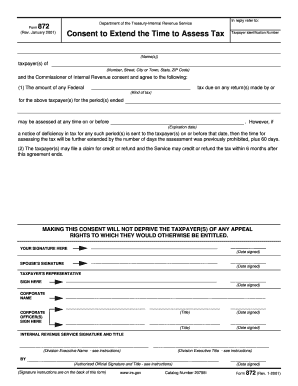

Form 872 Rev January Consent to Extend Time to Assess Tax

What is the Form 872 Rev January Consent To Extend Time To Assess Tax

The Form 872 Rev January, known as the Consent To Extend Time To Assess Tax, is an official document used by taxpayers in the United States to grant the Internal Revenue Service (IRS) additional time to assess tax liabilities. This form is particularly useful when there are complexities in a taxpayer's situation that may delay the assessment process. By signing this form, taxpayers can avoid potential penalties associated with late assessments and ensure compliance with IRS regulations.

How to use the Form 872 Rev January Consent To Extend Time To Assess Tax

To use the Form 872 Rev January, taxpayers must first complete the necessary sections, including personal information and details about the tax year in question. Once filled out, the form must be signed by the taxpayer and any authorized representatives. It is essential to submit this form to the IRS before the expiration of the original assessment period to ensure the extension is valid. The IRS will then acknowledge receipt and confirm the new assessment timeline.

Steps to complete the Form 872 Rev January Consent To Extend Time To Assess Tax

Completing the Form 872 Rev January involves several key steps:

- Obtain the form from the IRS website or through a tax professional.

- Fill in your name, address, and taxpayer identification number.

- Specify the tax year for which you are requesting an extension.

- Sign and date the form.

- Submit the completed form to the IRS via mail or electronically, if applicable.

Key elements of the Form 872 Rev January Consent To Extend Time To Assess Tax

Important elements of the Form 872 Rev January include:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Tax Year: The specific tax year for which the extension is requested must be clearly indicated.

- Signature: The form must be signed by the taxpayer or an authorized representative to be valid.

- IRS Acknowledgment: After submission, the IRS will send an acknowledgment confirming the extension.

Legal use of the Form 872 Rev January Consent To Extend Time To Assess Tax

The legal use of the Form 872 Rev January is to formally extend the period during which the IRS can assess taxes owed by a taxpayer. This form is recognized by the IRS as a binding agreement between the taxpayer and the agency. By signing the form, taxpayers agree to extend the assessment period, which can help mitigate the risk of penalties for late assessments and allows for thorough review of tax matters.

Filing Deadlines / Important Dates

Filing deadlines for the Form 872 Rev January are critical to ensure compliance. Generally, the form must be submitted before the expiration of the original assessment period, which is typically three years from the date a tax return was filed. However, specific circumstances may alter this timeline, so it is advisable to consult IRS guidelines or a tax professional for precise deadlines related to individual cases.

Quick guide on how to complete form 872 rev january consent to extend time to assess tax

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow offers all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Edit and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 872 Rev January Consent To Extend Time To Assess Tax

Create this form in 5 minutes!

How to create an eSignature for the form 872 rev january consent to extend time to assess tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 872 Rev January Consent To Extend Time To Assess Tax?

The Form 872 Rev January Consent To Extend Time To Assess Tax is a document used by taxpayers to allow the IRS additional time to assess taxes due. By signing this form, taxpayers can extend the statute of limitations for tax assessments, providing more time to settle tax liabilities. Utilizing airSlate SignNow simplifies the process of signing this form electronically.

-

How does airSlate SignNow simplify the process of signing Form 872 Rev January?

airSlate SignNow provides an easy-to-use platform that allows users to complete and eSign the Form 872 Rev January Consent To Extend Time To Assess Tax electronically. This feature eliminates the need for printing, scanning, or mailing the document, making the process not only quicker but also more efficient. Furthermore, you can track the signing status in real-time for added convenience.

-

What are the pricing options for airSlate SignNow services?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses of all sizes. Each plan includes features that facilitate the signing and management of important documents, such as the Form 872 Rev January Consent To Extend Time To Assess Tax. Visit our pricing page to explore the options that best fit your requirements.

-

Are electronic signatures on Form 872 Rev January legally binding?

Yes, electronic signatures created using airSlate SignNow for the Form 872 Rev January Consent To Extend Time To Assess Tax are legally binding under U.S. law. The platform complies with the ESIGN Act and UETA, ensuring the validity of eSignatures in legal transactions. This allows you to sign tax-related documents securely and confidently.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integration capabilities with various popular business applications such as CRM systems and cloud storage solutions. This seamless integration enhances your workflow and allows you to easily manage documents like the Form 872 Rev January Consent To Extend Time To Assess Tax alongside your existing tools.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the Form 872 Rev January Consent To Extend Time To Assess Tax, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface and advanced features help streamline the signing process, minimizing delays in tax assessment and compliance.

-

How do I get started with airSlate SignNow for Form 872 Rev January?

Getting started with airSlate SignNow is easy! Simply sign up for an account, and you can begin creating and eSigning the Form 872 Rev January Consent To Extend Time To Assess Tax right away. Our platform offers tutorials and support to guide you through each step of the process ensuring a smooth user experience.

Get more for Form 872 Rev January Consent To Extend Time To Assess Tax

Find out other Form 872 Rev January Consent To Extend Time To Assess Tax

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT