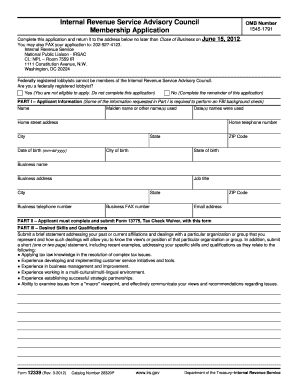

Internal Revenue Service Advisory Council Membership Application Complete This Application and Return it to the Address below No Form

What is the Internal Revenue Service Advisory Council Membership Application?

The Internal Revenue Service Advisory Council Membership Application is a formal document that individuals must complete to apply for membership in the IRS Advisory Council. This council provides valuable input to the IRS on various tax-related issues, helping to shape policies and practices that affect taxpayers. Completing this application is essential for those who wish to contribute their expertise and perspectives to the IRS.

Steps to Complete the Application

Completing the IRS Advisory Council Membership Application involves several key steps:

- Obtain the application form from the IRS website or relevant sources.

- Fill out the required personal and professional information accurately.

- Provide any necessary supporting documents that demonstrate your qualifications.

- Review the application for completeness and accuracy.

- Submit the application by the specified deadline, either by mail or via fax.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines when submitting the IRS Advisory Council Membership Application. Applications must be returned to the designated address no later than the close of business on the specified date in June. Late submissions may not be considered, so planning ahead is essential.

Form Submission Methods

Applicants have multiple options for submitting the IRS Advisory Council Membership Application. You can send the completed application by mail to the address provided in the instructions. Alternatively, you may also fax your application to the designated fax number, ensuring that it is received by the deadline.

Eligibility Criteria

To be eligible for membership in the IRS Advisory Council, applicants typically need to meet specific criteria. This may include having relevant professional experience, a strong understanding of tax issues, and a commitment to serving the interests of taxpayers. Review the eligibility requirements carefully to ensure you qualify before submitting your application.

Key Elements of the Application

The application form contains several key elements that must be addressed. These include personal identification information, a statement of qualifications, and any relevant professional affiliations. Ensuring that all sections of the application are completed thoroughly will enhance your chances of being selected for membership.

Quick guide on how to complete internal revenue service advisory council membership application complete this application and return it to the address below

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact private information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure outstanding communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Internal Revenue Service Advisory Council Membership Application Complete This Application And Return It To The Address Below No

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service advisory council membership application complete this application and return it to the address below

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Internal Revenue Service Advisory Council Membership Application?

The Internal Revenue Service Advisory Council Membership Application facilitates the process for individuals to apply for membership in the advisory council. It is crucial to complete this application and return it to the address below no later than close of business on June. You may also fax your application to 202-927-4123 Irs for quicker processing.

-

How can I ensure my Internal Revenue Service Advisory Council Membership Application is complete?

To ensure your Internal Revenue Service Advisory Council Membership Application is complete, follow the instructions provided and double-check all required fields. Submitting a complete application is vital, as incomplete forms may delay your application process. Remember to return it by the deadline, close of business on June, to the specified address, or fax it to 202-927-4123 Irs.

-

What are the benefits of joining the Internal Revenue Service Advisory Council?

Becoming a member of the Internal Revenue Service Advisory Council offers numerous benefits, including a platform to influence tax policy and provide valuable feedback to the IRS. Members can engage with other professionals and gain insights into federal tax systems. Complete this application and return it as instructed by the deadline to start enjoying these benefits.

-

Is there a fee associated with the Internal Revenue Service Advisory Council Membership Application?

There is no fee to submit the Internal Revenue Service Advisory Council Membership Application. Interested applicants should focus on correctly completing their application and returning it to the address below no later than close of business on June. Faxing to 202-927-4123 Irs is also an option for those who prefer faster submission.

-

What should I do if I miss the deadline for the Internal Revenue Service Advisory Council Membership Application?

If you miss the deadline to submit the Internal Revenue Service Advisory Council Membership Application, you will need to wait until the next application period. Make a note of the closing date and ensure that your application is submitted to the address below before close of business on June next time. Fax applications to 202-927-4123 Irs to ensure timely submissions.

-

What materials do I need to submit with my Internal Revenue Service Advisory Council Membership Application?

Typically, you'll need to submit personal information, a statement of interest, and any relevant qualifications with your Internal Revenue Service Advisory Council Membership Application. Ensure all documents are ready before sending them to the address below by the close of business on June, or fax them to 202-927-4123 Irs. This will improve your chances of acceptance.

-

How long does it take to get a response after submitting the Internal Revenue Service Advisory Council Membership Application?

Applicants can expect to hear back regarding their Internal Revenue Service Advisory Council Membership Application within a few weeks of the submission deadline. The review process takes time as each application is assessed carefully. Ensure your application is complete and submitted on time to receive timely feedback.

Get more for Internal Revenue Service Advisory Council Membership Application Complete This Application And Return It To The Address Below No

Find out other Internal Revenue Service Advisory Council Membership Application Complete This Application And Return It To The Address Below No

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement