Form 8845 Fill in Version Indian Employment Credit

What is the Form 8845 Fill in Version Indian Employment Credit

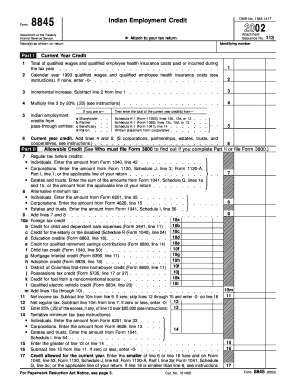

The Form 8845, also known as the Indian Employment Credit, is a tax form used by eligible taxpayers to claim a credit for qualified wages paid to employees who are enrolled members of an Indian tribe. This form is specifically designed for individuals and businesses who employ Native Americans and seek to benefit from the tax incentives offered under the Internal Revenue Code. The credit aims to encourage employment in economically disadvantaged areas and supports tribal communities by providing financial relief to employers.

How to use the Form 8845 Fill in Version Indian Employment Credit

Using the Form 8845 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including details about employees, wages paid, and the specific tribal affiliation of the employees. Next, complete the form by filling in the required fields, which include identifying information about the employer and the employees. After filling out the form, review it for accuracy and ensure that all calculations are correct. Finally, submit the completed form with your tax return to the IRS. It is important to keep a copy for your records.

Steps to complete the Form 8845 Fill in Version Indian Employment Credit

Completing the Form 8845 involves a systematic approach:

- Obtain the latest version of Form 8845 from the IRS website or through tax preparation software.

- Fill in your name, address, and taxpayer identification number in the designated sections.

- Provide information about your employees, including their names, tribal affiliation, and the wages paid to them during the tax year.

- Calculate the credit amount based on the qualified wages and enter the total on the form.

- Review all entries for accuracy and completeness before submission.

Eligibility Criteria

To qualify for the Indian Employment Credit, certain eligibility criteria must be met. Employers must pay qualified wages to employees who are enrolled members of a federally recognized Indian tribe. The credit applies to wages paid for work performed on or near a reservation. Additionally, the employer must not have any disqualifying factors, such as being a government entity or having claimed the credit for the same wages in a prior year. Understanding these criteria is essential for successfully claiming the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8845 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you file for an extension, the deadline may be extended to October 15. It is crucial to submit the Form 8845 along with your tax return by these deadlines to ensure the credit is processed timely. Late submissions may result in the loss of the credit for that tax year.

Form Submission Methods (Online / Mail / In-Person)

The Form 8845 can be submitted in several ways, depending on your preference and the requirements of the IRS. Most taxpayers choose to file electronically using tax preparation software, which simplifies the process and reduces the likelihood of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not an option, as the IRS does not accept forms directly at local offices. Ensure that you follow the submission guidelines to avoid delays in processing.

Quick guide on how to complete form 8845 fill in version indian employment credit

Effortlessly Prepare Form 8845 Fill in Version Indian Employment Credit on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Form 8845 Fill in Version Indian Employment Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Form 8845 Fill in Version Indian Employment Credit with Ease

- Find Form 8845 Fill in Version Indian Employment Credit and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant portions of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document navigation, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8845 Fill in Version Indian Employment Credit to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8845 fill in version indian employment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8845 Fill in Version Indian Employment Credit?

The Form 8845 Fill in Version Indian Employment Credit is a tax form used by employers to claim a credit for wages paid to qualified employees who are Indian Tribal members. This credit aims to incentivize hiring within the Indian community, fostering economic growth. By using our solution, you can easily fill out and manage this form.

-

How does airSlate SignNow help with the Form 8845 Fill in Version Indian Employment Credit?

AirSlate SignNow streamlines the process of filling out the Form 8845 Fill in Version Indian Employment Credit by providing a user-friendly interface and templates. This allows businesses to efficiently complete the form while ensuring compliance with IRS requirements. SignNow’s automated features also reduce the likelihood of errors.

-

Is there a cost associated with using the Form 8845 Fill in Version Indian Employment Credit on airSlate SignNow?

Yes, airSlate SignNow offers affordable pricing plans that include features for managing the Form 8845 Fill in Version Indian Employment Credit. You can choose a plan that best fits your business needs, whether you are a small business or an enterprise. All pricing plans are designed to provide great value for our users.

-

Can I integrate airSlate SignNow with other software to assist in processing the Form 8845 Fill in Version Indian Employment Credit?

Absolutely! AirSlate SignNow supports integrations with various CRM and accounting software, making it easier to manage the Form 8845 Fill in Version Indian Employment Credit seamlessly alongside your existing tools. These integrations enhance productivity and ensure that your documents are well organized.

-

What features does airSlate SignNow offer for completing the Form 8845 Fill in Version Indian Employment Credit?

AirSlate SignNow provides several features for completing the Form 8845 Fill in Version Indian Employment Credit, including customizable templates, eSignature capabilities, and real-time collaboration. Users can easily fill in fields and share the form with their teams for reviews and approvals, ensuring a smooth completion process.

-

How secure is the information when using airSlate SignNow for the Form 8845 Fill in Version Indian Employment Credit?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your sensitive information, including data related to the Form 8845 Fill in Version Indian Employment Credit. You can trust that your documents are secure and compliant with industry standards.

-

Can I track my submissions of the Form 8845 Fill in Version Indian Employment Credit using airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Form 8845 Fill in Version Indian Employment Credit submissions. This means you can see who has accessed the document, when it was signed, and any updates made. Staying informed helps you maintain an organized workflow.

Get more for Form 8845 Fill in Version Indian Employment Credit

Find out other Form 8845 Fill in Version Indian Employment Credit

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online