Form 1118 Schedule I Rev February , Not Fill in Capable

What is the Form 1118 Schedule I Rev February, Not Fill In Capable

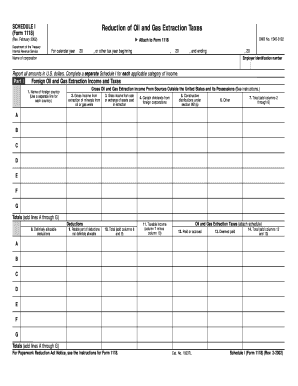

The Form 1118 Schedule I Rev February is a specific tax form used by corporations to claim a foreign tax credit. This form is particularly important for U.S. corporations that have paid foreign taxes on income earned outside the United States. The "Not Fill In Capable" designation indicates that this version of the form cannot be filled out electronically, which means it must be printed and completed by hand. Understanding this form is essential for businesses seeking to optimize their tax obligations while complying with U.S. tax laws.

How to use the Form 1118 Schedule I Rev February, Not Fill In Capable

To effectively use the Form 1118 Schedule I Rev February, corporations should first ensure they have the correct version of the form. After obtaining the form, businesses need to gather all relevant financial information regarding foreign income and taxes paid. This includes documentation of foreign tax payments and details about the income earned abroad. Once all information is collected, the form should be completed by entering the necessary data in the appropriate sections, ensuring accuracy to avoid potential issues with the IRS.

Steps to complete the Form 1118 Schedule I Rev February, Not Fill In Capable

Completing the Form 1118 Schedule I involves several key steps:

- Download or obtain a physical copy of the Form 1118 Schedule I Rev February.

- Gather all necessary documentation related to foreign income and taxes paid.

- Fill in the form by hand, ensuring all sections are accurately completed.

- Review the completed form for any errors or omissions.

- Sign and date the form where required.

- Submit the form according to IRS guidelines, either by mail or in person.

Filing Deadlines / Important Dates

When dealing with the Form 1118 Schedule I, it is crucial to be aware of the filing deadlines. Generally, the form must be submitted along with the corporation's tax return. For most corporations, this means filing by the fifteenth day of the fourth month following the end of the tax year. For corporations with a fiscal year ending on December 31, the deadline would typically fall on April 15 of the following year. It is advisable to check for any changes to deadlines or extensions that may apply.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1118 Schedule I. These guidelines include detailed instructions on how to report foreign taxes and income accurately. Corporations should consult the IRS instructions for the form to ensure compliance with all reporting requirements. Adhering to these guidelines helps prevent errors that could lead to penalties or issues during an audit.

Required Documents

To complete the Form 1118 Schedule I Rev February, corporations must have several key documents on hand. These include:

- Records of foreign income earned during the tax year.

- Documentation of foreign taxes paid, such as receipts or tax returns from foreign jurisdictions.

- Any relevant financial statements that support the income and tax claims made on the form.

Having these documents readily available will streamline the process of filling out the form and ensure accuracy in reporting.

Quick guide on how to complete form 1118 schedule i rev february not fill in capable

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to edit and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize pertinent portions of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal authority as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Stop worrying about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure perfect communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1118 Schedule I Rev February , Not Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 1118 schedule i rev february not fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1118 Schedule I Rev February , Not Fill In Capable?

The Form 1118 Schedule I Rev February , Not Fill In Capable is a specific IRS form used to claim a foreign tax credit. This form allows businesses to report foreign taxes and ensures compliance with U.S. tax laws while helping reduce the overall tax burden.

-

How can airSlate SignNow help with the Form 1118 Schedule I Rev February , Not Fill In Capable?

airSlate SignNow simplifies the process of sending and eSigning documents, including the Form 1118 Schedule I Rev February , Not Fill In Capable. With its user-friendly interface, you can easily manage your tax forms online, streamlining your workflow and ensuring timely submissions.

-

Is the Form 1118 Schedule I Rev February , Not Fill In Capable available for eSignature?

Yes, airSlate SignNow allows you to eSign the Form 1118 Schedule I Rev February , Not Fill In Capable electronically. This feature enhances convenience and facilitates easy document storage, tracking, and retrieval, making tax filing a breeze.

-

What features does airSlate SignNow offer for handling forms like the Form 1118 Schedule I Rev February , Not Fill In Capable?

airSlate SignNow provides a variety of features for managing forms such as the Form 1118 Schedule I Rev February , Not Fill In Capable. These include customizable templates, document sharing, secure storage, and robust security measures to protect sensitive information.

-

How much does airSlate SignNow cost for managing the Form 1118 Schedule I Rev February , Not Fill In Capable?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Pricing is tiered based on features, but it remains cost-effective, especially considering the efficiency gained in handling forms like the Form 1118 Schedule I Rev February , Not Fill In Capable.

-

Can I integrate airSlate SignNow with other tools for managing the Form 1118 Schedule I Rev February , Not Fill In Capable?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software and tools that can assist in managing the Form 1118 Schedule I Rev February , Not Fill In Capable. This ensures that your data flows smoothly between platforms, improving overall productivity.

-

What benefits do I gain by using airSlate SignNow for the Form 1118 Schedule I Rev February , Not Fill In Capable?

Using airSlate SignNow for the Form 1118 Schedule I Rev February , Not Fill In Capable offers numerous benefits including time savings, enhanced collaboration, and a reduction in errors compared to traditional paper methods. It empowers businesses to stay compliant while maintaining an efficient workflow.

Get more for Form 1118 Schedule I Rev February , Not Fill In Capable

Find out other Form 1118 Schedule I Rev February , Not Fill In Capable

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple