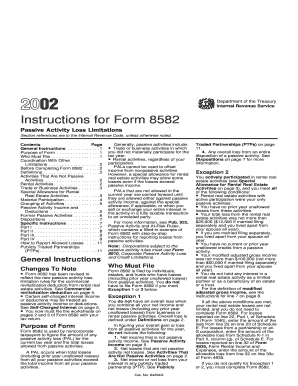

Instructions for Form 8582 Passive Activity Loss Limitations

What is the Instructions For Form 8582 Passive Activity Loss Limitations

The Instructions For Form 8582 Passive Activity Loss Limitations provide essential guidance for taxpayers who need to report passive activity losses and credits. This form is crucial for individuals and entities engaged in passive activities, such as rental real estate, where losses may exceed income. The instructions clarify how to accurately calculate and report these losses, ensuring compliance with IRS regulations. Understanding these instructions is vital for taxpayers to effectively manage their passive income and losses while adhering to tax laws.

How to use the Instructions For Form 8582 Passive Activity Loss Limitations

Using the Instructions For Form 8582 involves several key steps. First, taxpayers should gather all relevant financial information related to their passive activities, including income, expenses, and prior year losses. Next, they must carefully read the instructions to understand the specific requirements for reporting losses. The instructions detail how to fill out the form, including which sections to complete based on individual circumstances. It is important to follow the guidelines closely to avoid errors that could lead to penalties or delays in processing.

Steps to complete the Instructions For Form 8582 Passive Activity Loss Limitations

Completing the Instructions For Form 8582 involves a systematic approach:

- Gather all necessary financial documents related to passive activities.

- Review the instructions thoroughly to understand the reporting requirements.

- Calculate total passive activity income and losses for the year.

- Fill out the form, ensuring all information is accurate and complete.

- Double-check calculations to confirm they align with IRS guidelines.

- Submit the completed form along with your tax return by the deadline.

Key elements of the Instructions For Form 8582 Passive Activity Loss Limitations

Key elements of the Instructions For Form 8582 include definitions of passive activities, guidelines for determining material participation, and specific rules for calculating allowable losses. The instructions also outline how to handle special situations, such as real estate professionals or those with multiple passive activities. Understanding these elements helps taxpayers navigate the complexities of passive activity loss limitations and ensures they report their financial information correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 8582 align with the general tax return deadlines. Typically, individual taxpayers must submit their forms by April fifteenth of the following year, unless an extension is filed. It is essential to be aware of these deadlines to avoid late fees and penalties. Taxpayers should also note any changes to deadlines that may occur due to federal holidays or other circumstances that affect the tax calendar.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the use of Form 8582. These guidelines cover the eligibility criteria for passive activity loss deductions, the calculation methods for determining allowable losses, and the reporting requirements for different types of passive activities. Following these guidelines is crucial for compliance and helps taxpayers maximize their deductions while minimizing the risk of audits or penalties.

Quick guide on how to complete instructions for form 8582 passive activity loss limitations

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to adjust and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Obtain Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or cover sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Completed button to save your modifications.

- Choose how you'd like to submit your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 8582 Passive Activity Loss Limitations

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8582 passive activity loss limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 8582 Passive Activity Loss Limitations?

The Instructions For Form 8582 Passive Activity Loss Limitations provide guidance on how to report and apply passive activity losses against income. These instructions help taxpayers determine their eligibility for deductions and ensure compliance with IRS regulations.

-

How does airSlate SignNow assist with Form 8582?

AirSlate SignNow empowers users to easily eSign and send the Instructions For Form 8582 Passive Activity Loss Limitations digitally. This streamlines the documentation process, ensuring that all necessary signatures are obtained quickly and efficiently.

-

Are there any costs associated with using airSlate SignNow for Form 8582?

AirSlate SignNow offers a cost-effective solution for handling the Instructions For Form 8582 Passive Activity Loss Limitations. Our pricing plans are designed to fit various budgets, allowing users to manage their documents professionally without breaking the bank.

-

Can I customize the Instructions For Form 8582 using airSlate SignNow?

Yes, airSlate SignNow allows users to customize their documents, including the Instructions For Form 8582 Passive Activity Loss Limitations. You can add specific fields, adjust layouts, and include detailed notes to meet your unique requirements.

-

What features does airSlate SignNow offer for managing taxes?

AirSlate SignNow includes features like document templates, eSigning, and status tracking, making it easier to handle tax-related documents such as the Instructions For Form 8582 Passive Activity Loss Limitations. Our platform ensures you stay organized and compliant with tax regulations.

-

Is airSlate SignNow suitable for businesses of all sizes?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, allowing anyone to manage the Instructions For Form 8582 Passive Activity Loss Limitations efficiently. Whether you are a small startup or a large enterprise, our solution adapts to your needs.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing your experience while handling the Instructions For Form 8582 Passive Activity Loss Limitations. You can connect with tools you already use for greater productivity.

Get more for Instructions For Form 8582 Passive Activity Loss Limitations

Find out other Instructions For Form 8582 Passive Activity Loss Limitations

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT