Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e

Understanding Form 990 T for Exempt Organizations

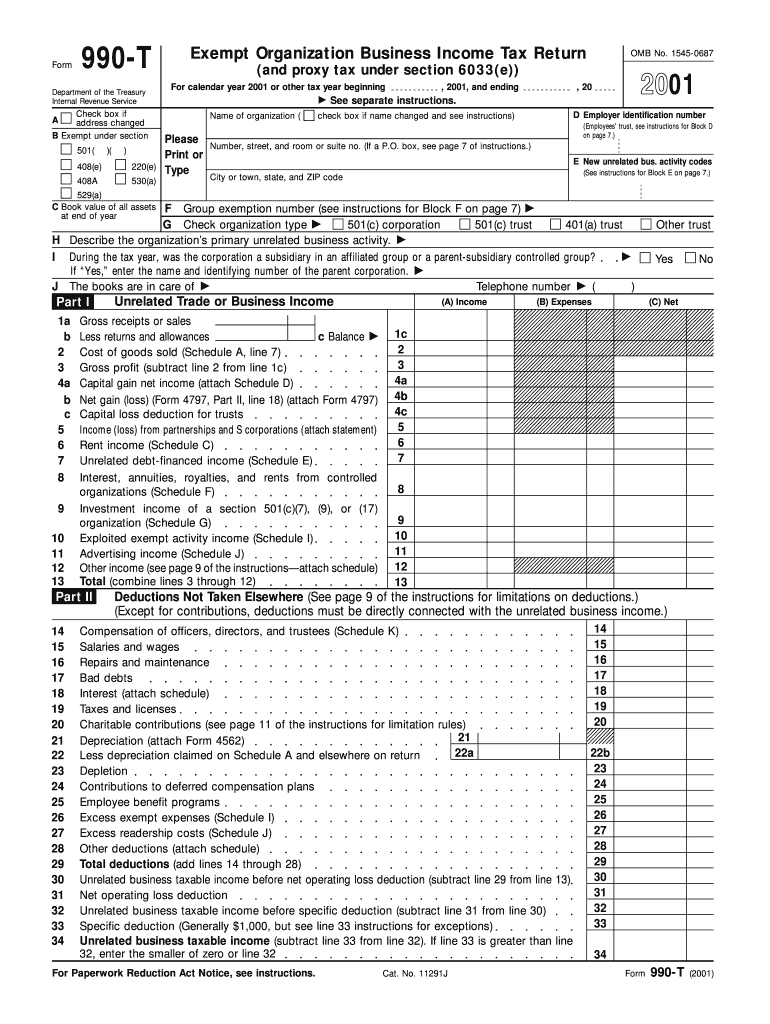

The Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e is a crucial document for tax-exempt organizations in the United States. This form is specifically designed for organizations that generate unrelated business income. It allows these entities to report their business income and pay any applicable taxes. Understanding this form is essential for compliance with IRS regulations, ensuring that organizations maintain their tax-exempt status while fulfilling their tax obligations.

Steps to Complete Form 990 T

Completing Form 990 T involves several key steps to ensure accuracy and compliance. First, organizations must gather all necessary financial information related to their unrelated business income. This includes revenue from activities not substantially related to their exempt purpose. Next, organizations should carefully fill out the form, providing detailed information about their income, expenses, and any deductions they are claiming. It is important to review the form for completeness and accuracy before submission. Finally, organizations should keep a copy of the completed form for their records.

Obtaining Form 990 T

Organizations can obtain the Form 990 T Fill in Version through the IRS website or by contacting the IRS directly. The form is available in a fillable PDF format, making it easy to complete electronically. Additionally, organizations can access instructions and guidelines that accompany the form, which provide valuable information on how to fill it out correctly. It is advisable to download the latest version of the form to ensure compliance with current tax laws.

Key Elements of Form 990 T

Several key elements are essential to understand when filling out Form 990 T. These include the identification section, where the organization provides its name, address, and Employer Identification Number (EIN). The income section details the types of unrelated business income being reported, while the expenses section outlines any deductions that the organization is claiming. Additionally, organizations must report any proxy tax under Section 6033e, which applies to certain political expenditures. Understanding these elements helps ensure accurate reporting and compliance.

Filing Deadlines for Form 990 T

Timely filing of Form 990 T is crucial for tax-exempt organizations. The form is typically due on the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this means the deadline is May fifteenth. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Organizations may file for an extension if needed, but it is important to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance with Form 990 T

Non-compliance with the filing requirements of Form 990 T can result in significant penalties for tax-exempt organizations. Failure to file the form on time may lead to a penalty of $20 per day, up to a maximum of $10,000. In cases where the organization fails to report unrelated business income, the IRS may impose additional penalties. Organizations should ensure timely and accurate filing to avoid these consequences and maintain their tax-exempt status.

Quick guide on how to complete form 990 t fill in version exempt organization business income tax return and proxy tax under section 6033e 1664117

Prepare [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any system using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive details with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Create this form in 5 minutes!

How to create an eSignature for the form 990 t fill in version exempt organization business income tax return and proxy tax under section 6033e 1664117

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e?

The Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e is a tax form required for certain exempt organizations to report unrelated business income. It ensures compliance with IRS regulations and helps organizations fulfill their tax obligations efficiently.

-

How can airSlate SignNow assist with filling out the Form 990 T?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e. Our solution allows users to easily fill in necessary information, eSign, and store documents securely, all in one place.

-

Is there a cost associated with using airSlate SignNow for the Form 990 T?

Yes, airSlate SignNow provides cost-effective pricing plans tailored for businesses needing to complete the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e. We offer different tiers based on user needs, ensuring you find a plan that fits your budget.

-

What features does airSlate SignNow offer for the Form 990 T completion?

Our platform offers features like easy form filling, templates for the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e, and seamless eSigning. Additionally, you can track document statuses and manage records efficiently.

-

Can I integrate airSlate SignNow with other software for handling Form 990 T?

Yes, airSlate SignNow allows for integrations with a variety of other software solutions, enhancing your workflow while preparing the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e. This functionality facilitates smoother operations and better data management.

-

How does airSlate SignNow ensure the security of my Form 990 T data?

airSlate SignNow prioritizes data security by implementing advanced encryption and secure servers to protect your information. As you fill out the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e, you can trust that your sensitive data remains private and secure.

-

What benefits does eSigning the Form 990 T provide?

eSigning the Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e streamlines the submission process, allowing for quicker approvals and processing. It reduces paperwork and provides a legally valid signature, making it easier to comply with IRS requirements.

Get more for Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

Find out other Form 990 T Fill in Version Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now