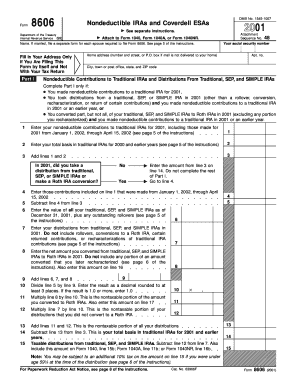

1545 1007 Department of the Treasury Internal Revenue Service 99 Attachment Sequence No Form

What is the Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

The Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No is a specific form used by the IRS for various tax-related purposes. This form is typically associated with reporting specific financial information that may be required for tax compliance. It is essential for taxpayers to understand the purpose of this form, as it can affect their tax filings and overall compliance with federal tax regulations.

How to use the Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

Using the form involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents that pertain to the information required on the form. After filling out the form accurately, it can be submitted either electronically or via mail, depending on the specific instructions provided by the IRS. Ensuring that all information is correct and complete is crucial to avoid delays in processing.

Steps to complete the Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

Completing the form requires careful attention to detail. Begin by downloading the form from the IRS website or accessing it through tax preparation software. Follow these steps:

- Review the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the required financial information as specified in the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Required Documents

To complete the form, you will need several supporting documents. These may include:

- Previous tax returns for reference.

- W-2 forms or 1099 statements that report income.

- Documentation of deductions or credits you plan to claim.

- Any other relevant financial statements that support the information on the form.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the form. Typically, these deadlines align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline to file is April 15 of each year. However, if you are requesting an extension, ensure that any additional forms or attachments are submitted by the extended deadline.

Penalties for Non-Compliance

Failure to properly complete and submit the form can result in penalties imposed by the IRS. These penalties may include fines for late submission or inaccuracies in the information provided. It is crucial to adhere to all guidelines and deadlines to avoid unnecessary financial consequences.

Quick guide on how to complete 1545 1007 department of the treasury internal revenue service 99 attachment sequence no

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it digitally. airSlate SignNow provides all the tools required to create, amend, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specially provides for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal value as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your method of delivering your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and guarantee superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

Create this form in 5 minutes!

How to create an eSignature for the 1545 1007 department of the treasury internal revenue service 99 attachment sequence no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No.?

The 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No. is a specific attachment required for certain IRS forms. It helps ensure that all necessary information is included and processed correctly. By understanding this sequence number, users can better manage their tax documentation and submissions.

-

How does airSlate SignNow help with the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No.?

airSlate SignNow streamlines the process of preparing and submitting documents related to the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No. Our platform allows users to eSign and send documents quickly and securely, minimizing the risk of errors or omissions.

-

What features does airSlate SignNow offer for handling IRS documents?

AirSlate SignNow provides various features for managing IRS documents, including customizable templates, easy eSignature capabilities, and secure document storage. These features make it convenient for businesses to handle documents associated with the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No. and other essential tax forms.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their tax document activities, including those related to the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No. Our pricing plans are designed to fit various business needs without compromising on features or security.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow offers numerous integrations with widely-used accounting and tax filing software. This allows for a seamless workflow as you prepare documents related to the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No., ensuring efficient data management and submission.

-

How secure is airSlate SignNow for sensitive tax documents?

AirSlate SignNow prioritizes security, offering advanced encryption and data protection measures. This ensures that all documents, including those related to the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No., are kept safe from unauthorized access and bsignNowes.

-

What are the benefits of using airSlate SignNow for IRS documentation?

Using airSlate SignNow for IRS documentation, including the 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No., simplifies the process and enhances accuracy. The platform reduces paperwork, accelerates processing times, and helps ensure compliance with IRS regulations.

Get more for 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

- Lexington insurance company homeownersdwelling program application form

- Business and management indemnity insurance form

- Xlsplpl135 form

- Form hcb 002p

- Louisiana department of insurance application form speciality insurer

- Th amp wendyamp39s workplace inspection recording form

- Alabama am intent to vacate form

- Special diet request form comal independent school district comalisd

Find out other 1545 1007 Department Of The Treasury Internal Revenue Service 99 Attachment Sequence No

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement