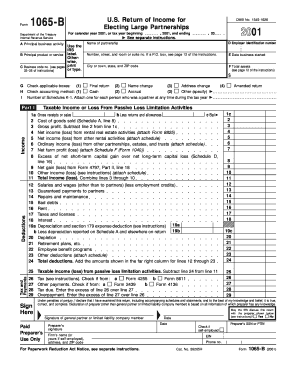

Return of Income for Electing Large Partnerships for Calendar Year , or Tax Year Beginning Name of Partnership Number, Street, a Form

What is the Return Of Income For Electing Large Partnerships For Calendar Year

The Return of Income for Electing Large Partnerships is a tax form specifically designed for partnerships that have elected to be treated as large partnerships under U.S. tax law. This form is crucial for reporting the income, deductions, and credits of the partnership for the calendar year or the tax year beginning on a specified date. It includes essential information such as the name of the partnership, the partnership's identification number, and the address, including street and room or suite number. This form ensures that the partnership complies with IRS regulations and accurately reports its financial activities.

Steps to Complete the Return Of Income For Electing Large Partnerships

Completing the Return of Income for Electing Large Partnerships involves several key steps:

- Gather necessary information, including the partnership's name, identification number, and address.

- Collect financial records for the tax year, including income, expenses, and any applicable deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or via mail, depending on the preferred method.

Key Elements of the Return Of Income For Electing Large Partnerships

The key elements of the Return of Income for Electing Large Partnerships include:

- Partnership Information: Name, identification number, and address of the partnership.

- Financial Data: Total income, deductions, and credits for the reporting period.

- Signature: Required signatures from authorized representatives of the partnership.

- Filing Status: Indication of whether the partnership is electing to be treated as a large partnership.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Return of Income for Electing Large Partnerships. Typically, the form must be filed by the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is due on March 15. Extensions may be available, but they must be requested in advance to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Return of Income for Electing Large Partnerships. These guidelines include instructions on how to report various types of income and deductions, as well as the requirements for electronic filing. Partnerships should review the latest IRS publications related to large partnerships to ensure compliance with current tax laws and regulations.

Form Submission Methods

The Return of Income for Electing Large Partnerships can be submitted through multiple methods. Partnerships may choose to file electronically using IRS-approved software, which often streamlines the process and reduces the likelihood of errors. Alternatively, the form can be mailed to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In-person submissions are generally not available for this form.

Quick guide on how to complete return of income for electing large partnerships for calendar year or tax year beginning name of partnership number street and

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your method of sending the form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Return Of Income For Electing Large Partnerships For Calendar Year , Or Tax Year Beginning Name Of Partnership Number, Street, A

Create this form in 5 minutes!

How to create an eSignature for the return of income for electing large partnerships for calendar year or tax year beginning name of partnership number street and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.'?

The 'Return Of Income For Electing Large Partnerships' is a tax document that large partnerships must file annually. It includes essential information like the partnership's name, address, and the applicable tax year. Understanding this process is crucial to ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with the 'Return Of Income For Electing Large Partnerships' process?

airSlate SignNow streamlines the process of preparing and submitting the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.' by providing users with easy-to-use templates and eSignature capabilities. This minimizes paperwork and enhances efficiency in filing tax returns. It's designed to make your tax-related tasks simpler and faster.

-

What features does airSlate SignNow offer for managing partnership tax documents?

airSlate SignNow offers features like customizable templates, document sharing, eSignatures, and tracking capabilities specifically for tax documents. This ensures that your 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.' documents are processed correctly and on time. The platform's collaboration tools also enhance team productivity.

-

Is there a pricing plan for using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. These plans include essential features for managing the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.' and can be customized based on your specific requirements. We recommend checking our pricing page for details on the most suitable option for your business.

-

Can airSlate SignNow integrate with other software for tax filing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your workflow for the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.'. This integration helps streamline processes, minimizes data entry, and keeps your information synchronized across different platforms.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow. We utilize robust encryption protocols and comply with industry standards to ensure the safety of sensitive documents, including the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.'. You can trust that your information remains secure and confidential while using our platform.

-

What are the benefits of electronic signatures for partnership tax returns?

Electronic signatures signNowly expedite the process of signing and submitting the 'Return Of Income For Electing Large Partnerships For Calendar Year, Or Tax Year Beginning Name Of Partnership Number, Street, And Room Or Suite No.'. They allow for quicker approvals and reduce the need for physical paperwork, which can save time and resources. Plus, eSignatures are legally recognized, ensuring compliance with tax regulations.

Get more for Return Of Income For Electing Large Partnerships For Calendar Year , Or Tax Year Beginning Name Of Partnership Number, Street, A

Find out other Return Of Income For Electing Large Partnerships For Calendar Year , Or Tax Year Beginning Name Of Partnership Number, Street, A

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple