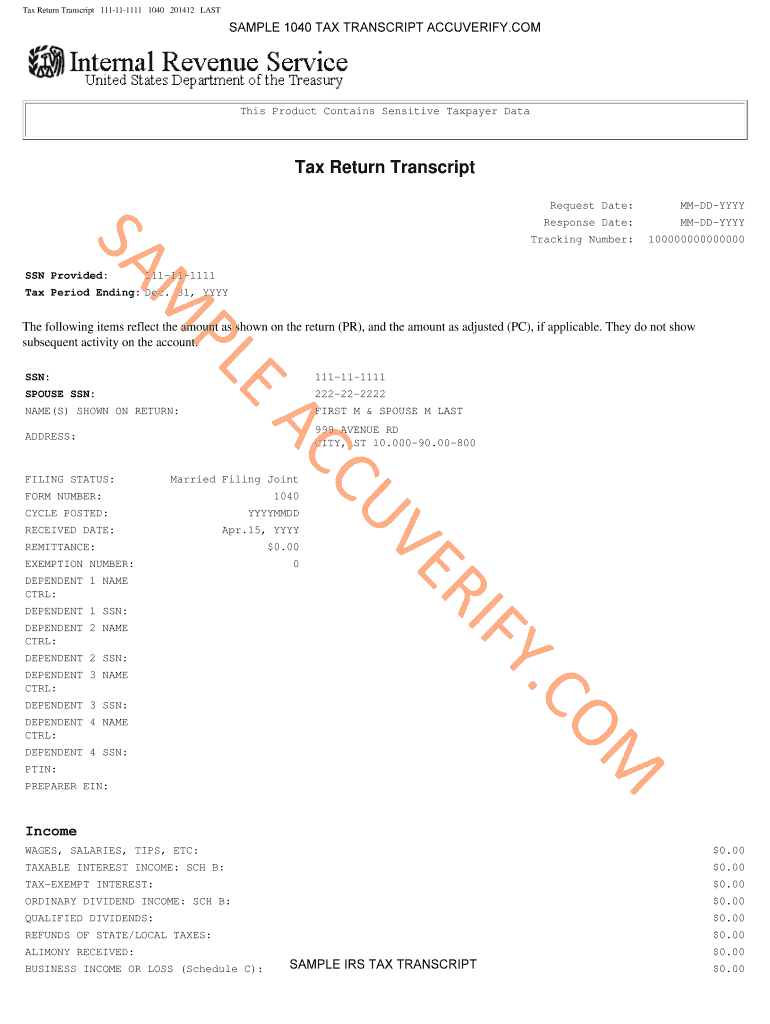

Copy of Tax Return Form

What is a tax return transcript?

A tax return transcript is a summary of your tax return information, including details from your IRS tax return. It provides a record of your income, tax deductions, and credits claimed. This document is often used for various purposes, such as applying for loans, verifying income, or completing financial aid applications. Unlike a full copy of your tax return, a transcript does not include all the details but offers essential information in a concise format.

How to obtain a tax return transcript

To obtain a tax return transcript, you can request it directly from the IRS. There are several methods available:

- Online: Use the IRS website to access the Get Transcript tool. You will need to verify your identity using personal information.

- By Mail: Complete Form 4506-T and mail it to the IRS. This form allows you to request a transcript by specifying the type you need.

- By Phone: Call the IRS at and follow the prompts to request your transcript.

Keep in mind that it may take several days to receive your transcript, especially if you request it by mail.

Key elements of a tax return transcript

A tax return transcript typically includes the following key elements:

- Filing Status: Indicates whether you filed as single, married filing jointly, or another status.

- Adjusted Gross Income (AGI): The total income after deductions, which is crucial for various financial assessments.

- Taxable Income: The portion of your income that is subject to tax.

- Tax Deductions and Credits: Summaries of deductions and credits claimed on your return.

- Payments Made: Any payments made towards your tax liabilities, including estimated payments.

These elements provide a clear overview of your tax situation and are essential for many financial processes.

Steps to complete a tax return transcript

Completing a tax return transcript involves several important steps:

- Gather Necessary Information: Collect your personal information, including Social Security number, date of birth, and filing status.

- Choose the Right Method: Decide whether to obtain your transcript online, by mail, or by phone based on your preferences.

- Submit Your Request: Follow the instructions for your chosen method, ensuring all information is accurate to avoid delays.

- Review Your Transcript: Once received, check the transcript for accuracy and completeness.

Following these steps will help ensure that you successfully complete your tax return transcript request.

IRS guidelines for tax return transcripts

The IRS provides specific guidelines regarding the use and request of tax return transcripts. It is important to note that:

- Transcripts are typically available for the current tax year and the previous three years.

- They are free of charge and can be obtained through the methods mentioned earlier.

- Transcripts are not considered official copies of your tax return and may not be accepted in all situations.

Understanding these guidelines can help you navigate the process more effectively and ensure compliance with IRS requirements.

Legal use of a tax return transcript

A tax return transcript can be used for various legal and financial purposes, including:

- Applying for federal student aid, where proof of income is required.

- Submitting documentation for loan applications, particularly for mortgages.

- Verifying income for tax purposes or during audits.

It is crucial to ensure that the transcript is used in accordance with IRS regulations and the requirements of the requesting institution.

Quick guide on how to complete sample tax return transcriptpdffillercom form

Explore the easiest method to complete and endorse your Copy Of Tax Return

Are you still spending time preparing your essential paperwork on physical copies instead of doing it online? airSlate SignNow provides a superior way to complete and endorse your Copy Of Tax Return and other forms for public services. Our advanced eSignature solution equips you with everything necessary to handle documents swiftly and in line with official standards - robust PDF editing, management, protection, signing, and sharing tools all available within a user-friendly interface.

There are only a few steps needed to finish completing and endorsing your Copy Of Tax Return:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you must include in your Copy Of Tax Return.

- Navigate between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to enter your information in the blanks.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Redact sections that are no longer relevant.

- Click on Sign to produce a legally valid eSignature using any method you choose.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished Copy Of Tax Return in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also provides flexible file sharing options. There’s no need to print your templates when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How do I submit income tax returns online?

Here is a step by step guide to e-file your income tax return using ClearTax. It is simple, easy and quick.From 1st July onwards, it is mandatory to link your PAN with Aadhaar and mention it in your IT returns. If you have applied for Aadhaar, you can mention the enrollment number in your returns.Read our Guide on how to link your PAN with Aadhaar.Step 1.Get startedLogin to your ClearTax account.Click on ‘Upload Form 16 PDF’ if you have your Form 16 in PDF format.If you do not have Form 16 in PDF format click on ‘Continue Here’Get an expert & supportive CA to manage your taxes. Plans start @ Rs.799/-ContinueWhat are you looking for?Account & Book KeepingCompany RegistrationGST RegistrationGST Return FilingIncome Tax FilingTrademark RegistrationOtherStep 2.Enter personal infoEnter your Name, PAN, DOB and Bank account details.Step 3.Enter salary detailsFill in your salary, employee details (Name and TAN) and TDS.Tip: Want to claim HRA? Read the guide.Step 4.Enter deduction detailsEnter investment details under Section 80C(eg. LIC, PPF etc., and claim other tax benefits here.Tip: Do you have kids?Claim benefits on their tuition fees under Section 80CStep 5.Add details of taxes paidIf you have non-salary income,eg. interest income or freelance income, then add tax payments that are already made. You can also add these details by uploading Form 26ASStep 6.E-file your returnIf you see “Refund” or “No Tax Due” here, Click on proceed to E-Filing.You will get an acknowledgement number on the next screen.Tip: See a “Tax Due” message? Read this guide to know how to pay your tax dues.Step 7: E-VerifyOnce your return is file E-Verify your income tax return

-

How do I fill an income tax return with the 16A form in India?

The applicable Form for filing of your income tax return shall need to examine nature of your income.If you are receiving Form 16A only, then it means you are earning income other than salaries, and therefore possibly you shall need to file Income Tax Return in Form ITR 3 or ITR 4 (depends over the nature of income as already said in above para).You shall need to register your PAN on the website of income tax efiling, thereafter you shall need to link your PAN if you are a resident of India.After successful registration, you may file your income tax return through applicable form. Show your income as being appearing in Form 16A, your bank interest and any other income if you do have.For any assistance/queries related to taxation, you may contact me on pkush39@gmail.com

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

Create this form in 5 minutes!

How to create an eSignature for the sample tax return transcriptpdffillercom form

How to generate an electronic signature for your Sample Tax Return Transcriptpdffillercom Form in the online mode

How to make an eSignature for the Sample Tax Return Transcriptpdffillercom Form in Google Chrome

How to generate an eSignature for putting it on the Sample Tax Return Transcriptpdffillercom Form in Gmail

How to make an eSignature for the Sample Tax Return Transcriptpdffillercom Form from your smart phone

How to create an electronic signature for the Sample Tax Return Transcriptpdffillercom Form on iOS

How to make an electronic signature for the Sample Tax Return Transcriptpdffillercom Form on Android devices

People also ask

-

What is a Copy Of Tax Return and why do I need it?

A Copy Of Tax Return is an official document that summarizes your income, deductions, and other financial information for a specific tax year. You may need it for purposes such as applying for loans, verifying income, or fulfilling legal obligations. Having access to your Copy Of Tax Return is essential for accurate financial documentation.

-

How can airSlate SignNow help me obtain a Copy Of Tax Return?

With airSlate SignNow, you can easily request and securely sign documents related to your Copy Of Tax Return. Our platform allows you to streamline the process of obtaining your tax return with electronic signatures and document management features. This ensures you have quick access to your financial documents when needed.

-

Is there a cost associated with obtaining a Copy Of Tax Return through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning and managing documents, obtaining a Copy Of Tax Return may involve fees from tax authorities. However, using airSlate SignNow can save you time and money by simplifying the process of signing and sending your request electronically.

-

What features does airSlate SignNow offer for managing a Copy Of Tax Return?

airSlate SignNow provides features such as secure electronic signatures, document templates, and a user-friendly interface that makes managing your Copy Of Tax Return straightforward. Our platform also allows for easy tracking of document status, ensuring you know when your request has been processed.

-

Can I integrate airSlate SignNow with other software for managing my Copy Of Tax Return?

Yes, airSlate SignNow seamlessly integrates with various software applications such as cloud storage services and accounting tools. This integration allows you to easily access and manage your Copy Of Tax Return alongside other financial documents, improving your overall workflow.

-

What is the turnaround time for receiving my Copy Of Tax Return after signing?

The turnaround time for receiving your Copy Of Tax Return primarily depends on the tax authority processing your request. However, with airSlate SignNow, you can expedite the signing process, ensuring that your request is sent promptly and efficiently.

-

Is airSlate SignNow secure for handling sensitive documents like a Copy Of Tax Return?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive documents such as your Copy Of Tax Return. You can trust that your information is safe and secure while using our platform.

Get more for Copy Of Tax Return

Find out other Copy Of Tax Return

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document