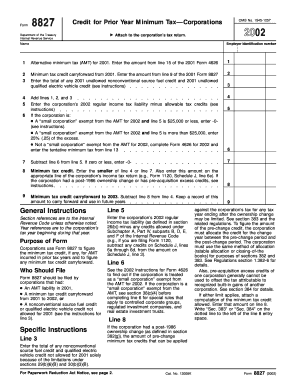

Form 8827 Fill in Version Credit for Prior Year Minimum Tax Corporations

Understanding Form 8827: Credit for Prior Year Minimum Tax Corporations

Form 8827 is a tax form used by corporations to claim a credit for prior year minimum tax. This credit is designed to provide relief to corporations that have previously paid alternative minimum tax (AMT) and are now eligible to recover some of that amount. Corporations that qualify can use this form to offset their regular tax liability, which can lead to significant tax savings.

The form is specifically tailored for corporations, including C corporations, that have paid AMT in prior years. By filing Form 8827, these corporations can effectively reduce their current tax obligations, making it an important tool for tax planning and financial management.

Steps to Complete Form 8827

Completing Form 8827 involves several key steps to ensure accurate filing. The process typically includes:

- Gathering necessary financial information, including prior year tax returns and AMT paid.

- Filling out the form by providing required details such as the corporation's name, Employer Identification Number (EIN), and the amount of credit being claimed.

- Calculating the allowable credit based on the corporation's AMT history and current tax liability.

- Reviewing the completed form for accuracy before submission.

Once completed, Form 8827 should be submitted along with the corporation's tax return for the year in which the credit is being claimed.

Obtaining Form 8827

Corporations can obtain Form 8827 directly from the Internal Revenue Service (IRS) website. The form is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include Form 8827 as part of their offerings, allowing for electronic completion and submission.

It is important to ensure that the most current version of the form is used, as tax laws and regulations may change from year to year. Keeping abreast of these changes can help corporations maximize their tax benefits.

IRS Guidelines for Form 8827

The IRS provides specific guidelines for the use of Form 8827, including eligibility criteria and instructions for completing the form. Corporations must meet certain requirements to qualify for the credit, such as having paid AMT in prior years and having a tax liability in the current year to offset.

Corporations should refer to the IRS instructions accompanying Form 8827 for detailed information on how to properly complete the form, including any necessary calculations and documentation that may be required to support the credit claim.

Filing Deadlines for Form 8827

Form 8827 must be filed in conjunction with the corporation's annual tax return. The filing deadline generally aligns with the corporate tax return due date, which is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15.

It is crucial for corporations to adhere to these deadlines to avoid penalties and ensure they receive the benefits of the credit in a timely manner.

Eligibility Criteria for Form 8827

To be eligible to file Form 8827, corporations must have previously paid alternative minimum tax in prior years. The credit is available to C corporations that have a tax liability in the current year against which the credit can be applied. Additionally, the corporation must not have claimed the credit in previous years for the same AMT paid.

Understanding these eligibility criteria is essential for corporations to determine whether they can take advantage of the credit and how it can impact their overall tax strategy.

Quick guide on how to complete form 8827

Easily Prepare form 8827 on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents promptly and without delays. Handle form 8827 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Edit and Electronically Sign form 8827 Effortlessly

- Locate form 8827 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign form 8827 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 8827

Create this form in 5 minutes!

How to create an eSignature for the form 8827

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8827

-

What is form 8827 and why is it important?

Form 8827 is used by businesses to claim the Credit for Increasing Research Activities. Understanding how to complete and file form 8827 can signNowly impact your company's financial benefits, making it essential for eligible taxpayers.

-

How can airSlate SignNow help with filling out form 8827?

AirSlate SignNow simplifies the signing and sending process of form 8827, allowing businesses to efficiently manage their document workflows. With ease of use and robust features, you can complete, sign, and send this important form effortlessly.

-

What are the pricing options for airSlate SignNow when filing form 8827?

AirSlate SignNow offers various pricing plans to cater to different business needs, including affordable options that provide access to features suitable for managing forms like 8827. You can explore a free trial to test the platform before committing to a plan.

-

Can I integrate airSlate SignNow with other software to manage form 8827?

Yes, airSlate SignNow provides integrations with many popular productivity and accounting software tools, allowing you to streamline the process of managing form 8827. This connectivity ensures that your workflow remains seamless and efficient.

-

Is it safe to eSign form 8827 using airSlate SignNow?

Absolutely! AirSlate SignNow employs top-notch security measures to ensure your form 8827 and other documents are securely signed and stored. With encryption and compliance with industry standards, your data remains protected.

-

What benefits does airSlate SignNow offer for managing tax forms like form 8827?

By using airSlate SignNow for form 8827, businesses can reduce paperwork and increase efficiency in submitting their claims. The platform allows for quick edits, secure eSigning, and easy tracking of document status, enhancing your productivity.

-

How does airSlate SignNow improve collaboration on form 8827 submissions?

AirSlate SignNow enhances collaboration by allowing multiple users to work on form 8827 simultaneously. Team members can comment, make edits, and sign the document, ensuring that everyone stays informed and the submission is completed swiftly.

Get more for form 8827

Find out other form 8827

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online