T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada Form

Understanding the T101D Sommaire Du Montant D'aide

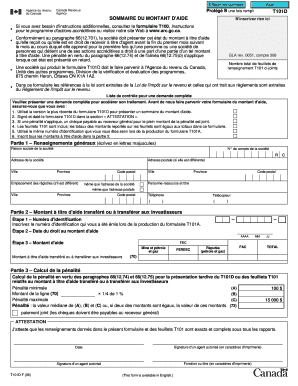

The T101D Sommaire Du Montant D'aide is a document issued by the Canada Revenue Agency (CRA) that summarizes the amount of assistance received. This form is essential for individuals and businesses that have received financial aid, as it provides a clear record of the support provided. Understanding this form is crucial for accurate reporting and compliance with tax regulations.

How to Use the T101D Sommaire Du Montant D'aide

Using the T101D involves reviewing the details provided in the document to ensure that all amounts are accurately reported on your tax returns. The form outlines the total assistance received, which must be included in your income. It is important to keep this form on hand when preparing your tax filings to ensure compliance with IRS guidelines.

Steps to Complete the T101D Sommaire Du Montant D'aide

Completing the T101D requires careful attention to detail. First, gather all relevant financial records that detail the assistance received. Next, accurately fill out the form by entering the total amounts in the designated fields. Make sure to double-check all entries for accuracy to avoid potential issues with tax compliance. Finally, retain a copy of the completed form for your records.

Key Elements of the T101D Sommaire Du Montant D'aide

The T101D includes several key elements that are vital for understanding the assistance received. These elements include the total amount of aid, the type of assistance, and the period during which the aid was provided. Each of these components plays a significant role in how the assistance is reported on tax returns.

Eligibility Criteria for the T101D Sommaire Du Montant D'aide

Eligibility for the T101D typically involves receiving financial assistance from government programs or other qualifying sources. Individuals and businesses must meet specific criteria set forth by the CRA to qualify for the assistance that is documented on this form. Understanding these criteria is essential for anyone seeking to utilize the T101D for tax reporting purposes.

Form Submission Methods for the T101D Sommaire Du Montant D'aide

The T101D can be submitted through various methods, including online submission, mail, or in-person delivery to the appropriate tax office. Each method has its own guidelines and timelines, so it is important to choose the one that best fits your needs and ensures timely processing of your tax documents.

Penalties for Non-Compliance with the T101D Sommaire Du Montant D'aide

Failure to comply with the reporting requirements associated with the T101D can result in penalties. These may include fines or additional taxes owed if the assistance is not accurately reported. It is crucial to adhere to the guidelines set by the CRA to avoid any potential legal or financial repercussions.

Quick guide on how to complete t101d sommaire du montant d39aide agence du revenu du canada

Easily prepare [SKS] on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Complete button to save your modifications.

- Decide how you wish to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t101d sommaire du montant d39aide agence du revenu du canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada?

The T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada is a summary form used to report assistance amounts. This form is crucial for tax reporting purposes, ensuring that businesses accurately document any financial aid received from the government. Understanding how to properly complete and submit this form is essential for compliance.

-

How can airSlate SignNow help with the T101D Sommaire Du Montant D'aide submission?

airSlate SignNow streamlines the documentation process by allowing users to easily fill out and eSign the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada online. Our platform ensures that your forms are securely stored and easily accessible for compliance needs. This saves time and reduces errors associated with paper forms.

-

What features does airSlate SignNow offer for managing the T101D form?

With airSlate SignNow, you get features like customizable templates, secure eSignatures, and automated workflows specifically designed for forms like the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada. These tools enhance efficiency and simplify the management of financial documentation. Additionally, you can track document status and ensure timely submissions.

-

Is airSlate SignNow cost-effective for businesses handling T101D forms?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada. The pricing plans are designed to cater to different business sizes while ensuring access to essential features. This allows businesses to save on traditional printing and mailing costs associated with paper forms.

-

How does airSlate SignNow ensure the security of my T101D documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive forms like the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada. Our platform uses advanced encryption methods to protect documents during transmission and storage. This guarantees that your information remains confidential and secure throughout the process.

-

Can I integrate airSlate SignNow with other software for handling T101D forms?

Absolutely! airSlate SignNow offers seamless integrations with various software and applications, allowing you to manage the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada alongside your existing tools. This integration capability enhances workflow efficiency and consolidates your documentation processes into one platform.

-

What are the benefits of using airSlate SignNow for T101D forms?

Using airSlate SignNow for the T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada provides benefits such as increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, making it quick and easy for all parties involved. This not only boosts productivity but also improves accuracy in your submissions.

Get more for T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada

Find out other T101D Sommaire Du Montant D'aide Agence Du Revenu Du Canada

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast