Approval for Distribution of IRAs, SEPIRAs, Roth IRAs, & Coverdell Form

What is the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

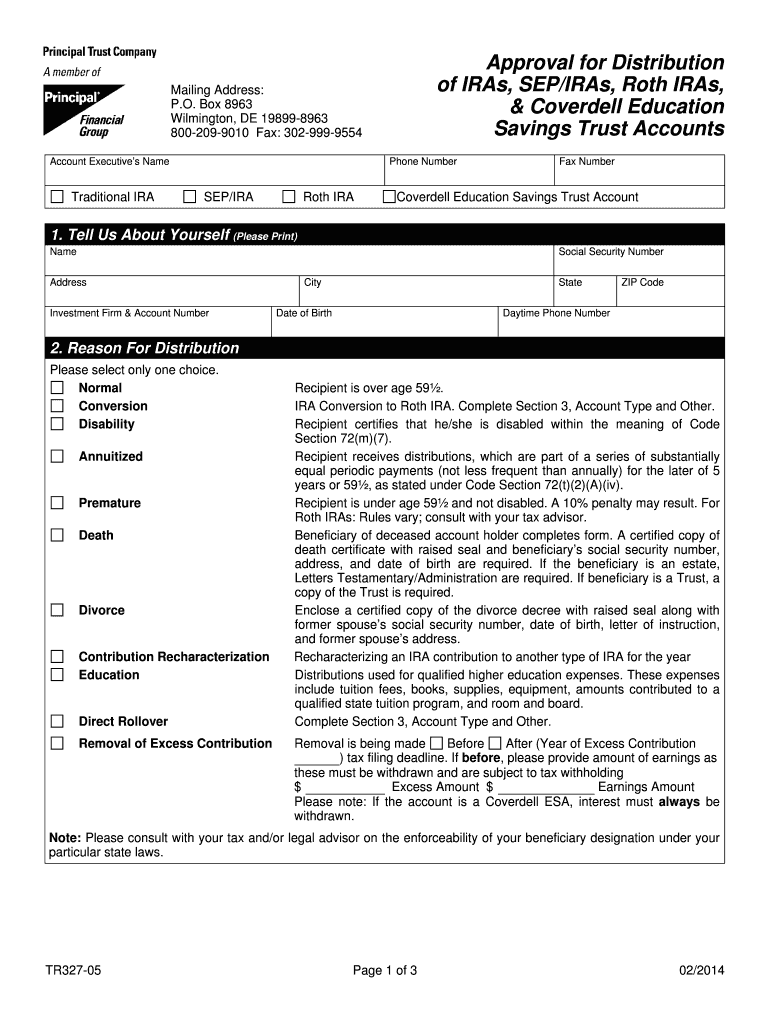

The Approval For Distribution of IRAs, SEPIRAs, Roth IRAs, and Coverdell accounts is a crucial document that allows account holders to withdraw funds from their retirement accounts. This approval is essential for ensuring that distributions comply with Internal Revenue Service (IRS) regulations. Each type of account has specific rules regarding distributions, and the approval process helps maintain adherence to these guidelines while minimizing tax liabilities and penalties.

Steps to Complete the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

Completing the Approval For Distribution involves several key steps:

- Gather necessary information, including account details and the purpose of the withdrawal.

- Fill out the required form accurately, ensuring all sections are completed as per the guidelines.

- Review the form for any errors or omissions before submission.

- Submit the form through the appropriate channel, which may include online submission, mailing, or in-person delivery.

- Keep a copy of the submitted form for your records.

How to Obtain the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

To obtain the Approval For Distribution, individuals typically need to contact their financial institution or plan administrator. Most institutions provide the necessary forms on their websites or upon request. It is important to ensure that the correct form for the specific account type is used, as there may be variations in the requirements for IRAs, SEPIRAs, Roth IRAs, and Coverdell accounts.

Eligibility Criteria

Eligibility for distributions from IRAs, SEPIRAs, Roth IRAs, and Coverdell accounts generally depends on factors such as age, account type, and the reason for withdrawal. For example, individuals must be at least fifty-nine and a half years old to avoid early withdrawal penalties from traditional IRAs. Additionally, certain conditions, such as financial hardship or education expenses, may allow for penalty-free withdrawals from specific accounts. Understanding these criteria is essential for ensuring compliance with IRS regulations.

IRS Guidelines

The IRS provides detailed guidelines regarding distributions from retirement accounts. These guidelines outline the tax implications, allowable withdrawal amounts, and any penalties for early withdrawals. For instance, Roth IRAs allow for tax-free distributions of contributions, while traditional IRAs may incur taxes on the amount withdrawn. Familiarizing oneself with these guidelines can help account holders make informed decisions regarding their distributions.

Required Documents

When applying for the Approval For Distribution, several documents may be required to support the request. Commonly required documents include:

- Proof of identity, such as a government-issued ID.

- Account statements that verify the account balance and ownership.

- Documentation supporting the reason for withdrawal, if applicable.

Having these documents ready can streamline the approval process and ensure timely access to funds.

Quick guide on how to complete approval for distribution of iras sepiras roth iras amp coverdell

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize important parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

Create this form in 5 minutes!

How to create an eSignature for the approval for distribution of iras sepiras roth iras amp coverdell

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell using airSlate SignNow?

To obtain Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell, you can easily upload your documents to airSlate SignNow. After that, you can add recipients, set signing roles, and send the documents for eSignature. The entire process is streamlined, ensuring you get timely approvals.

-

What features does airSlate SignNow offer for managing IRA distributions?

airSlate SignNow provides essential features such as templates for IRA documents, automated reminders, and real-time tracking of signatures. These features help ensure that you can efficiently manage the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell while staying compliant with regulations.

-

How can airSlate SignNow help save costs associated with IRA distributions?

By using airSlate SignNow for Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell, businesses can reduce paper and mailing costs signNowly. The digital signing process eliminates the need for physical paperwork, allowing for quicker transactions and saving valuable time and resources.

-

Is airSlate SignNow secure for handling financial documents like IRA distributions?

Yes, airSlate SignNow uses advanced security measures such as encryption and multi-factor authentication to ensure that your documents are safe. This guarantees that all Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell are protected against unauthorized access.

-

Can I integrate airSlate SignNow with other tools for managing IRA transactions?

Absolutely! airSlate SignNow offers integrations with various CRM systems, cloud storage solutions, and financial software. This allows for seamless handling of the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell alongside your existing tools.

-

How can I ensure compliance when obtaining approvals for IRA distributions with airSlate SignNow?

airSlate SignNow helps you maintain compliance through features like audit trails and customizable workflows. These tools are specifically designed for the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell, ensuring you adhere to all necessary regulations and guidelines.

-

What customer support options does airSlate SignNow offer for users dealing with IRA distributions?

airSlate SignNow provides comprehensive customer support through live chat, email, and phone assistance. Whether you have questions about the Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell or need help with the platform, our team is here to assist you.

Get more for Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

- Slaughter anne marie international relations principal theories form

- Sample welcome speech for an event pdf form

- Mcdonalds qrg pdf form

- Construction company employee handbook form

- Spm bir form

- Emp501 form pdf

- American heart association emergency cardiovascular care programs heartsaver course roster course information heartsaver cpr

- Ecs custom order form final evans custom surfboards

Find out other Approval For Distribution Of IRAs, SEPIRAs, Roth IRAs, & Coverdell

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast