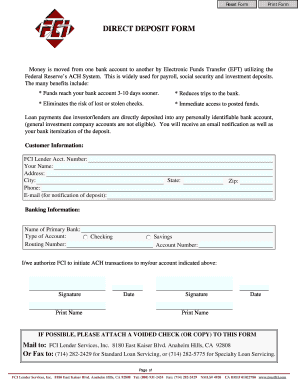

Fci Lender Services Form

What is the FCI Lender Services?

The FCI Lender Services refers to a suite of offerings designed to assist lenders in managing their financial operations effectively. This service typically includes loan processing, underwriting, and servicing, aimed at enhancing efficiency and compliance within the lending industry. By utilizing FCI Lender Services, financial institutions can streamline their workflows, reduce operational risks, and improve customer satisfaction.

How to Use the FCI Lender Services

Using FCI Lender Services involves several steps to ensure that lenders can maximize the benefits of the offerings. First, lenders should familiarize themselves with the specific services available, such as loan origination and servicing tools. Next, they can integrate these services into their existing systems, often requiring minimal training for staff. Regularly reviewing the performance of these services will help lenders identify areas for improvement and ensure compliance with industry standards.

Key Elements of the FCI Lender Services

Key elements of FCI Lender Services include:

- Loan Processing: Streamlined workflows for efficient loan applications.

- Underwriting Support: Tools and resources to assist in risk assessment.

- Servicing Solutions: Ongoing support for managing loan accounts.

- Compliance Assistance: Resources to help lenders adhere to regulatory requirements.

Steps to Complete the FCI Lender Services

Completing the FCI Lender Services typically involves the following steps:

- Identify the specific services needed based on your lending operations.

- Gather necessary documentation and data for integration.

- Implement the services into your existing processes.

- Train staff on the new systems and workflows.

- Monitor performance and compliance regularly.

Legal Use of the FCI Lender Services

Legal use of FCI Lender Services requires adherence to federal and state regulations governing lending practices. Lenders must ensure that their use of these services complies with laws such as the Truth in Lending Act and the Equal Credit Opportunity Act. Regular audits and compliance checks can help maintain legal standards and protect both the lender and the borrower.

Required Documents

To utilize FCI Lender Services effectively, several documents may be required, including:

- Loan applications from borrowers.

- Credit reports and financial statements.

- Identification and verification documents.

- Compliance-related documentation.

Examples of Using the FCI Lender Services

Examples of using FCI Lender Services can vary widely depending on the lender's needs. For instance, a mortgage lender may use these services to streamline the application process, while a small business lender might leverage them for efficient loan servicing. Each example highlights how FCI Lender Services can enhance operational efficiency and improve customer experiences in different lending scenarios.

Quick guide on how to complete fci lender services

Complete Fci Lender Services effortlessly on any device

Web-based document management has become widely embraced by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Fci Lender Services on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Fci Lender Services without strain

- Locate Fci Lender Services and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Fci Lender Services while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fci lender services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are FCI lender services?

FCI lender services refer to a range of solutions designed to assist lenders in managing their financial and operational tasks effectively. These services typically include document processing, risk management, and compliance support. Leveraging FCI lender services can streamline workflows and help lenders meet regulatory requirements more easily.

-

How can airSlate SignNow enhance FCI lender services?

AirSlate SignNow enhances FCI lender services by providing a seamless platform for sending and eSigning documents electronically. This simplifies the documentation process, allowing lenders to accelerate transactions while maintaining compliance and security. With customizable templates and easy integrations, airSlate SignNow is a powerful tool for optimizing FCI lender services.

-

What pricing plans are available for airSlate SignNow FCI lender services?

AirSlate SignNow offers various pricing plans tailored to suit the needs of businesses utilizing FCI lender services. Pricing is based on features and the number of users, ensuring affordability while delivering a robust set of tools. Prospective customers can choose a plan that best fits their operational requirements without overspending.

-

What features does airSlate SignNow offer for FCI lender services?

AirSlate SignNow provides essential features for FCI lender services, including custom workflows, unlimited document storage, and mobile access. These functionalities are designed to make document management easy and efficient. Additionally, eSignature capabilities ensure that all transactions are secure and comply with industry regulations.

-

Can airSlate SignNow integrate with other tools for FCI lender services?

Yes, airSlate SignNow can integrate seamlessly with many third-party applications, enhancing FCI lender services' functionality. Popular integrations include CRM systems, payment processors, and document management platforms. This connectivity ensures that lenders can maintain their preferred workflows while utilizing airSlate SignNow's capabilities.

-

What are the benefits of using airSlate SignNow for FCI lender services?

Using airSlate SignNow for FCI lender services comes with multiple benefits, such as increased efficiency and reduced turnaround times for document processing. The platform's user-friendly interface makes it accessible for all team members, enhancing collaboration. Additionally, implementing eSignatures can signNowly decrease costs associated with paper-based processes.

-

Is airSlate SignNow secure for handling FCI lender services?

Yes, airSlate SignNow incorporates robust security measures suitable for handling FCI lender services. The platform adheres to industry standards, including encryption and secure data storage, which ensures sensitive information remains protected. Compliance with regulations such as GDPR and HIPAA further underscores its commitment to security.

Get more for Fci Lender Services

- Warranty deed from individual to a trust vermont form

- Warranty deed from husband and wife to a trust vermont form

- Warranty deed from husband to himself and wife vermont form

- Quitclaim deed from husband to himself and wife vermont form

- Administrator dbn form

- Quitclaim deed from husband and wife to husband and wife vermont form

- Warranty deed from husband and wife to husband and wife vermont form

- Vt special form

Find out other Fci Lender Services

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement