Form 1040 ES Espanol

What is the Form 1040 ES Español

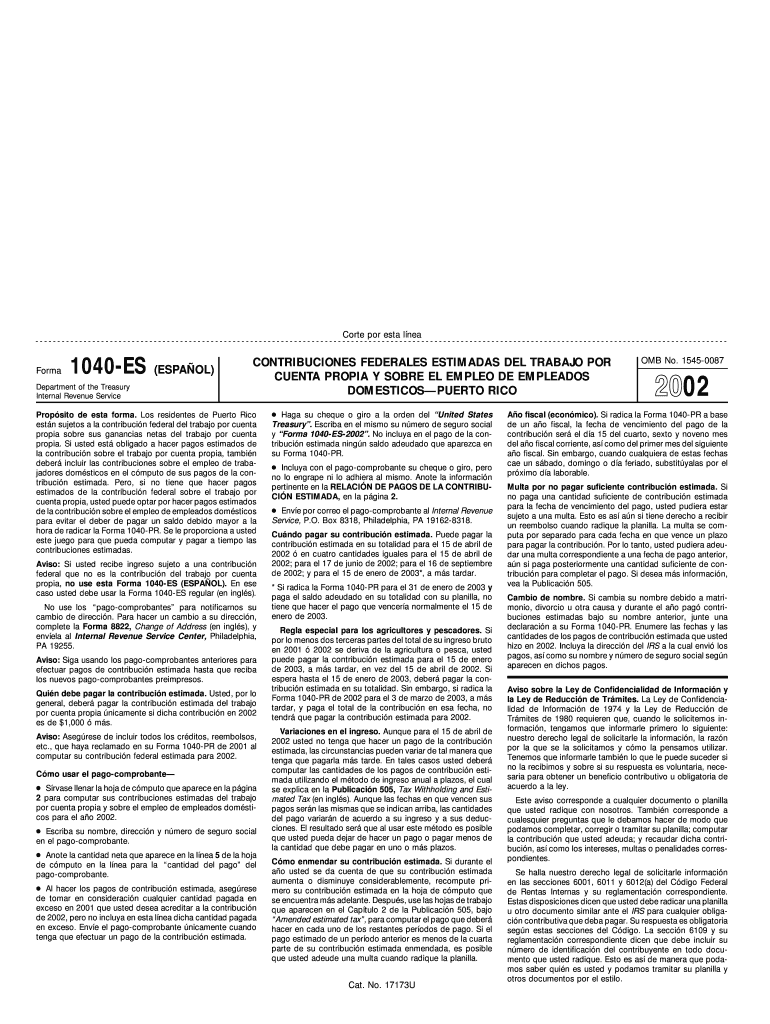

The Form 1040 ES Español is the Spanish version of the estimated tax payment form used by individuals in the United States. This form is essential for taxpayers who expect to owe taxes of one thousand dollars or more when they file their annual return. It allows individuals to calculate and pay estimated taxes quarterly, ensuring they meet their tax obligations throughout the year. The form is specifically designed to accommodate Spanish-speaking taxpayers, providing them with the necessary tools to manage their tax responsibilities effectively.

How to obtain the Form 1040 ES Español

To obtain the Form 1040 ES Español, individuals can visit the official IRS website, where the form is available for download in PDF format. It can also be requested by calling the IRS directly or visiting a local IRS office. Additionally, many tax preparation services and community organizations provide copies of this form to assist Spanish-speaking taxpayers in fulfilling their tax obligations.

Steps to complete the Form 1040 ES Español

Completing the Form 1040 ES Español involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Calculate your expected income for the year, taking into account any deductions or credits.

- Use the form's worksheet to determine your estimated tax liability based on your projected income.

- Divide your total estimated tax by four to find the amount due for each quarterly payment.

- Complete the form by filling in your personal information and the calculated amounts.

- Submit the form along with your payment by the specified due dates.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Form 1040 ES Español. Typically, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes. Taxpayers should mark their calendars to ensure timely submissions and avoid any complications with their tax obligations.

Legal use of the Form 1040 ES Español

The Form 1040 ES Español is legally recognized by the IRS for estimating and paying federal income taxes. It is important for taxpayers to use this form correctly to avoid issues with compliance. Proper use of the form helps ensure that individuals meet their tax obligations and can prevent potential penalties for underpayment. Taxpayers are encouraged to keep copies of their submitted forms and payment receipts for their records.

Key elements of the Form 1040 ES Español

Key elements of the Form 1040 ES Español include:

- Personal information section for taxpayer identification.

- Estimated tax calculation worksheet to assist in determining tax liability.

- Payment vouchers for submitting quarterly payments.

- Instructions in Spanish to guide taxpayers through the completion process.

Quick guide on how to complete form 1040 es espanol

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly option to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the essential tools required to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to deliver your form, through email, SMS, an invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, monotonous form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040 ES Espanol

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es espanol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 ES Espanol and who needs it?

Form 1040 ES Espanol is the Spanish version of the estimated tax payment voucher used by individuals to make quarterly tax payments to the IRS. It is essential for self-employed individuals and those with income not subject to withholding. If you're earning income without taxes being deducted, Form 1040 ES Espanol helps ensure you meet your tax obligations.

-

How can I complete Form 1040 ES Espanol using airSlate SignNow?

With airSlate SignNow, you can easily complete Form 1040 ES Espanol by uploading the document, filling it out electronically, and signing it securely. Our platform provides a user-friendly interface that simplifies the process, making it easy for you to fulfill your tax requirements without hassle.

-

Are there any costs associated with using airSlate SignNow to fill out Form 1040 ES Espanol?

airSlate SignNow offers a variety of pricing plans that are flexible and cost-effective, allowing you to choose one that fits your needs. Depending on the features you require, you can access the full benefits of eSigning and document management for a monthly or annual fee. You can pay for only what you need when completing Form 1040 ES Espanol.

-

What features does airSlate SignNow provide for handling Form 1040 ES Espanol?

airSlate SignNow offers features like document uploading, electronic signatures, and secure sharing that make handling Form 1040 ES Espanol easy. Additionally, it allows for real-time collaboration, ensuring that you can work with your tax advisor or accountant efficiently. Our platform enhances your document management workflow.

-

Is airSlate SignNow secure for storing Form 1040 ES Espanol?

Yes, airSlate SignNow prioritizes your security and privacy. All documents, including Form 1040 ES Espanol, are stored using advanced encryption methods to protect your sensitive information. Our commitment to security means you can confidently manage and sign your tax documents without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other applications for managing Form 1040 ES Espanol?

Absolutely! airSlate SignNow provides integration capabilities with various popular applications such as Google Drive, Dropbox, and more. This allows you to seamlessly manage and share your Form 1040 ES Espanol alongside your other documents, streamlining your workflow and improving efficiency.

-

What are the benefits of using airSlate SignNow for Form 1040 ES Espanol?

Using airSlate SignNow for Form 1040 ES Espanol provides numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The electronic signing process speeds up your filing, ensuring that you meet deadlines conveniently. Plus, our platform is designed for ease of use, making tax documentation stress-free.

Get more for Form 1040 ES Espanol

Find out other Form 1040 ES Espanol

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation