Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

Understanding the Form 943 X Rev January

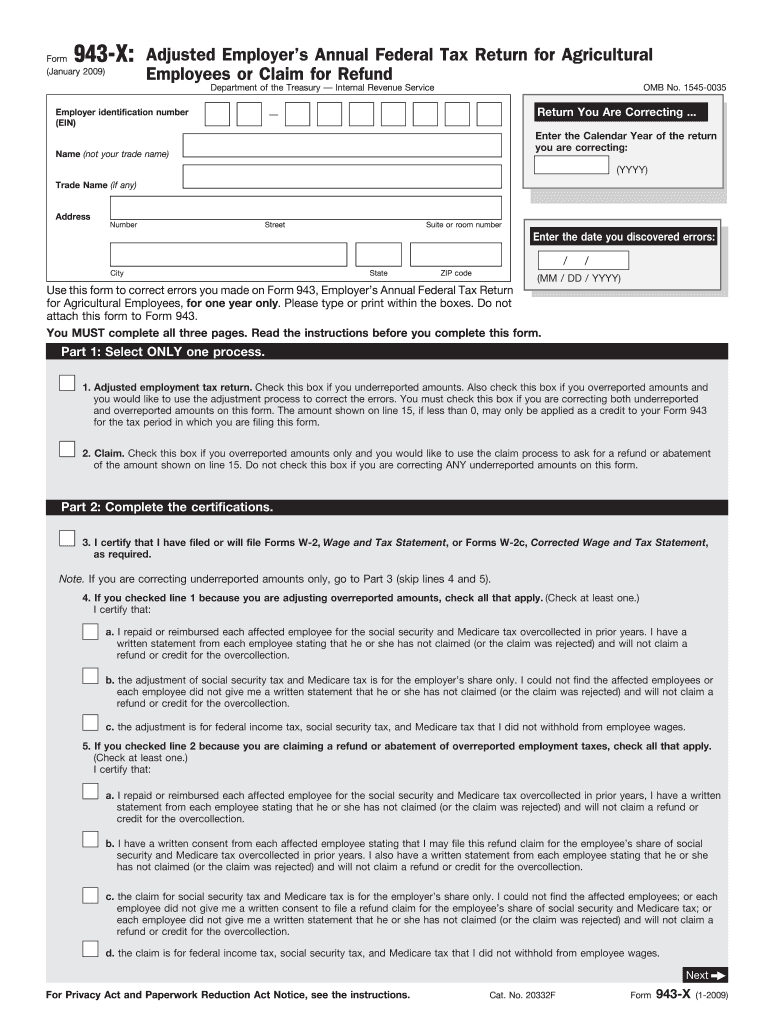

The Form 943 X Rev January is essential for employers in the agricultural sector who need to adjust their annual federal tax return for agricultural employees or claim a refund. This form allows employers to correct errors made on previously filed Form 943, which reports wages and taxes withheld for agricultural workers. It is crucial for ensuring compliance with IRS requirements and maintaining accurate tax records.

How to Complete the Form 943 X Rev January

Completing the Form 943 X Rev January involves several steps to ensure accuracy. First, gather all relevant information, including previous filings and documentation of the errors to be corrected. Next, accurately fill out the form, indicating the specific changes being made. Be sure to provide clear explanations for each adjustment in the designated sections. Finally, review the completed form for any errors before submission.

Obtaining the Form 943 X Rev January

The Form 943 X Rev January can be obtained directly from the IRS website or through authorized tax preparation software. Employers may also request a paper copy by contacting the IRS directly. It is advisable to ensure that you are using the most current version of the form to avoid complications during the filing process.

Filing Deadlines for Form 943 X Rev January

Employers must adhere to specific deadlines when filing the Form 943 X Rev January. Typically, the form should be filed within three years from the original due date of the Form 943 that is being amended. It is important to stay informed about any updates to IRS deadlines, as these can affect the timing of your submission and potential refunds.

Key Elements of the Form 943 X Rev January

The Form 943 X Rev January includes several key elements that employers must complete. These include the employer's name, address, and identification number, as well as the tax year for which the adjustments are being made. Additionally, the form requires detailed information about the corrections, including the amounts being adjusted and the reasons for these changes. Properly completing these sections is vital for a successful filing.

Legal Use of the Form 943 X Rev January

The legal use of the Form 943 X Rev January is governed by IRS regulations. Employers must ensure that they only use this form to correct legitimate errors related to their tax filings for agricultural employees. Misuse of the form can lead to penalties or further scrutiny from the IRS. Therefore, it is essential to understand the legal implications and requirements associated with this form.

Quick guide on how to complete form 943 x rev january adjusted employers annual federal tax return for agricultural employees or claim for refund

Complete [SKS] seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to easily locate and securely archive the appropriate forms online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The most efficient way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal confidential information with the specialized tools that airSlate SignNow offers.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund

Create this form in 5 minutes!

How to create an eSignature for the form 943 x rev january adjusted employers annual federal tax return for agricultural employees or claim for refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund?

Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund is used to correct errors on previously filed 943 tax returns for agricultural employees. This form allows employers to amend their filings and potentially claim refunds for overpaid taxes. Understanding this form is essential for maintaining compliance and ensuring accurate tax submissions.

-

How can airSlate SignNow help me with Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund?

airSlate SignNow simplifies the process of completing and eSigning Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund. Our platform provides templates that guide users through the necessary information, making it quick and efficient. You can easily share your completed forms with your accountant or submit them directly to the IRS.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing options tailored to meet the needs of various businesses. Our plans include pay-as-you-go, monthly, and annual subscriptions, all of which provide features that make submitting forms like Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund easier. Each plan is designed to be cost-effective, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for completing tax forms?

airSlate SignNow includes several features that enhance the completion of tax forms such as Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund. These features include customizable templates, collaborative editing, and encrypted eSignature capabilities. With these tools, users can ensure their documents are both accurate and secure.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various platforms to streamline your workflow. You can link it with accounting software and document management systems, enhancing your ability to handle Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund among other forms efficiently. These integrations allow for greater flexibility and ease in managing your documentation process.

-

How secure is airSlate SignNow when handling sensitive forms?

AirSlate SignNow places a high priority on security, using encryption technology to protect all documents, including Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund. We comply with industry-standard security protocols, ensuring that your sensitive information remains confidential and protected from unauthorized access. You can sign and send documents with peace of mind.

-

Can I track the status of my Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund submissions?

Absolutely! airSlate SignNow provides real-time tracking for all submitted forms, including Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund. Users can easily monitor when their documents are viewed, signed, and submitted. This transparency helps you stay informed about the status of your tax returns.

Get more for Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund

Find out other Form 943 X Rev January Adjusted Employer's Annual Federal Tax Return For Agricultural Employees Or Claim For Refund

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement