Form 1065 Schedule D, Fill in Version Capital Gains and Losses

Understanding Form 1065 Schedule D, Fill in Version Capital Gains and Losses

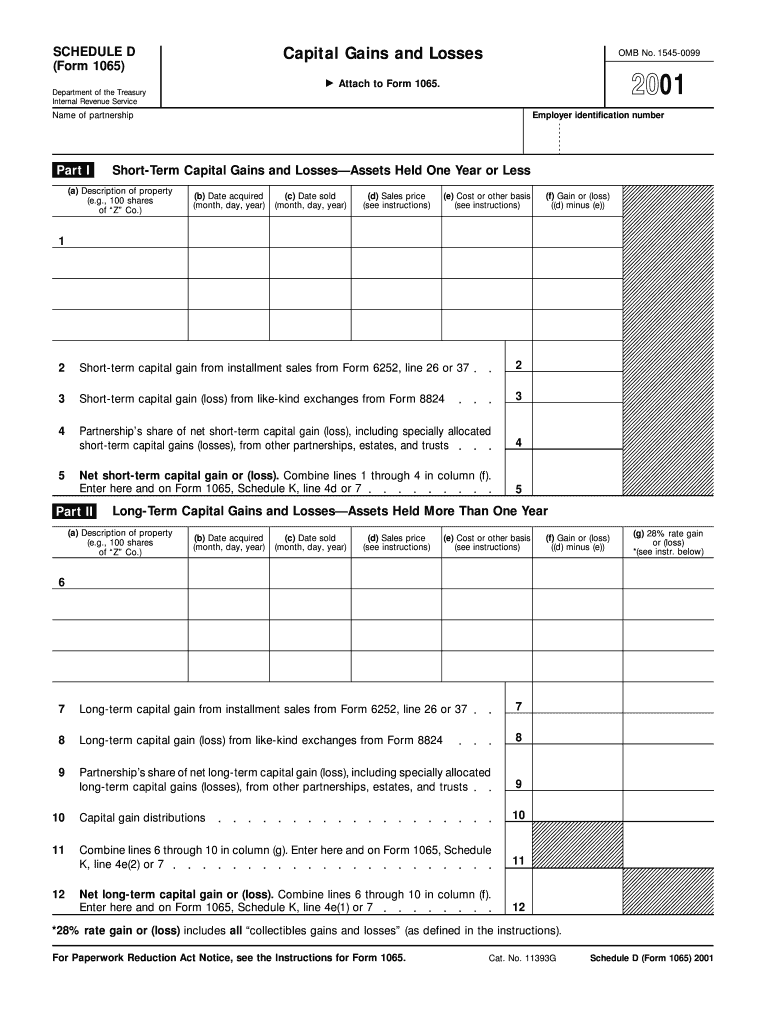

Form 1065 Schedule D is a crucial document for partnerships in the United States, used to report capital gains and losses. This form allows partnerships to detail their transactions involving capital assets, which include stocks, bonds, and real estate. The fill-in version is designed for ease of use, enabling partners to input their information directly into the form, ensuring accurate reporting and compliance with IRS regulations.

How to Complete Form 1065 Schedule D

Completing Form 1065 Schedule D involves several steps. First, gather all necessary financial documents, including records of capital asset transactions. Next, accurately report each transaction on the form, categorizing gains and losses. It is essential to differentiate between short-term and long-term gains, as they are taxed differently. Finally, review the completed form for accuracy before submission to ensure compliance with IRS guidelines.

Obtaining Form 1065 Schedule D

Form 1065 Schedule D can be obtained directly from the IRS website or through authorized tax preparation software. The form is available in a fillable format, allowing users to enter their information electronically. Additionally, tax professionals can provide access to this form as part of their services, ensuring that it is completed correctly and submitted on time.

Key Components of Form 1065 Schedule D

The key components of Form 1065 Schedule D include sections for reporting short-term and long-term capital gains and losses. Each section requires detailed information about the asset, including the date acquired, date sold, proceeds from the sale, and the cost basis. Accurate reporting of these elements is vital for determining the correct tax liability for the partnership.

Filing Deadlines for Form 1065 Schedule D

The filing deadline for Form 1065 Schedule D typically aligns with the partnership's tax return due date, which is usually March 15 for most partnerships. If additional time is needed, partnerships can file for an extension, allowing them until September 15 to submit the form. It is important to adhere to these deadlines to avoid penalties and interest charges.

IRS Guidelines for Form 1065 Schedule D

The IRS provides specific guidelines for completing Form 1065 Schedule D, including instructions on how to report different types of capital gains and losses. Partnerships must ensure they follow these guidelines to maintain compliance. This includes understanding the implications of netting gains and losses, as well as the proper documentation required for each transaction reported on the form.

Digital Submission Methods for Form 1065 Schedule D

Form 1065 Schedule D can be submitted digitally through various tax preparation software platforms that support e-filing. This method streamlines the filing process, allowing for quicker submission and confirmation of receipt by the IRS. Partnerships opting for digital submission should ensure they have the necessary electronic signatures and documentation in place to comply with IRS requirements.

Quick guide on how to complete form 1065 schedule d fill in version capital gains and losses

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the essential tools to swiftly create, modify, and electronically sign your documents without any delays. Manage [SKS] on any platform with the airSlate SignNow apps available for Android or iOS, and enhance any document-oriented task today.

How to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, and mistakes that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and guarantee seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 Schedule D, Fill in Version Capital Gains And Losses

Create this form in 5 minutes!

How to create an eSignature for the form 1065 schedule d fill in version capital gains and losses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 Schedule D, Fill in Version Capital Gains And Losses?

Form 1065 Schedule D, Fill in Version Capital Gains And Losses is used by partnerships to report capital gains and losses from the sale of assets. This form is essential for ensuring proper tax reporting and compliance. Understanding how to correctly fill it in can save your business time and potential penalties.

-

How can airSlate SignNow help with Form 1065 Schedule D, Fill in Version Capital Gains And Losses?

airSlate SignNow allows you to efficiently fill out and eSign Form 1065 Schedule D, Fill in Version Capital Gains And Losses. With our intuitive interface, you can quickly complete the necessary sections and ensure accurate submissions. This not only streamlines the process but also helps you keep track of your documents.

-

Is there a cost associated with using airSlate SignNow for Form 1065 Schedule D?

Yes, airSlate SignNow offers various pricing plans to meet the needs of different customers. Our plans provide excellent value for businesses looking to fill in and eSign Form 1065 Schedule D, Fill in Version Capital Gains And Losses. Visit our pricing page for detailed information on features included in each plan.

-

What features does airSlate SignNow offer for eSigning documents?

airSlate SignNow provides a range of features to enhance your eSigning experience, including customizable templates, in-person signing, and secure storage. These features ensure that filling in Form 1065 Schedule D, Fill in Version Capital Gains And Losses is not only easy but also secure and efficient. You can also track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for tax reporting?

Absolutely! airSlate SignNow offers integrations with popular accounting and tax software, making it easier to manage your documents. This integration can assist with filling in Form 1065 Schedule D, Fill in Version Capital Gains And Losses by automating workflows and reducing manual entry. Access your forms seamlessly while maintaining compliance.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow. We use industry-standard encryption and secure data centers to protect all your documents, including Form 1065 Schedule D, Fill in Version Capital Gains And Losses. You can rest assured that your sensitive information remains confidential and secure during the eSigning process.

-

Is there support available for users of airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or concerns related to Form 1065 Schedule D, Fill in Version Capital Gains And Losses. Our support team is available through various channels, including chat, email, and phone, ensuring you get the help you need when you need it.

Get more for Form 1065 Schedule D, Fill in Version Capital Gains And Losses

Find out other Form 1065 Schedule D, Fill in Version Capital Gains And Losses

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form