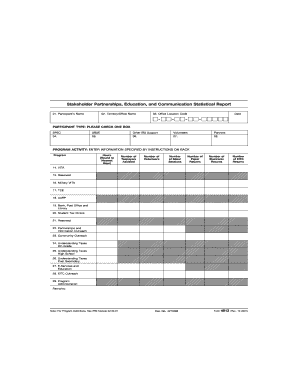

Form 4913 Rev December , Fill in Version

What is the Form 4913 Rev December, Fill in Version

The Form 4913 Rev December, Fill in Version is a specific document utilized for various administrative purposes. It is essential for individuals and businesses to understand its function and requirements. This form may be used in different contexts, such as tax reporting or compliance with regulatory standards. Knowing its purpose helps ensure proper completion and submission.

How to use the Form 4913 Rev December, Fill in Version

Using the Form 4913 Rev December, Fill in Version involves several steps to ensure accurate completion. First, gather all necessary information required to fill out the form. This includes personal details, financial data, or any other relevant information. Next, carefully fill in each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for accuracy before submission.

Steps to complete the Form 4913 Rev December, Fill in Version

Completing the Form 4913 Rev December, Fill in Version requires a systematic approach. Follow these steps:

- Obtain the latest version of the form from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in personal information, including name, address, and contact details.

- Provide any required financial information or data specific to the form's purpose.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated.

Legal use of the Form 4913 Rev December, Fill in Version

The legal use of the Form 4913 Rev December, Fill in Version is crucial for compliance with applicable laws and regulations. This form must be filled out accurately to avoid potential legal issues. It is important to understand the legal implications of the information provided, as inaccuracies may lead to penalties or other consequences.

Who Issues the Form

The Form 4913 Rev December, Fill in Version is typically issued by a governmental agency or regulatory body. Understanding the issuing authority is important, as it provides context for the form's requirements and the legal framework surrounding its use. Users should always refer to the official guidelines provided by the issuing entity to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4913 Rev December, Fill in Version can vary based on its purpose. It is essential to be aware of any important dates associated with the form to avoid late submissions. Users should check for specific deadlines related to their circumstances, as timely filing is often critical for compliance and avoiding penalties.

Quick guide on how to complete form 4913 rev december fill in version

Complete [SKS] effortlessly on any device

Web-based document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign [SKS] with minimal effort

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4913 Rev December , Fill in Version

Create this form in 5 minutes!

How to create an eSignature for the form 4913 rev december fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form 4913 Rev December, Fill in Version?

The Form 4913 Rev December, Fill in Version is designed for businesses to easily complete and manage their document signing processes. It streamlines the submission of important forms while ensuring all necessary information is captured accurately.

-

How can I fill out the Form 4913 Rev December, Fill in Version using airSlate SignNow?

Filling out the Form 4913 Rev December, Fill in Version with airSlate SignNow is simple. Users can upload the form, and then utilize our intuitive interface to complete each required field, making document handling efficient and straightforward.

-

Is there a cost associated with using airSlate SignNow for the Form 4913 Rev December, Fill in Version?

Yes, there is a subscription cost associated with using airSlate SignNow, which varies based on the selected plan. However, the cost-effective pricing structure provides signNow value through features like eSigning and document management for the Form 4913 Rev December, Fill in Version.

-

What features does airSlate SignNow offer for managing the Form 4913 Rev December, Fill in Version?

airSlate SignNow offers a range of features for effectively managing the Form 4913 Rev December, Fill in Version, including customizable templates, real-time collaboration, and secure cloud storage. These features enhance productivity and ensure seamless workflow.

-

Can I integrate airSlate SignNow with other applications for processing the Form 4913 Rev December, Fill in Version?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive and Dropbox, allowing you to manage the Form 4913 Rev December, Fill in Version alongside your existing tools. This integration helps streamline your workflows.

-

What are the benefits of using airSlate SignNow for the Form 4913 Rev December, Fill in Version?

Using airSlate SignNow for the Form 4913 Rev December, Fill in Version provides numerous benefits including increased efficiency, reduced turnaround time, and enhanced accuracy. These advantages contribute to a smoother document signing process for businesses.

-

Is it secure to use airSlate SignNow for the Form 4913 Rev December, Fill in Version?

Yes, airSlate SignNow prioritizes security by implementing features such as encryption and secure cloud storage. This ensures that all documents, including the Form 4913 Rev December, Fill in Version, are handled with the utmost confidentiality and protection.

Get more for Form 4913 Rev December , Fill in Version

Find out other Form 4913 Rev December , Fill in Version

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast