For IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, and Form

What is the FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

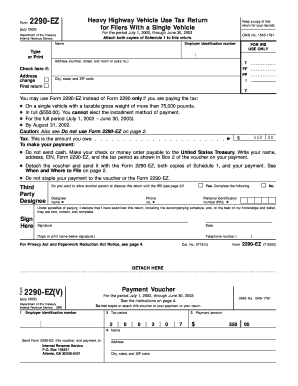

The form labeled "FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And" is primarily used for tax purposes in the United States. It allows taxpayers to indicate an address change on their final return. This form is essential for ensuring that the Internal Revenue Service (IRS) has the correct address on file for correspondence and any potential refunds. Accurate information is crucial for timely processing and communication regarding tax matters.

How to use the FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

To effectively use this form, begin by filling in your personal information, including your name and Social Security number. Next, locate the section designated for indicating an address change. Mark the appropriate box to confirm that this is a final return and provide your new address details, including city and state. It is important to ensure that all information is accurate to prevent any delays in processing your tax return.

Steps to complete the FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

Completing this form involves several straightforward steps:

- Gather your personal information, including your full name and Social Security number.

- Locate the section for address changes on the form.

- Check the box indicating that this is a final return.

- Enter your new address, ensuring you include the city and state.

- Review all entries for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines regarding the use of this form. It is essential to follow these guidelines to ensure compliance and avoid penalties. The IRS recommends that taxpayers submit this form as part of their final return if they have changed their address during the tax year. Additionally, taxpayers should keep a copy of the completed form for their records.

Required Documents

When submitting the "FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And," it is important to have the following documents ready:

- Your completed tax return.

- Any supporting documents that verify your address change, if applicable.

- Identification documents, such as a driver's license or Social Security card, may be required for verification.

Form Submission Methods

This form can be submitted through various methods. Taxpayers can file their tax returns electronically, which often allows for quicker processing. Alternatively, the form can be mailed to the appropriate IRS address, or, in some cases, submitted in person at local IRS offices. It is advisable to check the IRS website for the most current submission methods and addresses.

Quick guide on how to complete for irs use only t ff fp check here if address change final return city state and

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to discover the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your choice. Modify and eSign [SKS] and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

Create this form in 5 minutes!

How to create an eSignature for the for irs use only t ff fp check here if address change final return city state and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.'?

airSlate SignNow is a user-friendly eSignature platform that allows businesses to send, sign, and manage documents effortlessly. With its powerful features, you can ensure compliance and streamline the process for forms like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.' directly from your device.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you’re a small business or a large enterprise, you can find a cost-effective solution that includes features useful for handling documents like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.'

-

What features does airSlate SignNow offer for IRS-related documents?

airSlate SignNow provides a range of features designed for efficient document management, including templates, automated workflows, and secure storage. Specifically, these features make it easy to fill out and manage forms like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.'

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows you to manage documents such as 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.' within your existing workflows.

-

Is airSlate SignNow secure for handling sensitive information?

Absolutely! airSlate SignNow employs top-notch security measures, including encryption and authentication protocols, ensuring that your documents, including sensitive IRS forms like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And,' are protected.

-

How does airSlate SignNow simplify the signing process for IRS forms?

airSlate SignNow simplifies the signing process by enabling users to eSign documents from any device, anywhere. This is particularly useful for forms like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.' which need timely submission.

-

Can I track the status of documents sent with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all sent documents. This feature allows you to monitor the status of important submissions like 'FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And.' and ensure timely compliance.

Get more for FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

- Cloze ing in on science from 7 11bc 12a adaptations of species form

- Form 7204 direct deposit

- Er nurse competency test form

- Yacht charter party agreement page 1 of 4 yachtcharters form

- Appendix a waste management plan template gosford city council vivid blob core windows form

- Nib refund form

- Collateral assignment form

- Kaufvertrag flugzeug pdf form

Find out other FOR IRS USE ONLY T FF FP Check Here If Address Change Final Return City, State, And

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document