalty.

- Review the form for accuracy before submission.

Key elements of the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Several key elements are essential when filling out the Form 2210. These include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Tax Liability Calculation: A detailed breakdown of total income, deductions, and tax owed.

- Estimated Payments: A record of all estimated tax payments made throughout the year.

- Penalty Calculation: A section for determining if penalties apply based on underpayment.

- Exceptions: Areas where taxpayers can indicate if they qualify for exceptions to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2210 are typically aligned with the annual tax return deadlines. Taxpayers should be aware that the standard due date for individual tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to file the form by the due date to avoid penalties and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to accurately complete and submit the Form 2210 can result in penalties imposed by the IRS. These penalties may include interest on unpaid tax amounts and additional charges for underpayment. Understanding the potential consequences of non-compliance emphasizes the importance of timely and accurate filing. Taxpayers should ensure they are aware of their payment obligations to avoid these penalties.

Quick guide on how to complete form 2210 fill in version underpayment of estimated tax by individuals estates and trusts

Effortlessly Manage [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Obtain Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a standard handwritten signature.

- Review all details and click on the Finish button to store your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 2210 fill in version underpayment of estimated tax by individuals estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts?

The Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts is a tax form used to calculate any underpayment of estimated tax for the current tax year. It helps individuals, estates, and trusts determine if they owe penalties for not paying enough estimated tax throughout the year. Using this form ensures compliance with IRS regulations and assists in accurate tax planning.

-

How can the airSlate SignNow platform assist with filling out the Form 2210?

airSlate SignNow offers a user-friendly interface that simplifies the process of filling out the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts. With customizable templates and easy document sharing, users can complete and send the form efficiently. Additionally, eSignature capabilities streamline the signing process, making it quicker and hassle-free.

-

Is there a cost to use airSlate SignNow for the Form 2210 Fill in Version?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs when handling the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts. The plans are designed to provide cost-effective solutions for individuals and businesses, ensuring accessibility while delivering premium services. You can explore our pricing page for detailed options and features.

-

Can I integrate airSlate SignNow with other software for the Form 2210?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easy to manage the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts alongside other tools. This integration capability helps streamline your workflow, ensuring you can send and eSign documents seamlessly within your preferred ecosystem.

-

What are the benefits of using airSlate SignNow for tax forms like the Form 2210?

Using airSlate SignNow for your tax forms, including the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts, offers numerous benefits. You gain precision with automated fields and templates, save time with quick eSigning, and maintain compliance with standard practices. The platform enhances your document management process, providing a reliable solution for your tax-related needs.

-

Is the Form 2210 easy to fill out on airSlate SignNow?

Yes, the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts is designed for ease of use on airSlate SignNow. The intuitive interface guides users through each step of filling out the form, reducing the potential for errors. Additionally, helpful tips and pre-filled fields make the process smoother for first-time users.

-

How does airSlate SignNow ensure the security of my Form 2210 data?

airSlate SignNow prioritizes the security of your information, including all data related to the Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts. The platform employs robust encryption and secure data storage measures to protect sensitive information. Regular audits further verify the integrity and security of our systems.

Get more for Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

Find out other Form 2210 Fill in Version Underpayment Of Estimated Tax By Individuals, Estates And Trusts

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later