Form 3520 a Annual Information Return of Foreign Trust with a U S Owner Annual Information Return of Foreign Trust with a U S Ow

Understanding Form 3520-A

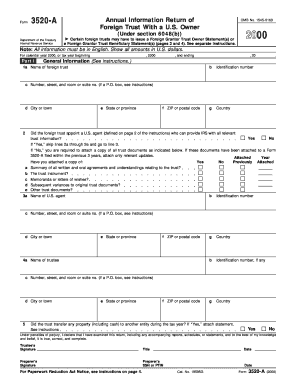

Form 3520-A, officially known as the Annual Information Return of Foreign Trust with a U.S. Owner, is a crucial document for U.S. taxpayers who are beneficiaries of foreign trusts. This form is required by the Internal Revenue Service (IRS) to report information about the foreign trust, including its financial activities and the assets held within it. The form ensures compliance with U.S. tax laws and helps the IRS monitor foreign trusts that may impact U.S. tax liabilities.

How to Obtain Form 3520-A

To obtain Form 3520-A, taxpayers can visit the IRS website, where the form is available for download. It is also possible to request a physical copy by contacting the IRS directly. Additionally, tax professionals and accountants often have access to the form and can assist in obtaining it. Ensuring you have the correct version of the form is essential for accurate reporting.

Steps to Complete Form 3520-A

Completing Form 3520-A involves several key steps:

- Gather all necessary information about the foreign trust, including its name, address, and taxpayer identification number.

- Provide details about the U.S. owner, including their name, address, and Social Security number.

- Complete the sections regarding the trust's financial activities, including income, distributions, and assets.

- Review the form for accuracy before submission to avoid penalties.

Legal Use of Form 3520-A

The legal use of Form 3520-A is mandated by U.S. tax law for individuals who have ownership in a foreign trust. Filing this form is essential to avoid potential legal issues, including penalties for non-compliance. It serves as a declaration of the trust's existence and its financial dealings, ensuring that U.S. tax obligations are met. Understanding the legal implications of the form is crucial for U.S. owners of foreign trusts.

Filing Deadlines for Form 3520-A

Form 3520-A must be filed annually, with specific deadlines that align with the tax year of the trust. Typically, the form is due on the 15th day of the third month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due by March 15 of the following year. It is important to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failing to file Form 3520-A or submitting it late can result in significant penalties. The IRS imposes fines that can vary based on the amount of unreported income and the duration of the delay. Understanding these penalties highlights the importance of timely and accurate filing, as they can have substantial financial consequences for U.S. owners of foreign trusts.

Quick guide on how to complete form 3520 a annual information return of foreign trust with a u s owner annual information return of foreign trust with a u s

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as it allows you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] easily

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal value as a conventional wet ink signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Annual Information Return Of Foreign Trust With A U S Ow

Create this form in 5 minutes!

How to create an eSignature for the form 3520 a annual information return of foreign trust with a u s owner annual information return of foreign trust with a u s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner?

Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner is a tax form required by the IRS for U.S. persons who are owners of foreign trusts. This form provides the IRS with information about the trust's income, distributions, and expenses. Filing this form accurately is crucial to comply with U.S. tax regulations.

-

How does airSlate SignNow facilitate the completion of Form 3520 A?

airSlate SignNow simplifies the process of completing Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner by offering user-friendly templates and eSignature capabilities. Our platform allows users to fill out forms digitally, ensuring accuracy while saving time. This enhances efficiency, especially for businesses managing multiple trusts.

-

Are there any costs associated with using airSlate SignNow for Form 3520 A?

Yes, airSlate SignNow offers various pricing plans to cater to different user needs, which include features for managing Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner. Pricing is competitive, making it a cost-effective solution for businesses that require compliance and efficient document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for foreign trust forms?

airSlate SignNow offers a variety of features for handling Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner. These include document editing, template creation, and secure eSigning capabilities. Our platform also allows users to track document statuses and set reminders to ensure timely filing.

-

How secure is my information on airSlate SignNow when filing Form 3520 A?

Security is a top priority at airSlate SignNow. When you use our platform to manage Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner, your data is protected with industry-leading encryption and secure storage. We adhere to strict compliance standards to ensure that your sensitive information remains confidential.

-

Can airSlate SignNow integrate with other software for handling Form 3520 A?

Yes, airSlate SignNow offers integrations with various business software that can assist in the management of Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner. This allows for seamless data transfer and enhances workflow efficiency, enabling users to utilize their existing tools alongside our platform.

-

Who should file Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner?

Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner should be filed by any U.S. person who is the owner of a foreign trust. This includes not only individuals but also businesses and estates that hold interests in foreign trusts. It's essential for all U.S. owners to understand their responsibilities to avoid penalties.

Get more for Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Annual Information Return Of Foreign Trust With A U S Ow

- Idaho application and affidavit for writ of continuing garnishment form

- Tender documents pdf form

- Form addversion additional card bbhpetrolb x fleet card

- Musical instruments picture dictionary form

- Boli oregon prevailing wage form fillable

- Ps form 3735

- Navmc 11905 form

- Cobra account status update request form

Find out other Form 3520 A Annual Information Return Of Foreign Trust With A U S Owner Annual Information Return Of Foreign Trust With A U S Ow

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast