Your Projected Total Tax for Form

What is the Your Projected Total Tax For

The "Your Projected Total Tax For" form is designed to help individuals and businesses estimate their tax liabilities for the upcoming tax year. By calculating projected taxes, users can better understand their financial obligations and plan accordingly. This form typically incorporates various income sources, deductions, and credits applicable to the taxpayer's situation. It serves as a valuable tool for effective tax planning and ensuring compliance with federal and state tax regulations.

How to use the Your Projected Total Tax For

Using the "Your Projected Total Tax For" form requires gathering relevant financial information. Begin by collecting your income details, including wages, self-employment earnings, and investment income. Next, identify potential deductions, such as mortgage interest, student loan interest, and business expenses. Once you have this data, follow the form's instructions to input your figures accurately. The calculations will guide you in estimating your total tax liability, helping you make informed financial decisions throughout the year.

Key elements of the Your Projected Total Tax For

Several key elements are essential for completing the "Your Projected Total Tax For" form effectively. These include:

- Income Sources: List all sources of income, including wages, dividends, and rental income.

- Deductions: Identify applicable deductions that can reduce taxable income, such as retirement contributions and charitable donations.

- Tax Credits: Include any tax credits that may apply, which can directly reduce the amount of tax owed.

- Filing Status: Select your appropriate filing status, as it influences tax rates and eligibility for certain deductions.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers using the "Your Projected Total Tax For" form. Typically, the deadline for submitting tax returns is April fifteenth of each year. However, if you are projecting taxes for the current year, it is advisable to start early, ideally by January, to ensure you have ample time to gather documentation and make necessary calculations. Additionally, estimated tax payments may be required quarterly, with deadlines falling in April, June, September, and January of the following year.

Examples of using the Your Projected Total Tax For

Practical examples can illustrate the utility of the "Your Projected Total Tax For" form. For instance, a self-employed individual may use the form to estimate taxes based on projected earnings and allowable business expenses. Similarly, a family anticipating changes in income due to a new job or a child entering college can use the form to assess how these changes will impact their tax situation. By considering various scenarios, taxpayers can make proactive financial decisions and avoid surprises during tax season.

Required Documents

To complete the "Your Projected Total Tax For" form accurately, several documents are typically required. These may include:

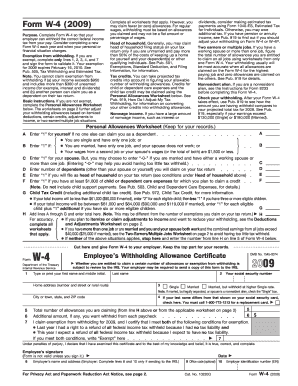

- W-2 Forms: For employees, these forms provide information on wages and withholding.

- 1099 Forms: For freelancers or contractors, these forms report non-employee compensation.

- Receipts: Documentation for deductible expenses, such as medical bills or charitable contributions.

- Investment Statements: Information on dividends, interest, and capital gains.

Quick guide on how to complete your projected total tax for 5108372

Complete [SKS] smoothly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without holdups. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind concerns of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you select. Modify and eSign [SKS] and ensure exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Your Projected Total Tax For

Create this form in 5 minutes!

How to create an eSignature for the your projected total tax for 5108372

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with calculating Your Projected Total Tax For?

airSlate SignNow is a digital document management solution that simplifies the process of sending and electronically signing documents. It allows businesses to efficiently manage their paperwork and financial agreements, ensuring accurate projections of Your Projected Total Tax For through streamlined workflows.

-

How can I use airSlate SignNow to improve my tax estimation process?

By utilizing airSlate SignNow, you can easily send necessary tax documents and get them signed electronically. This facilitates a smoother process in collecting data needed to calculate Your Projected Total Tax For, helping you to meet tax deadlines without hassle.

-

Is airSlate SignNow a cost-effective solution for managing tax-related documents?

Yes, airSlate SignNow offers a cost-effective solution for managing tax-related documents and signatures. Given the affordable pricing tiers, businesses can efficiently handle their documentation processes while accurately calculating Your Projected Total Tax For without incurring high costs.

-

What features does airSlate SignNow offer to assist in the tax preparation process?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure storage that enhance your tax preparation process. These tools make it easier to gather the necessary information for calculating Your Projected Total Tax For quickly and efficiently.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow provides various integrations with popular financial and accounting software. This enables seamless data exchange, ensuring you have the necessary information to accurately calculate Your Projected Total Tax For without duplicating efforts.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow employs advanced security measures such as encryption and secure cloud storage to protect your documents. This ensures that when you're calculating Your Projected Total Tax For, your sensitive tax information remains confidential and secure.

-

What kind of customer support does airSlate SignNow offer for users calculating taxes?

airSlate SignNow offers robust customer support to assist users with any questions regarding document management and tax calculations. Whether you're unsure about features related to Your Projected Total Tax For or need technical assistance, the support team is readily available to help.

Get more for Your Projected Total Tax For

Find out other Your Projected Total Tax For

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later