Form 9325 Rev November , Fill in Version

What is the Form 9325 Rev November, Fill in Version

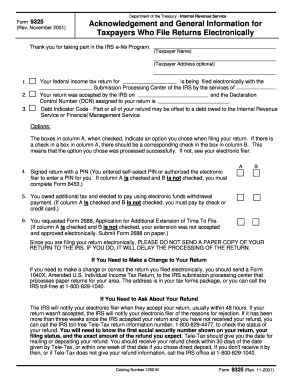

The Form 9325 Rev November, Fill in Version is a document used by taxpayers to provide a summary of their tax return filings. This form is particularly important for individuals and businesses who want to ensure compliance with IRS requirements. It serves as a record of the submission of tax returns, detailing the type of return filed, the tax year, and other pertinent information. Understanding this form is crucial for maintaining accurate tax records and fulfilling legal obligations.

How to use the Form 9325 Rev November, Fill in Version

Using the Form 9325 Rev November, Fill in Version involves several steps. First, ensure you have the correct version of the form, as updates may occur. Next, fill in the required fields, which typically include your name, taxpayer identification number, and details about the tax return you are submitting. Once completed, this form should be submitted alongside your tax return to the IRS. It is advisable to keep a copy for your records, as it can serve as proof of submission if needed in the future.

Steps to complete the Form 9325 Rev November, Fill in Version

Completing the Form 9325 Rev November, Fill in Version requires careful attention to detail. Follow these steps:

- Download the latest version of the form from the IRS website or obtain it from your tax professional.

- Fill in your personal information, including your name and taxpayer identification number.

- Indicate the type of tax return you are filing, such as individual, corporate, or partnership.

- Provide the tax year for which the return is being filed.

- Review all entries for accuracy before submission.

Key elements of the Form 9325 Rev November, Fill in Version

The Form 9325 Rev November, Fill in Version includes several key elements that are essential for accurate completion. These elements typically encompass:

- Taxpayer Information: This section requires your name and identification number.

- Return Type: Specify the type of return being filed.

- Tax Year: Clearly indicate the year associated with the tax return.

- Submission Date: Document the date on which you are submitting the form.

Form Submission Methods

The Form 9325 Rev November, Fill in Version can be submitted through various methods. Taxpayers have the option to file their forms online, which is often the quickest method. Alternatively, forms may be mailed to the appropriate IRS address or submitted in person at designated IRS offices. Each submission method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 9325 Rev November, Fill in Version. It is important to familiarize yourself with these guidelines to ensure compliance. The IRS outlines the necessary information to include on the form, deadlines for submission, and any additional documentation that may be required. Adhering to these guidelines helps prevent delays in processing and potential penalties.

Quick guide on how to complete form 9325 rev november fill in version

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow satisfies all your needs in document management in just a few clicks from any device of your preference. Alter and electronically sign [SKS] and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9325 Rev November , Fill in Version

Create this form in 5 minutes!

How to create an eSignature for the form 9325 rev november fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 9325 Rev November, Fill in Version used for?

The Form 9325 Rev November, Fill in Version is utilized to acknowledge the submission of tax documents to the IRS. This fillable version simplifies the process by allowing users to complete and submit necessary information electronically, ensuring compliance and accuracy.

-

How does airSlate SignNow help with Form 9325 Rev November, Fill in Version?

airSlate SignNow provides an efficient platform to eSign and send the Form 9325 Rev November, Fill in Version securely. This tool enables businesses to handle their tax documentation swiftly while maintaining the integrity and confidentiality of sensitive information.

-

Is there a cost associated with using the Form 9325 Rev November, Fill in Version on airSlate SignNow?

While the Form 9325 Rev November, Fill in Version itself may be free to use, airSlate SignNow offers various pricing plans that grant access to its features and functionalities. These cost-effective solutions empower businesses to manage document transactions without breaking the bank.

-

What are the key features of airSlate SignNow related to the Form 9325 Rev November, Fill in Version?

Key features of airSlate SignNow include document templates, eSignature capabilities, and secure storage solutions. These features make working with the Form 9325 Rev November, Fill in Version more manageable, allowing users to streamline their workflow and ensure swift compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other applications for handling Form 9325 Rev November, Fill in Version?

Absolutely! airSlate SignNow offers integrations with a variety of applications, enhancing your experience when working with the Form 9325 Rev November, Fill in Version. Common integrations with customer relationship management (CRM) platforms can facilitate easier document processing and management.

-

What benefits do I get from using airSlate SignNow for Form 9325 Rev November, Fill in Version?

Using airSlate SignNow for the Form 9325 Rev November, Fill in Version offers advantages like improved efficiency, enhanced security, and simplified compliance. These benefits allow businesses to focus on their core operations while managing their tax documentation effortlessly.

-

Is it easy to fill out the Form 9325 Rev November, Fill in Version on airSlate SignNow?

Yes, filling out the Form 9325 Rev November, Fill in Version on airSlate SignNow is user-friendly and intuitive. The platform's design allows users to easily navigate through the form, ensuring that all required fields are completed accurately.

Get more for Form 9325 Rev November , Fill in Version

- Business information form

- Fire sprinkler hydraulic data plate form

- Authorization agreement for direct deposit form

- Account application form template nz

- Universiteit aansoek vorm form

- Manulife group benefits extended health care claim form

- State tax registration application the payroll center form

- Hac rrisd form

Find out other Form 9325 Rev November , Fill in Version

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy