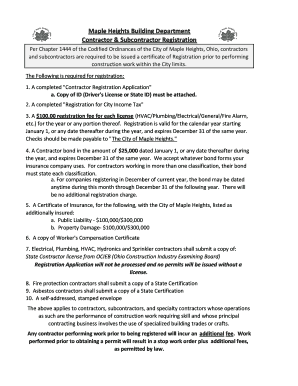

Oh City Maple Heights Form

Understanding the Ohio Income Tax Application

The Ohio income tax application is a crucial document for residents and businesses in Ohio. This application is used to report income and calculate the amount of tax owed to the state. It is essential for ensuring compliance with state tax laws and for determining eligibility for various tax credits and deductions. Understanding the specifics of this application helps taxpayers navigate their responsibilities effectively.

Steps to Complete the Ohio Income Tax Application

Completing the Ohio income tax application involves several key steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid penalties.

- Calculate your taxable income by subtracting any deductions or credits you qualify for.

- Determine the amount of tax owed based on the current Ohio tax rates.

- Review the application for accuracy and completeness before submission.

Required Documents for the Ohio Income Tax Application

When preparing to submit the Ohio income tax application, it is important to have the following documents ready:

- W-2 forms from employers, detailing your earned income.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for any deductions or credits you plan to claim, such as receipts for charitable donations.

Form Submission Methods for Ohio Income Tax Application

There are several methods available for submitting the Ohio income tax application:

- Online: Many taxpayers choose to file electronically through the Ohio Department of Taxation's website or authorized e-filing services.

- Mail: You can print the completed application and send it via postal mail to the appropriate state address.

- In-Person: Some individuals may prefer to submit their application in person at designated tax offices.

Filing Deadlines for the Ohio Income Tax Application

It is important to be aware of the filing deadlines for the Ohio income tax application to avoid penalties:

- The standard deadline for filing is typically April 15th of each year.

- If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

- Extensions may be available, but it is essential to file for an extension before the original deadline.

Penalties for Non-Compliance with Ohio Income Tax Regulations

Failing to comply with Ohio income tax regulations can result in various penalties:

- Late Filing Penalty: A percentage of the tax due may be charged for each month the application is late.

- Late Payment Penalty: Interest may accrue on any unpaid tax amounts, increasing the total owed.

- Legal Action: Continued non-compliance can lead to more severe consequences, including liens or garnishments.

Quick guide on how to complete oh city maple heights

Complete Oh City Maple Heights seamlessly on any device

Digital document management has become widely adopted by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and electronically sign your files efficiently without delays. Manage Oh City Maple Heights on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Oh City Maple Heights effortlessly

- Find Oh City Maple Heights and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your files or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Oh City Maple Heights and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oh city maple heights

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for ohio income tax registration?

The process for ohio income tax registration involves completing the necessary forms and submitting them to the Ohio Department of Taxation. You will need to provide details about your business structure, ownership, and anticipated income. Additionally, you may want to explore tools that streamline this process, such as airSlate SignNow for eSigning and document management.

-

How does airSlate SignNow assist with ohio income tax registration?

airSlate SignNow simplifies the ohio income tax registration by allowing businesses to prepare and eSign documents digitally. This helps in eliminating cumbersome paperwork and speeds up the registration process. With a user-friendly interface, you can manage all your necessary documents in one place.

-

Are there any costs associated with ohio income tax registration?

There are typically no direct costs for registering for ohio income tax registration, as the filing itself is free. However, businesses may incur fees for certain licenses or the services of accountants. Using airSlate SignNow can help reduce administrative costs associated with paperwork management.

-

What benefits does airSlate SignNow offer for businesses registering for ohio income tax?

airSlate SignNow provides several benefits for businesses registering for ohio income tax, including fast and secure eSigning, templates for commonly required documents, and easy collaboration with stakeholders. These features help streamline the entire registration process, making it more efficient and less time-consuming.

-

Can I integrate airSlate SignNow with other software for ohio income tax registration?

Yes, airSlate SignNow offers integrations with various accounting and business software, enhancing your ohio income tax registration experience. Whether you use QuickBooks, Salesforce, or other tools, you can connect seamlessly and streamline your workflows. This capability improves efficiency and data accuracy.

-

How long does the ohio income tax registration process take?

The time it takes for ohio income tax registration can vary based on several factors, including the completeness of your application and the current workload at the Ohio Department of Taxation. Generally, you can expect it to take a few weeks. Utilizing airSlate SignNow's eSigning feature can help expedite the preparation of documents needed for registration.

-

What documents do I need for ohio income tax registration?

For ohio income tax registration, you typically need to submit documents such as your business registration paperwork, financial statements, and federal tax identification. airSlate SignNow allows you to digitize these documents, making it easy to manage and send them securely for registration purposes.

Get more for Oh City Maple Heights

- Letter landlord notice rent form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase montana form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant montana form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services montana form

- Temporary lease agreement to prospective buyer of residence prior to closing montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497316208 form

- Letter from landlord to tenant returning security deposit less deductions montana form

Find out other Oh City Maple Heights

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online