Annual Summary and Transmittal of U S Information Returns Irs

What is the Annual Summary and Transmittal of U.S. Information Returns?

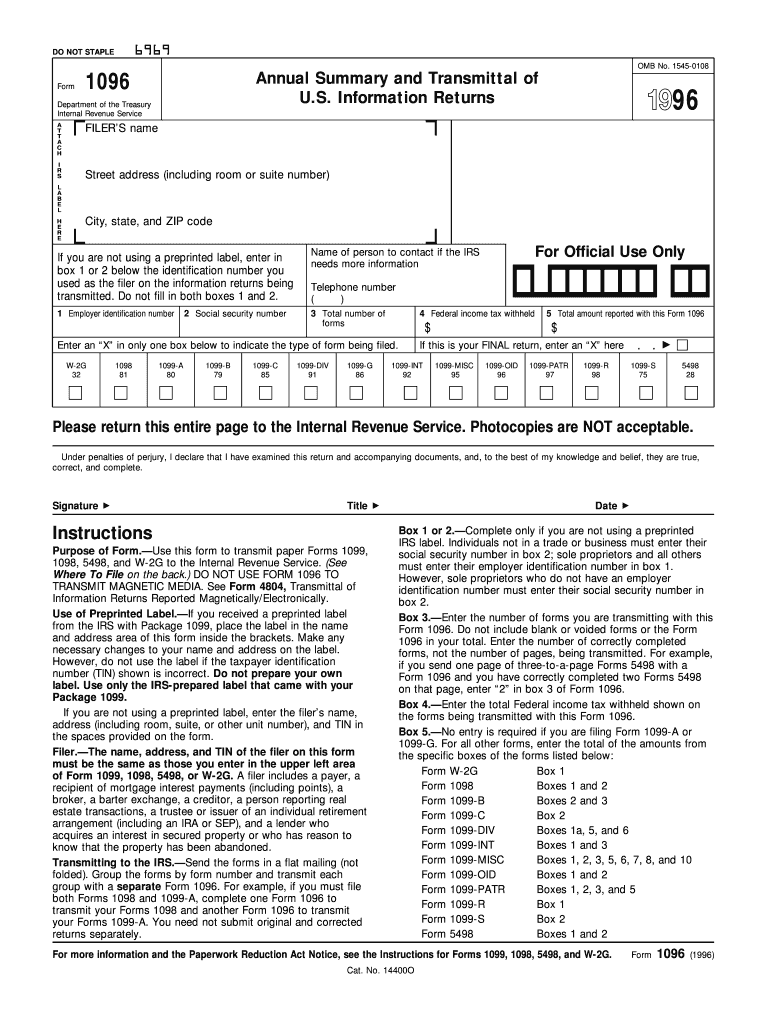

The Annual Summary and Transmittal of U.S. Information Returns, commonly referred to as Form 1096, is a crucial document used by businesses and organizations to summarize and transmit various information returns to the Internal Revenue Service (IRS). This form serves as a cover sheet for the accompanying forms, such as Forms 1099, 1098, and W-2, which report income, payments, and other tax-related information. By submitting Form 1096, filers ensure that the IRS receives a comprehensive overview of their information returns for the tax year.

Steps to Complete the Annual Summary and Transmittal of U.S. Information Returns

Completing the Annual Summary and Transmittal of U.S. Information Returns involves several key steps:

- Gather all relevant information returns that need to be submitted, such as Forms 1099 and W-2.

- Fill out Form 1096, ensuring that you include your name, address, and taxpayer identification number (TIN).

- Indicate the total number of information returns being submitted and the appropriate box for the type of returns.

- Sign and date the form to certify that the information provided is accurate and complete.

- Submit Form 1096 along with the accompanying information returns to the IRS by the specified deadline.

Filing Deadlines / Important Dates

Timely submission of the Annual Summary and Transmittal of U.S. Information Returns is essential to avoid penalties. The filing deadline for Form 1096 typically aligns with the due date for the information returns it summarizes, which is generally January thirty-first for paper filings. However, if you are filing electronically, the deadline extends to March thirty-first. It is important to check for any updates or changes to these dates each tax year.

Required Documents

To successfully complete the Annual Summary and Transmittal of U.S. Information Returns, you will need the following documents:

- Completed Form 1096

- All relevant information returns, such as Forms 1099, 1098, or W-2

- Taxpayer identification number (TIN) for the business or organization

- Any additional documentation required by the IRS for specific information returns

Penalties for Non-Compliance

Failure to file the Annual Summary and Transmittal of U.S. Information Returns on time or providing inaccurate information can result in significant penalties. The IRS imposes fines based on the number of days late, starting at fifty dollars per return if filed late, with the penalty increasing for each additional month the returns remain unfiled. It is crucial to ensure that all forms are completed accurately and submitted by the deadlines to avoid these financial repercussions.

Digital vs. Paper Version

The Annual Summary and Transmittal of U.S. Information Returns can be filed either digitally or via paper submission. Filing electronically is often more efficient and may reduce the risk of errors. The IRS encourages electronic filing through its e-file program, which can streamline the process and provide immediate confirmation of receipt. However, businesses that prefer paper filing must ensure that they use the correct forms and follow the appropriate mailing procedures.

Quick guide on how to complete annual summary and transmittal of u s information returns irs

Prepare [SKS] effortlessly on any device

Online document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to get started.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive details with the features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Adjust and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Annual Summary And Transmittal Of U S Information Returns Irs

Create this form in 5 minutes!

How to create an eSignature for the annual summary and transmittal of u s information returns irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Annual Summary and Transmittal of U.S. Information Returns IRS?

The Annual Summary and Transmittal of U.S. Information Returns IRS is a form used by businesses to report various information returns to the IRS. This document summarizes the forms like W-2s and 1099s submitted during the year. Properly completing this form is essential for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the Annual Summary and Transmittal of U.S. Information Returns IRS?

airSlate SignNow simplifies the process of preparing and submitting the Annual Summary and Transmittal of U.S. Information Returns IRS by providing seamless eSignature and document management solutions. Users can easily collect signatures and track document progress, ensuring timely submissions. This helps reduce errors and improves overall efficiency during tax season.

-

What are the costs associated with using airSlate SignNow for document management?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes looking to handle documents like the Annual Summary and Transmittal of U.S. Information Returns IRS. With a range of features included in each tier, you can choose the best package that suits your needs. Additionally, a free trial is available to explore the features before making a commitment.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow offers various integrations with popular accounting software to streamline your workflow. This means you can easily manage the Annual Summary and Transmittal of U.S. Information Returns IRS alongside your financial data. Integrating these systems helps ensure accuracy and saves time on repetitive tasks.

-

Is airSlate SignNow compliant with IRS regulations regarding the Annual Summary and Transmittal of U.S. Information Returns?

Absolutely, airSlate SignNow is designed to comply with all applicable IRS regulations, including the guidelines for the Annual Summary and Transmittal of U.S. Information Returns. Our platform follows best practices for security and data protection, giving you peace of mind as you manage sensitive tax documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides several features tailored for tax document management, including templates for the Annual Summary and Transmittal of U.S. Information Returns IRS, automated reminders, secure eSigning, and real-time tracking. These features enhance productivity and accuracy, making the tax preparation process more efficient.

-

How can I ensure that my documents are secure when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize advanced encryption technology, secure servers, and multi-factor authentication to protect your documents, including the Annual Summary and Transmittal of U.S. Information Returns IRS. You can confidently manage your sensitive information with our platform.

Get more for Annual Summary And Transmittal Of U S Information Returns Irs

Find out other Annual Summary And Transmittal Of U S Information Returns Irs

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe