MO W 4A Form

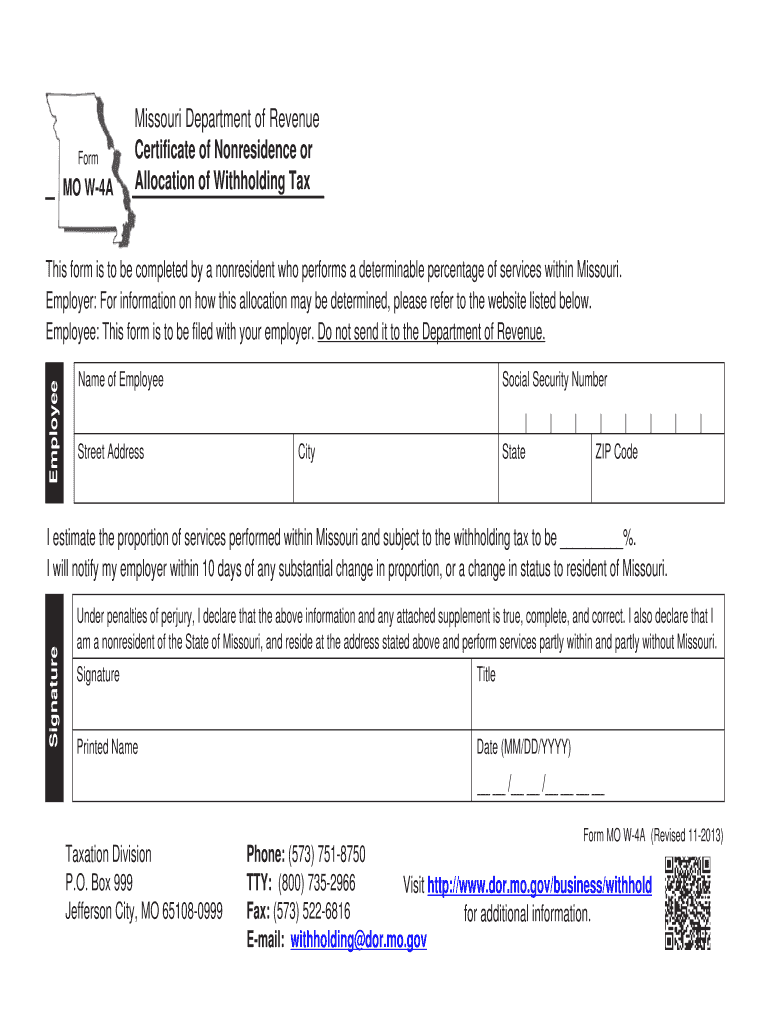

What is the Missouri W-4A?

The Missouri W-4A is a state-specific form used by employees to determine their state income tax withholding. This form allows employees to indicate their personal allowances and any additional amounts they wish to withhold from their paychecks. The information provided helps employers calculate the correct amount of state tax to withhold based on the employee's financial situation. Understanding the W-4A is essential for ensuring compliance with Missouri tax laws and for managing personal tax liabilities effectively.

How to Obtain the Missouri W-4A

To obtain the Missouri W-4A, individuals can visit the official Missouri Department of Revenue website, where the form is available for download. It can be printed directly from the site or requested from an employer. Many employers also provide the form during the onboarding process or when changes to withholding are necessary. Ensuring you have the most current version of the form is crucial for accurate tax withholding.

Steps to Complete the Missouri W-4A

Completing the Missouri W-4A involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which could be single, married, or head of household.

- Calculate your allowances based on your personal and financial situation. This includes factors such as dependents and other deductions.

- If desired, specify any additional amount you wish to withhold from each paycheck.

- Sign and date the form before submitting it to your employer.

Reviewing the completed form for accuracy is important to avoid any issues with tax withholding.

Key Elements of the Missouri W-4A

The Missouri W-4A includes several key elements that are essential for accurate tax withholding:

- Personal Information: This section captures the employee's name, address, and Social Security number.

- Filing Status: Employees must select their filing status, which impacts the withholding calculations.

- Allowances: Employees can claim allowances based on their personal circumstances, which reduces the amount withheld.

- Additional Withholding: There is an option to request extra withholding if the employee anticipates owing more tax.

Understanding these elements helps employees make informed decisions about their tax withholding preferences.

Legal Use of the Missouri W-4A

The Missouri W-4A is legally required for employees to ensure accurate withholding of state income taxes. Employers must keep this form on file for each employee to comply with state tax regulations. Incorrect or missing forms can lead to improper withholding, which may result in penalties for both the employer and employee. It is important for employees to update their W-4A whenever there are significant changes in their personal or financial situations.

Form Submission Methods

Employees can submit the completed Missouri W-4A to their employers through various methods:

- In-Person: Handing the form directly to the human resources or payroll department is a common method.

- Email: Some employers may allow submission via email, provided the form is scanned and sent as an attachment.

- Mail: If necessary, employees can mail the form to their employer’s payroll department.

Employers are responsible for processing the information and adjusting the withholding accordingly.

Quick guide on how to complete mo w 4a

Effortlessly Prepare MO W 4A on Any Device

Digital document management has gained immense traction among corporations and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features you require to create, modify, and eSign your documents quickly without delays. Manage MO W 4A on any device using airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

How to Modify and eSign MO W 4A with Ease

- Obtain MO W 4A and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details carefully and click the Done button to save your changes.

- Choose your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign MO W 4A to ensure seamless communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo w 4a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w4a allocation download feature in airSlate SignNow?

The w4a allocation download feature in airSlate SignNow allows users to easily download their W4A allocation documents electronically. This feature streamlines the management of your documents, ensuring you have access to the necessary forms at any time, which enhances productivity and compliance.

-

How does airSlate SignNow facilitate the w4a allocation download process?

airSlate SignNow simplifies the w4a allocation download process by providing a user-friendly interface that guides users through downloading and completing their forms. The process is automated, reducing the time spent on manual entries and allowing for quicker submissions.

-

Is there a cost associated with the w4a allocation download feature?

The w4a allocation download feature is included in the pricing plans of airSlate SignNow, making it a cost-effective solution for businesses. By opting for our plans, users gain access to this feature alongside a range of other document management tools without hidden fees.

-

What are the benefits of using airSlate SignNow for w4a allocation download?

Using airSlate SignNow for w4a allocation download offers multiple benefits, including fast processing times, secure document management, and convenient eSigning options. It helps businesses save time and resources while ensuring that all necessary documentation is organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for w4a allocation download?

Yes, airSlate SignNow supports various integrations that enhance the experience of the w4a allocation download. You can connect it with popular software applications, which allows for seamless data transfer and improved workflow efficiency across your business processes.

-

Is the w4a allocation download process secure with airSlate SignNow?

Absolutely, the w4a allocation download process is secure with airSlate SignNow. We prioritize the security of your documents by utilizing advanced encryption protocols and compliance with industry standards, ensuring your sensitive information is protected throughout the download process.

-

What types of W4A allocation documents can I download using airSlate SignNow?

With airSlate SignNow, you can download various types of W4A allocation documents, including updated tax forms and allocation statements. The platform ensures that you have the latest templates available, making it easier to stay compliant with current regulations.

Get more for MO W 4A

- Warning of default on residential lease wyoming form

- Landlord tenant closing statement to reconcile security deposit wyoming form

- Wyoming marriage form

- Name change notification form wyoming

- Commercial building or space lease wyoming form

- Wyoming relative caretaker legal documents package wyoming form

- Wy legal documents form

- Wy bankruptcy form

Find out other MO W 4A

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word