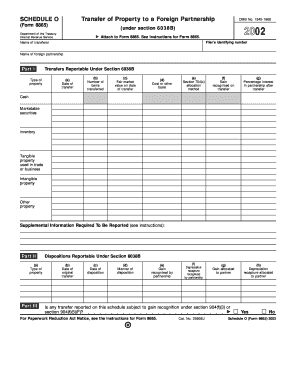

Schedule O Form 8865 Transfer of Property to a Foreign Partnership

Understanding the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

The Schedule O Form 8865 is a crucial document used by U.S. taxpayers who transfer property to a foreign partnership. This form is part of the IRS Form 8865 series, which is required for reporting certain transactions involving foreign partnerships. The purpose of Schedule O is to provide detailed information about the transfer, ensuring compliance with U.S. tax laws. Taxpayers must accurately report the fair market value of the property transferred and any associated liabilities. Understanding the requirements of this form is essential for avoiding potential penalties and ensuring proper tax reporting.

Steps to Complete the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

Completing the Schedule O Form 8865 involves several important steps:

- Gather necessary documentation, including details about the property being transferred and its fair market value.

- Complete the identifying information section, including the taxpayer's name, address, and taxpayer identification number.

- Provide a description of the property being transferred, including type, location, and any relevant details.

- Report the fair market value of the property at the time of transfer, along with any liabilities associated with the property.

- Review the completed form for accuracy and ensure all necessary signatures are included.

Legal Use of the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

The Schedule O Form 8865 serves a legal purpose in the context of U.S. tax compliance. It is required for taxpayers who engage in transactions involving foreign partnerships, particularly when transferring property. Proper completion and submission of this form help ensure that taxpayers meet their reporting obligations and avoid legal repercussions. Failure to file this form when required may result in significant penalties, including fines and increased scrutiny from the IRS.

Key Elements of the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

Several key elements must be included when filling out the Schedule O Form 8865:

- Taxpayer Information: This includes the name, address, and taxpayer identification number of the individual or entity making the transfer.

- Property Description: A detailed description of the property being transferred, including its type and location.

- Fair Market Value: The value of the property at the time of transfer, which is critical for accurate tax reporting.

- Liabilities: Any liabilities associated with the property must also be reported, as they can affect the overall tax implications.

Filing Deadlines for the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

It is important to be aware of the filing deadlines associated with the Schedule O Form 8865. Generally, the form is due on the same date as the taxpayer's income tax return. For most individual taxpayers, this means the form should be filed by April 15 of the following year. However, if an extension is filed for the income tax return, the deadline for submitting the Schedule O may also be extended. Taxpayers should ensure timely filing to avoid penalties.

Required Documents for the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

When preparing to file the Schedule O Form 8865, several documents are typically required:

- Documentation supporting the fair market value of the property being transferred, such as appraisals or market analyses.

- Records of any liabilities associated with the property, including mortgages or other debts.

- Identification documents for the taxpayer, including Social Security numbers or Employer Identification Numbers.

Quick guide on how to complete schedule o form 8865 transfer of property to a foreign partnership

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can find the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

Create this form in 5 minutes!

How to create an eSignature for the schedule o form 8865 transfer of property to a foreign partnership

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

The Schedule O Form 8865 Transfer Of Property To A Foreign Partnership is a tax form used by U.S. persons to report certain transfers of property to foreign partnerships. It is crucial for compliance with IRS regulations when foreign partnerships are involved. Using airSlate SignNow, businesses can easily eSign and manage documents related to this form.

-

How can airSlate SignNow help with the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

airSlate SignNow provides an efficient platform for eSigning and managing the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership. The user-friendly interface allows users to complete and send documents seamlessly, ensuring compliance while saving time. Additionally, it simplifies tracking the status of documents sent for eSignature.

-

Is there a cost associated with using airSlate SignNow for the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to the tools necessary for efficiently managing the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership and other document workflows. Pricing is competitive and designed to deliver value through our secure eSigning services.

-

What features does airSlate SignNow include for handling the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

airSlate SignNow includes features such as customizable templates, bulk sending, and advanced document tracking, which are ideal for handling the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership. Furthermore, it offers secure storage and multiple user access, making collaboration more straightforward. These features enhance efficiency and ensure all parties are informed throughout the process.

-

Can I integrate airSlate SignNow with other software to manage the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

Yes, airSlate SignNow can be integrated with several popular applications and software solutions to streamline processes related to the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership. These integrations allow users to import data directly from other platforms, reducing the chances of errors and enhancing workflow automation. This interoperability is essential for businesses who want to maintain comprehensive workflows.

-

What benefits does airSlate SignNow provide for eSigning the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

Using airSlate SignNow for eSigning the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership offers a range of benefits, including speed, convenience, and enhanced security. The electronic signature process is faster than traditional methods, reducing turnaround time signNowly. Additionally, signed documents are securely stored and easily accessible as needed.

-

Is airSlate SignNow compliant with legal requirements for the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership?

Yes, airSlate SignNow complies with all relevant legal standards for electronic signatures and document management, making it a reliable option for handling the Schedule O Form 8865 Transfer Of Property To A Foreign Partnership. This compliance ensures that your eSigned documents are legally binding and recognized by tax authorities. Using a compliant platform is crucial for businesses dealing with sensitive tax forms.

Get more for Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

Find out other Schedule O Form 8865 Transfer Of Property To A Foreign Partnership

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online