Form it 203Nonresident and Part Year Resident Income Tax Wiltonlibrary

Understanding Form IT-203 Nonresident and Part-Year Resident Income Tax

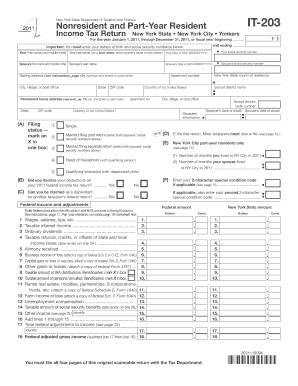

Form IT-203 is designed for nonresident and part-year resident taxpayers in New York State. This form allows individuals who earn income in New York but do not reside there for the entire year to report their earnings accurately. It ensures compliance with state tax regulations while allowing for the appropriate tax credits and deductions applicable to nonresidents. Understanding the purpose of this form is crucial for anyone who has worked in New York but maintains residency in another state.

Steps to Complete Form IT-203

Completing Form IT-203 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2 forms and any 1099s that report income earned in New York. Next, fill out your personal information, including your name, address, and Social Security number. Then, report your total income earned in New York, followed by any deductions you are eligible for. Finally, calculate your tax liability and ensure you sign and date the form before submission. Each step is essential to avoid errors that could lead to delays or penalties.

Obtaining Form IT-203

Form IT-203 can be obtained through several channels. The New York State Department of Taxation and Finance provides the form on its official website, where it can be downloaded and printed. Additionally, physical copies may be available at local tax offices or libraries. It is important to ensure that you are using the most current version of the form to comply with any recent tax law changes.

Filing Deadlines for Form IT-203

Filing deadlines for Form IT-203 typically align with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is crucial to file the form on time to avoid penalties and interest on any taxes owed. Taxpayers should also be aware of any extensions that may apply, particularly for those who may need additional time to gather necessary documentation.

Key Elements of Form IT-203

Form IT-203 includes several key elements that taxpayers must understand. These elements include personal identification information, income reporting sections, and deductions specific to nonresidents. Taxpayers must accurately report their New York source income and may also claim credits for taxes paid to other jurisdictions. Understanding these elements is vital for ensuring that the form is completed correctly and that taxpayers take advantage of all available benefits.

Legal Use of Form IT-203

The legal use of Form IT-203 is essential for compliance with New York State tax laws. Nonresidents and part-year residents are required to file this form if they earn income from New York sources. Failure to file can result in penalties and interest on unpaid taxes. It is important for taxpayers to be aware of their obligations under state law and to use the form as a means of fulfilling their tax responsibilities accurately and timely.

Quick guide on how to complete form it 203nonresident and part year resident income tax wiltonlibrary

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you prefer to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form hunting, or errors that require printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you choose. Alter and electronically sign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary

Create this form in 5 minutes!

How to create an eSignature for the form it 203nonresident and part year resident income tax wiltonlibrary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary?

Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary is a tax form required for nonresidents and part-year residents to report their income and calculate taxes owed in New York. This form is essential for ensuring compliance with state tax laws and is designed to make the filing process clearer and more accessible.

-

How can airSlate SignNow help me manage Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary?

airSlate SignNow simplifies the process of managing Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary by allowing users to electronically fill, sign, and send the form securely. Our user-friendly platform streamlines document management, making your tax filing faster and more efficient.

-

What pricing options does airSlate SignNow offer for services related to Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, from individual users to large teams. Each plan provides access to features that help you effortlessly manage Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary along with other documents, ensuring you find a fit for your budget.

-

Are there any integrations available for managing Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enabling users to manage Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary alongside other business tools. This means you can enhance your workflow by linking SignNow with your existing software, making tax management easier.

-

What are the main benefits of using airSlate SignNow for Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary?

By using airSlate SignNow for Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary, you gain a secure platform to eSign documents, reduce processing time, and minimize errors. Our cost-effective solution helps you stay organized, ensuring timely submissions of your tax forms.

-

Can I track the status of my Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary documents. You will receive real-time notifications and updates, ensuring you know when your forms are viewed, signed, or completed.

-

Is airSlate SignNow user-friendly for completing Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to complete Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary. Our intuitive interface guides you through the signing and submission process, even for those who may not be tech-savvy.

Get more for Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary

Find out other Form IT 203Nonresident And Part Year Resident Income Tax Wiltonlibrary

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word