Form 4797

What is Form 4797

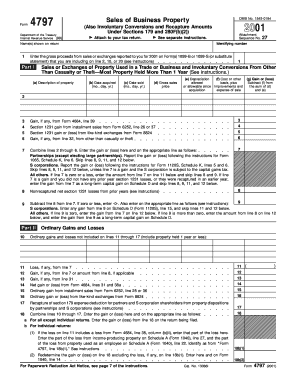

Form 4797, officially titled "Sales of Business Property," is a tax form used by businesses and individuals in the United States to report the sale or exchange of business property. This form is particularly important for reporting gains or losses from the sale of assets such as real estate, equipment, and other business-related properties. It helps taxpayers calculate the tax implications of these transactions and ensures compliance with IRS regulations.

How to use Form 4797

Using Form 4797 involves several steps. First, taxpayers must determine if they have sold or exchanged any business property during the tax year. If so, they will need to gather relevant information, including the date of sale, the selling price, and the original cost of the property. Next, the taxpayer will fill out the form, detailing the transactions and calculating any gains or losses. Finally, the completed form must be submitted along with the taxpayer's annual tax return.

Steps to complete Form 4797

Completing Form 4797 requires careful attention to detail. Here are the key steps:

- Gather all necessary documentation related to the sale of business property.

- Report the details of each sale in the appropriate sections of the form.

- Calculate any gains or losses by subtracting the property's adjusted basis from the selling price.

- Complete the summary section to provide an overview of all transactions.

- Review the form for accuracy before submitting it with your tax return.

Filing Deadlines / Important Dates

Form 4797 must be filed by the due date of your tax return, which is typically April 15 for most taxpayers. However, if you are filing for a business entity, the deadline may vary. It is crucial to be aware of these deadlines to avoid penalties and ensure timely processing of your tax return.

IRS Guidelines

The IRS provides specific guidelines for completing Form 4797, including instructions on how to report different types of transactions. Taxpayers should refer to the IRS instructions for Form 4797 for detailed information on eligibility, reporting requirements, and any updates to the form. Following these guidelines helps ensure compliance and accuracy in reporting.

Key elements of Form 4797

Form 4797 includes several key elements that taxpayers must understand:

- Part I: This section is for reporting sales of property used in a trade or business.

- Part II: This part is dedicated to reporting like-kind exchanges.

- Part III: This section covers the sale of depreciable property.

- Summary: A summary of total gains and losses must be provided at the end of the form.

Quick guide on how to complete form 4797 1664707

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Handle [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to Alter and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new printed copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4797

Create this form in 5 minutes!

How to create an eSignature for the form 4797 1664707

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4797 and how does it work with airSlate SignNow?

The Form 4797 is used to report the sale of business property. With airSlate SignNow, you can easily eSign and manage your Form 4797 documents online, ensuring a seamless process for filing and compliance.

-

How much does it cost to use airSlate SignNow for processing Form 4797?

airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. You can choose a plan that fits your needs, providing you with the ability to eSign your Form 4797 without breaking the bank.

-

What are the key features of airSlate SignNow for handling Form 4797?

airSlate SignNow provides features such as secure eSigning, templates for quick Form 4797 creation, and document tracking. These features enhance efficiency, making it easy to complete and file your Form 4797 accurately.

-

Can I store and manage my Form 4797 documents using airSlate SignNow?

Yes, airSlate SignNow allows you to store and manage your Form 4797 documents securely in the cloud. You can easily access, edit, and share your documents whenever needed, ensuring they are always available for your reference.

-

Are there integrations available for Form 4797 with airSlate SignNow?

airSlate SignNow offers integrations with popular business tools, allowing you to streamline your workflow when dealing with Form 4797. Whether you use CRM software or other document management systems, you can simplify your processes with these integrations.

-

How does airSlate SignNow ensure the security of my Form 4797 documents?

Security is a top priority at airSlate SignNow. Your Form 4797 documents are protected with advanced encryption methods, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

Is it easy to eSign Form 4797 on airSlate SignNow?

Absolutely! airSlate SignNow provides an intuitive platform that makes it easy to eSign your Form 4797. With a few clicks, you can sign, send, and receive notifications, streamlining your documentation process.

Get more for Form 4797

Find out other Form 4797

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation