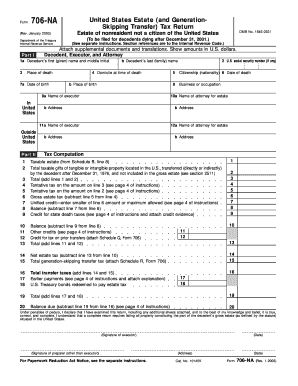

Form 706 NA United States Estate and GenerationSkipping Transfer Tax Return Estate of Nonresident Not a Citizen of the United St

Understanding Form 706 NA

The Form 706 NA is a crucial document for the estate of a nonresident who is not a citizen of the United States. This form is specifically designed for estates of decedents who pass away after December 31 and are subject to the United States Estate and Generation-Skipping Transfer Tax. It serves as a means to report the value of the decedent's estate and any applicable generation-skipping transfer taxes. This form is essential for ensuring compliance with U.S. tax laws regarding estates of nonresidents.

How to Complete Form 706 NA

Completing Form 706 NA involves several important steps. First, gather all necessary information regarding the decedent's assets, liabilities, and any previous gifts that may impact the estate's tax obligations. Next, fill out the form accurately, providing detailed information about the estate's value and any deductions that may apply. It is advisable to consult with a tax professional to ensure that the form is completed correctly and all applicable laws are followed.

Obtaining Form 706 NA

Form 706 NA can be obtained directly from the Internal Revenue Service (IRS) website or through tax professionals who can assist in the filing process. The form is available in a printable format, allowing individuals to fill it out manually. Additionally, tax software may offer features that streamline the completion of this form, making it easier to gather the necessary information and submit it electronically.

Key Elements of Form 706 NA

Several key elements must be included in Form 706 NA to ensure it is complete and accurate. These elements include the decedent's personal information, a detailed inventory of the estate's assets, liabilities, and any deductions or credits that apply. It is also important to include information on any generation-skipping transfers that may be relevant. Each section of the form must be filled out with precision to avoid issues with the IRS.

Filing Deadlines for Form 706 NA

Filing deadlines for Form 706 NA are critical to avoid penalties and interest. Generally, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is important to be aware of these deadlines and plan accordingly to ensure timely submission of the form.

Penalties for Non-Compliance

Failure to file Form 706 NA or inaccuracies in the form can lead to significant penalties. The IRS may impose fines for late submissions, and interest may accrue on any unpaid taxes. In severe cases, non-compliance can result in legal action. Therefore, it is essential to adhere to all filing requirements and ensure the form is completed accurately.

Examples of Using Form 706 NA

Form 706 NA is often utilized in various scenarios involving nonresident decedents. For instance, if a nonresident individual passes away owning U.S. real estate, this form would be necessary to report the estate's value and calculate any taxes owed. Additionally, if the decedent made significant gifts prior to their death, these would need to be reported on the form, impacting the overall estate tax liability.

Quick guide on how to complete form 706 na united states estate and generationskipping transfer tax return estate of nonresident not a citizen of the united

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct template and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

How to adjust and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form—by email, SMS, or invitation link—or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 NA United States Estate and GenerationSkipping Transfer Tax Return Estate Of Nonresident Not A Citizen Of The United St

Create this form in 5 minutes!

How to create an eSignature for the form 706 na united states estate and generationskipping transfer tax return estate of nonresident not a citizen of the united

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return?

Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return Estate Of Nonresident Not A Citizen Of The United States To Be Filed For Decedents Dying After December 31, is a tax form required for nonresident decedents. This form helps calculate the estate and generation-skipping transfer taxes for estates exceeding a certain threshold. It ensures compliance with U.S. tax regulations for estates of non-citizen decedents.

-

How can airSlate SignNow help with filing Form 706 NA?

airSlate SignNow provides features that simplify the preparation and submission of Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return. With our platform, you can easily upload necessary documents, eSign them, and securely send them to the relevant parties, streamlining the filing process. This reduces the administrative burden often associated with complicated tax forms.

-

What are the benefits of using airSlate SignNow for estate document management?

Using airSlate SignNow for managing the Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return can save you time and reduce errors. Our platform offers an intuitive interface and reliable e-signature capabilities that enhance user experience. Additionally, it ensures that documents are securely stored and easily retrievable when needed.

-

What is the cost of using airSlate SignNow for filing Form 706 NA?

airSlate SignNow offers affordable pricing plans tailored to various business needs, especially for those handling complex documents like the Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return. Pricing includes access to essential features for eSigning and document management, eliminating unexpected costs. Contact our sales team for customized options.

-

Are there any integrations available with airSlate SignNow for tax filing purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software to enhance your workflow for tasks like preparing Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return. These integrations allow for easy data transfer and document synchronization, ensuring that you can efficiently manage all your financial and estate-related documents.

-

Is airSlate SignNow compliant with legal and security standards for sensitive documents?

Absolutely! airSlate SignNow complies with robust legal and security standards, ensuring that forms like the Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return are handled securely. Our platform employs encryption and other security measures to protect your sensitive information, providing peace of mind when managing estate documents.

-

Can I track the status of my Form 706 NA submissions through airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their documents, including Form 706 NA United States Estate and Generation-Skipping Transfer Tax Return submissions. You will receive notifications upon document viewing, signing, and completion, giving you full visibility and control over the submission process.

Get more for Form 706 NA United States Estate and GenerationSkipping Transfer Tax Return Estate Of Nonresident Not A Citizen Of The United St

- Ar 2004 6 form

- Registrars office mizzou refund appeal form

- Met 2 adj the comptroller of maryland form

- 51a209 form

- Nc242 form 1113273

- North carolina complaint in summary ejectment form online

- Advance directive for a natural death quotliving willquot north carolina ncmedsoc form

- Petition to sueappeal north carolina court system nccourts form

Find out other Form 706 NA United States Estate and GenerationSkipping Transfer Tax Return Estate Of Nonresident Not A Citizen Of The United St

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple