Form 2439 Fill in Version Notice to Shareholder of Undistributed Long Term Capital Gains

What is the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

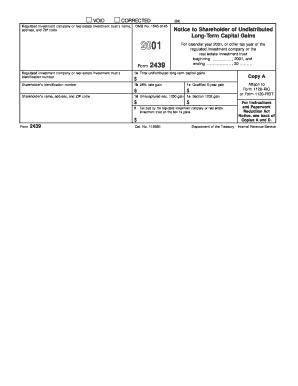

The Form 2439 is a tax document issued by regulated investment companies (RICs) to inform shareholders of undistributed long-term capital gains. This form is essential for shareholders to report these gains on their individual tax returns. It details the amount of capital gains that have not been distributed, allowing shareholders to accurately calculate their tax liabilities. Understanding this form is crucial for shareholders to comply with IRS regulations and ensure proper tax reporting.

How to use the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Using Form 2439 involves a few key steps. First, shareholders should receive the form from their investment company, typically by mail or electronically. Once received, shareholders must review the information provided, including the total undistributed long-term capital gains. This information should be reported on the shareholder's tax return, specifically on Schedule D and Form 1040. It is important to retain a copy of the form for personal records and future reference.

Steps to complete the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Completing Form 2439 requires careful attention to detail. Shareholders should follow these steps:

- Review the form for accuracy, ensuring all personal information is correct.

- Locate the total undistributed long-term capital gains amount on the form.

- Report this amount on the appropriate lines of Schedule D and Form 1040.

- Keep a copy of the completed form for your records.

These steps help ensure compliance with tax regulations and accurate reporting of capital gains.

Key elements of the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Form 2439 contains several key elements that shareholders should be aware of. These include:

- The name and address of the investment company issuing the form.

- The shareholder's name and address.

- The amount of undistributed long-term capital gains.

- Any taxes paid on these gains.

Understanding these elements helps shareholders accurately report their tax obligations and ensures they have all necessary information for their filings.

Legal use of the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

The legal use of Form 2439 is primarily for tax reporting purposes. Shareholders must include the information from this form when filing their annual tax returns. Failure to report undistributed long-term capital gains can lead to penalties and interest charges from the IRS. Therefore, it is important for shareholders to understand their responsibilities regarding this form and to use it in accordance with IRS guidelines.

IRS Guidelines

The IRS provides specific guidelines for the use of Form 2439. Shareholders should refer to IRS publications for detailed instructions on reporting undistributed long-term capital gains. These guidelines outline how to correctly fill out the form, the deadlines for submission, and the consequences of non-compliance. Staying informed about IRS requirements ensures that shareholders remain compliant and avoid potential tax issues.

Quick guide on how to complete form 2439 fill in version notice to shareholder of undistributed long term capital gains

Effortlessly Prepare [SKS] on Any Device

The management of documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Method to Edit and Electronically Sign [SKS] without Stress

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Select key sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to store your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] while ensuring effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

Create this form in 5 minutes!

How to create an eSignature for the form 2439 fill in version notice to shareholder of undistributed long term capital gains

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains?

The Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains is a document used by regulated investment companies to inform shareholders about undistributed long-term capital gains. This form ensures that shareholders are adequately aware of their tax liabilities regarding dividends and gains, facilitating better financial planning.

-

How does airSlate SignNow simplify the eSigning of Form 2439?

airSlate SignNow provides an efficient platform for users to send and eSign the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains. With its user-friendly interface and streamlined processes, users can create and store forms securely while ensuring compliance with IRS regulations.

-

What features does airSlate SignNow offer for handling Form 2439?

Our platform offers key features such as customizable templates for the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains, advanced electronic signature options, and automated workflows. These features are designed to save time and reduce errors when preparing and sending important tax documents.

-

Is there pricing for using airSlate SignNow for Form 2439?

Yes, airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you are a small business or looking for enterprise solutions, you can choose a plan that suits your requirements for handling the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains effectively and affordably.

-

Can I integrate other applications with airSlate SignNow while using Form 2439?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage your Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains within your existing workflows. Popular integrations include CRM, accounting software, and more, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for tax documents like Form 2439?

Using airSlate SignNow for documents like the Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages help businesses streamline their tax processes and ensure compliance with regulations.

-

How can I track the status of my Form 2439 sent through airSlate SignNow?

airSlate SignNow offers tracking features that allow you to monitor the status of your Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains in real-time. You will receive notifications when the document is viewed, signed, and completed, giving you full visibility into your document's journey.

Get more for Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

- Cf6r form

- Form lir 27 example

- To place an order please call your scholastic book fairs sales consultant or fax this form to 888 288 7323

- Military transfer form

- Note taking worksheet weathering and soil answers form

- Letter of recommendation for eagle scout candidate form

- Air quality webquest answer key form

- Termo de responsabilidade e compromisso 333717972 form

Find out other Form 2439 Fill in Version Notice To Shareholder Of Undistributed Long Term Capital Gains

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer