Form 5227 Fill in Version Split Interest Trust Information Return

What is the Form 5227 Fill in Version Split Interest Trust Information Return

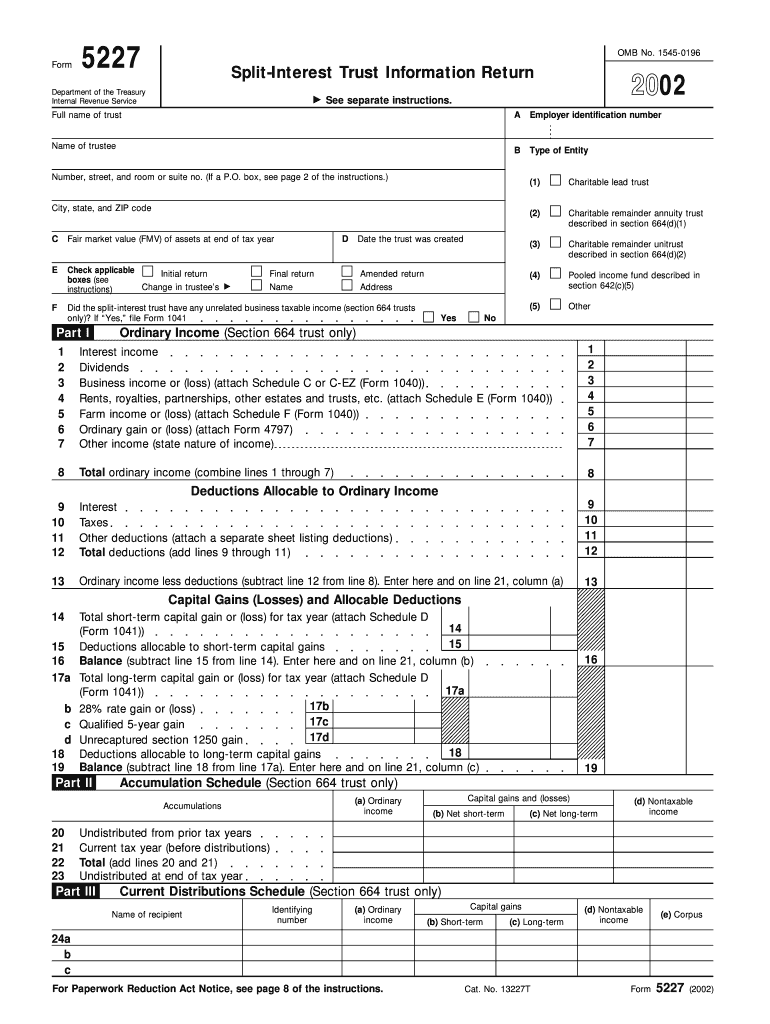

The Form 5227 Fill in Version Split Interest Trust Information Return is a tax form used in the United States to report information about split-interest trusts. These trusts are designed to benefit both charitable organizations and non-charitable beneficiaries. The form requires detailed information about the trust's assets, income, and distributions, ensuring compliance with IRS regulations. It is essential for trustees to accurately complete this form to maintain the trust's tax-exempt status and fulfill reporting obligations.

How to use the Form 5227 Fill in Version Split Interest Trust Information Return

Using the Form 5227 involves several key steps. First, trustees must gather all necessary financial information regarding the trust, including assets, liabilities, and income generated. Next, complete each section of the form accurately, ensuring that all required details are included. After filling out the form, it is important to review it for any errors before submission. Finally, the completed form can be filed with the IRS according to the specified deadlines.

Steps to complete the Form 5227 Fill in Version Split Interest Trust Information Return

Completing the Form 5227 involves a systematic approach:

- Gather financial documents related to the trust.

- Fill in the trust's identification information, including name and tax identification number.

- Report the trust's income, deductions, and distributions accurately.

- Provide detailed information about the beneficiaries and their respective interests.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline.

Filing Deadlines / Important Dates

It is crucial for trustees to be aware of the filing deadlines associated with the Form 5227. Generally, the form must be filed annually by the 15th day of the third month following the end of the trust's tax year. For example, if the trust operates on a calendar year, the form is due by March 15 of the following year. Failure to meet these deadlines may result in penalties or loss of tax-exempt status.

Legal use of the Form 5227 Fill in Version Split Interest Trust Information Return

The legal use of Form 5227 is primarily to ensure compliance with IRS regulations regarding split-interest trusts. Trustees are legally obligated to report accurate information about the trust's financial activities. This includes disclosing income, distributions, and any changes in the trust's structure. Proper use of the form helps maintain transparency and accountability, protecting both the trust and its beneficiaries.

Key elements of the Form 5227 Fill in Version Split Interest Trust Information Return

Key elements of the Form 5227 include:

- Identification information for the trust and its trustee.

- Details about the trust's income and expenses.

- Information on distributions made to beneficiaries.

- Compliance with IRS regulations regarding charitable contributions.

- Signature of the trustee certifying the accuracy of the information provided.

Quick guide on how to complete form 5227 fill in version split interest trust information return

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and is legally equivalent to a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5227 Fill in Version Split Interest Trust Information Return

Create this form in 5 minutes!

How to create an eSignature for the form 5227 fill in version split interest trust information return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5227 Fill in Version Split Interest Trust Information Return?

The Form 5227 Fill in Version Split Interest Trust Information Return is a tax form used by split-interest trusts to report income, deductions, and distributions. This form is essential for compliance with IRS regulations and ensures that the trust operates within legal boundaries. Understanding how to accurately fill in this form can signNowly impact your tax obligations.

-

How can airSlate SignNow help with the Form 5227 Fill in Version?

airSlate SignNow offers a user-friendly electronic signature solution that simplifies the process of completing the Form 5227 Fill in Version Split Interest Trust Information Return. With our platform, you can easily fill out and securely eSign your documents online. This not only streamlines your workflow but also ensures compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for the Form 5227?

Yes, airSlate SignNow offers various pricing plans to fit different needs. Our pricing is designed to be cost-effective, providing excellent value for businesses that require reliable document signing solutions, including the Form 5227 Fill in Version Split Interest Trust Information Return. Visit our pricing page for detailed information on our packages and features.

-

What features does airSlate SignNow provide for filling out the Form 5227?

airSlate SignNow provides features such as customizable templates, document editing capabilities, and electronic signature options to assist in completing the Form 5227 Fill in Version. These tools are designed to enhance user experience and ensure that you have everything you need to complete the form accurately. Additionally, our platform supports real-time collaboration for easier input from multiple stakeholders.

-

Can I integrate airSlate SignNow with other software for managing Form 5227?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, enhancing your ability to manage the Form 5227 Fill in Version. Whether you're using accounting software or document management systems, our platform can likely connect to improve your workflow and efficiency. Check our integrations page for a complete list of compatible software.

-

What are the benefits of using airSlate SignNow for Form 5227?

Using airSlate SignNow for the Form 5227 Fill in Version provides multiple benefits, including increased efficiency and reduced processing time. Our secure platform ensures that your sensitive information is protected throughout the signing process. Additionally, electronic signatures are legally binding and help you meet compliance requirements with ease.

-

Is airSlate SignNow secure for handling the Form 5227?

Absolutely! airSlate SignNow employs industry-standard security measures to protect your data while you fill in and sign the Form 5227 Fill in Version Split Interest Trust Information Return. This includes encryption and secure storage protocols. We understand the importance of confidentiality and work diligently to ensure your information remains safe.

Get more for Form 5227 Fill in Version Split Interest Trust Information Return

Find out other Form 5227 Fill in Version Split Interest Trust Information Return

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself