Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De P Form

Understanding the Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4

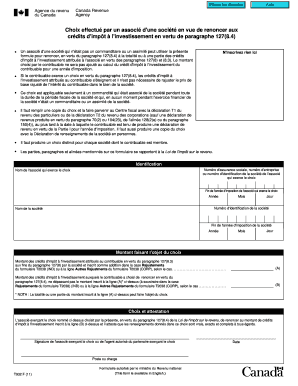

The Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4 is a formal decision made by a partner within a company to waive certain tax credits related to investment. This choice is significant as it can impact the financial obligations of the business and its partners. Understanding the implications of this decision is essential for effective tax planning and compliance.

Steps to Complete the Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4

Completing the Choix Effectu involves several key steps:

- Review the relevant tax regulations and guidelines outlined in paragraph 1278 4.

- Gather necessary financial documents that support the decision to renounce tax credits.

- Consult with a tax professional to understand the consequences of this choice.

- Fill out the required forms accurately, ensuring all information is up to date.

- Submit the completed forms to the appropriate tax authority by the specified deadline.

Key Elements of the Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4

Several key elements must be considered when dealing with the Choix Effectu:

- Eligibility Criteria: Ensure that the partner qualifies for making this choice based on their investment status.

- Documentation: Maintain thorough records of all financial transactions and decisions related to the credits.

- Tax Implications: Understand how waiving these credits will affect the overall tax liability of the company and its partners.

- Compliance Requirements: Follow all legal obligations to avoid penalties or audits from tax authorities.

Legal Use of the Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4

The legal framework surrounding the Choix Effectu is crucial for ensuring compliance. This choice must adhere to the stipulations set forth in paragraph 1278 4, which outlines the conditions under which a partner may renounce tax credits. Legal counsel should be consulted to navigate potential complexities and ensure that all actions taken are within the bounds of the law.

Examples of Using the Choix Effectu Par Un Associ D'une Soci T En Vue De Renoncer Aux Cr Dits D'imp T L'investissement En Vertu De Paragraphe 1278 4

Practical examples can help clarify the application of the Choix Effectu:

- A partner in a limited liability company decides to renounce tax credits to offset losses from other investments.

- A corporation may choose to waive credits to simplify its tax reporting process in a given fiscal year.

- In a partnership, one partner may opt to renounce credits to allow the other partners to benefit from them instead.

Filing Deadlines / Important Dates

Timely submission of the Choix Effectu is critical to avoid penalties. Partners must be aware of specific filing deadlines set by the IRS or relevant state authorities. Generally, these deadlines align with the annual tax filing dates, but it is advisable to check for any updates or changes each tax year to ensure compliance.

Quick guide on how to complete choix effectu par un associ d une soci t en vue de renoncer aux cr dits d imp t l investissement en vertu de paragraphe 1278 4

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Modify and eSign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivery for your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De P

Create this form in 5 minutes!

How to create an eSignature for the choix effectu par un associ d une soci t en vue de renoncer aux cr dits d imp t l investissement en vertu de paragraphe 1278 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.'?

The 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' refers to a decision made by an associate of a company to waive tax credits associated with investments. This choice can affect the tax liabilities of both the individual and the business. Understanding this choice is crucial for strategic financial planning.

-

How can airSlate SignNow assist with the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' documentation?

AirSlate SignNow simplifies the documentation process related to the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' by enabling users to create, send, and eSign forms easily. This streamlines compliance and ensures all necessary information is accurately captured. Our platform supports a variety of templates that cater specifically to these financial declarations.

-

What are the pricing options for airSlate SignNow when dealing with tax-related documents?

AirSlate SignNow offers a range of cost-effective pricing plans that cater to businesses of all sizes. Whether you're handling the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' or other tax-related documentation, our flexible plans ensure you only pay for what you need. Contact our sales team for a customized quote.

-

What features does airSlate SignNow offer for managing tax exemptions?

With airSlate SignNow, you have access to features that facilitate the management of tax exemptions, including customizable templates, automated workflows, and secure eSigning. These tools help streamline processes associated with the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' ensuring compliance and efficiency. Additionally, our audit trails provide transparency throughout the document lifecycle.

-

Can airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow seamlessly integrates with a variety of financial software solutions, making it easy to manage all aspects of your business's documentation. Whether it’s accounting software or CRM tools, our platform enhances productivity for handling the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' and other documentation needs. Check our integrations page for more details.

-

What benefits does using airSlate SignNow provide for businesses addressing investment tax credits?

Using airSlate SignNow provides numerous benefits, including reduced processing time for documents related to the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' and improved compliance management. Our platform enhances collaboration across teams, allowing for real-time updates and secure sharing of sensitive documents. This results in more efficient handling of tax strategies.

-

Is there customer support available for airSlate SignNow users dealing with tax documents?

Absolutely! AirSlate SignNow provides robust customer support for users navigating tax documents, including those related to the 'Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De Paragraphe 1278 4.' Our support team is available via chat, email, and phone to assist you with any questions or challenges you might encounter. We also offer a resources section filled with FAQs and guides.

Get more for Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De P

- Djin vao international student background information checklist

- Fiche d inscription service de garde en milieu form

- Wccp chassis form

- Motion to vacate judgment sample letter form

- Expense claim form apex

- Change of subcontractor brevard county form

- Ppo offer letter sample form

- Edison care program application form

Find out other Choix Effectu Par Un Associ D 'une Soci T En Vue De Renoncer Aux Cr Dits D 'imp T L 'investissement En Vertu De P

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy