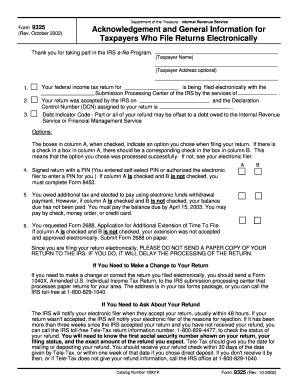

Form 9325 Rev October Acknowledgement and General Information for Taxpayers Who File Returns Electronically

Understanding Form 9325 Rev October

Form 9325 Rev October serves as an important acknowledgement and general information document for taxpayers who file their returns electronically. This form is issued by the Internal Revenue Service (IRS) and provides essential details about the electronic filing process. It confirms the successful submission of your electronic tax return and outlines the next steps you should take. This form is particularly beneficial for ensuring that taxpayers are aware of their filing status and any additional requirements that may apply.

Steps to Complete Form 9325 Rev October

Completing Form 9325 Rev October involves several straightforward steps:

- Begin by providing your name, address, and taxpayer identification number (TIN).

- Indicate the type of return you are filing electronically.

- Review the information to ensure accuracy, as errors may delay processing.

- Submit the form electronically as part of your tax return filing process.

It is essential to follow these steps carefully to ensure that your electronic filing is acknowledged and processed without issues.

Obtaining Form 9325 Rev October

Taxpayers can obtain Form 9325 Rev October directly from the IRS website or through tax preparation software. Most electronic filing systems automatically generate this form upon successful submission of your tax return. If you prefer to access it manually, you can download it as a PDF file from the IRS forms section. Ensure that you are using the most recent version of the form to avoid any complications.

Legal Use of Form 9325 Rev October

Form 9325 Rev October is legally recognized as proof of electronic filing. It serves as an official acknowledgement from the IRS that your tax return has been submitted. Retaining this form is crucial, as it may be required for future reference, especially in the event of audits or inquiries regarding your tax filings. Understanding the legal implications of this form helps ensure compliance with IRS regulations.

IRS Guidelines for Form 9325 Rev October

The IRS provides specific guidelines regarding the use of Form 9325 Rev October. These guidelines detail the importance of timely filing and the requirements for electronic submissions. Taxpayers are encouraged to familiarize themselves with these guidelines to ensure that they meet all necessary criteria for successful electronic filing. Adhering to these regulations can help avoid penalties and ensure a smooth filing experience.

Penalties for Non-Compliance with Form 9325 Rev October

Failure to comply with the requirements associated with Form 9325 Rev October can result in penalties. These may include fines or delays in processing your tax return. It is essential to keep accurate records and submit the form as required to avoid any complications. Understanding these potential penalties can motivate taxpayers to adhere to the filing requirements and maintain compliance with IRS regulations.

Quick guide on how to complete form 9325 rev october acknowledgement and general information for taxpayers who file returns electronically

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without holdups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you would like to distribute your form—via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically

Create this form in 5 minutes!

How to create an eSignature for the form 9325 rev october acknowledgement and general information for taxpayers who file returns electronically

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically?

Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically is a document provided by the IRS that confirms your submission of electronically filed tax returns. This form includes vital information such as your submission date and your return's identification number, helping taxpayers maintain accurate records.

-

How does airSlate SignNow support the completion of Form 9325?

airSlate SignNow provides an intuitive platform to easily fill out and electronically sign Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically. Our solution streamlines the completion process, ensuring accuracy while preserving the integrity of your documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit the needs of different users, whether you're an individual or a business. By selecting our services, you gain the ability to manage forms like Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically at a cost-effective price, without sacrificing features.

-

What features does airSlate SignNow provide for tax document management?

Our platform includes features such as customizable templates, secure electronic signatures, and real-time tracking that enhance the management of tax documents, including Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically. These functionalities simplify your workflow and improve efficiency.

-

How can I integrate airSlate SignNow with other tools I use?

airSlate SignNow offers seamless integrations with a variety of popular applications such as Google Drive and Dropbox, allowing you to streamline your workflow. By using our platform, you can manage and sign Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically alongside your current tools.

-

What benefits does eSigning provide for Form 9325?

eSigning with airSlate SignNow not only accelerates the process of finalizing Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically, but it also enhances security and reduces the need for paper records. Our electronic signatures are legally binding and widely recognized, ensuring your documents are valid.

-

Is my data secure when using airSlate SignNow for tax documents?

Yes, airSlate SignNow prioritizes the security of your data by implementing strong encryption protocols and compliance with industry standards. When completing documents like Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically, you can trust that your information is protected.

Get more for Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically

- Walter charley memorial scholarship application form

- Pumpco application form

- Nmfs southwest region hms form

- Jarvis leadership hall information and application

- Direct payment plan south dakota state employee health plan benefits sd form

- Felony questionnaire the ocdp board ocdp ohio form

- Samba beneficiary form

- Infoieseduorg form

Find out other Form 9325 Rev October Acknowledgement And General Information For Taxpayers Who File Returns Electronically

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form