Do NOT Cut or Separate Forms on This Page IRS Irs

What is the Do NOT Cut Or Separate Forms On This Page IRS Irs

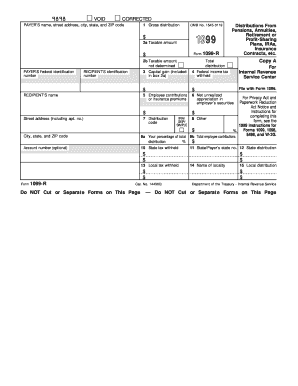

The directive "Do NOT Cut Or Separate Forms On This Page" appears on certain IRS forms to ensure that all parts of the document remain intact. This is crucial because many IRS forms are designed with multiple sections that work together. Cutting or separating these forms can lead to incomplete submissions, which may result in processing delays or complications with your tax filings.

How to use the Do NOT Cut Or Separate Forms On This Page IRS Irs

When you encounter the instruction to not cut or separate forms, it is essential to maintain the integrity of the document. Users should fill out the entire form as it is presented, ensuring that all sections are completed correctly. After filling out the form, you can submit it as a whole, either by mailing it to the IRS or electronically, depending on the specific form's submission guidelines.

Steps to complete the Do NOT Cut Or Separate Forms On This Page IRS Irs

To complete the forms correctly, follow these steps:

- Read the instructions provided with the form carefully.

- Fill out all required fields without cutting or separating any sections.

- Double-check your entries for accuracy and completeness.

- Sign and date the form if required.

- Submit the form according to the specified submission methods.

Key elements of the Do NOT Cut Or Separate Forms On This Page IRS Irs

Key elements to consider when dealing with these forms include:

- Understanding the purpose of each section of the form.

- Ensuring that all necessary information is provided in the correct format.

- Being aware of any deadlines for submission to avoid penalties.

- Recognizing that some forms may require additional documentation to be submitted alongside them.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of forms. These guidelines emphasize the importance of not altering the form's structure, which includes cutting or separating any parts. Adhering to these guidelines helps ensure that your submission is processed efficiently and accurately.

Penalties for Non-Compliance

Failing to comply with the instruction to not cut or separate forms can lead to various penalties. These may include:

- Delays in processing your tax return.

- Potential rejection of your submission.

- Additional fines or penalties if the form is deemed incomplete.

Quick guide on how to complete do not cut or separate forms on this page irs irs

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hesitation. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related tasks today.

How to Modify and eSign [SKS] Without Hassle

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools specifically designed for this purpose that airSlate SignNow provides.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the do not cut or separate forms on this page irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What should I do if I see a message saying 'Do NOT Cut Or Separate Forms On This Page IRS Irs'?

If you encounter a message that says 'Do NOT Cut Or Separate Forms On This Page IRS Irs', it is crucial to follow those instructions. Cutting or separating the forms can lead to errors in processing, delaying your submission. Always keep the documents intact to ensure compliance with IRS requirements.

-

How does airSlate SignNow help with IRS document compliance?

airSlate SignNow provides a streamlined approach to sending and signing documents, ensuring they remain compliant with IRS standards. By using our platform, you can safely manage forms without worrying about cutting or separating them. This not only saves time but also minimizes the risk of submission errors.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and secure storage, enabling you to manage documents efficiently. By utilizing these features, users can ensure they adhere to instructions like 'Do NOT Cut Or Separate Forms On This Page IRS Irs'. This makes it easier to handle sensitive information safely.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be cost-effective, making it ideal for small businesses needing document signing solutions. By offering various plans and pricing options, businesses can choose what fits their needs best while ensuring compliance with requirements like 'Do NOT Cut Or Separate Forms On This Page IRS Irs'.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow offers integrations with popular software tools such as Google Workspace and Salesforce. These integrations allow you to maintain consistency in your workflows and ensure that documents, especially those requiring compliance with instructions like 'Do NOT Cut Or Separate Forms On This Page IRS Irs', are handled seamlessly.

-

What are the security measures in place for documents signed on airSlate SignNow?

airSlate SignNow prioritizes security with features like encryption and authentication. This ensures that your documents are safe from unauthorized access while complying with instructions such as 'Do NOT Cut Or Separate Forms On This Page IRS Irs'. You can trust that your sensitive information is protected throughout the signing process.

-

How can I track the status of my documents in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your documents within the platform. You'll receive notifications when your documents are viewed and signed, helping you manage your workflow efficiently. This tracking capability ensures you adhere to necessary guidelines, including 'Do NOT Cut Or Separate Forms On This Page IRS Irs'.

Get more for Do NOT Cut Or Separate Forms On This Page IRS Irs

- Summary of troop finances and detailed cash record gsnc gsnc form

- Lesson 1 the movement begins form

- Terminate w 4 form

- Behavior chain form

- Master pooled trust disbursement request form the arc of texas thearcoftexas

- Aanpcp preceptorship form the american academy of nurse healthprofessions nku

- Slumdog millionaire worksheet pdf form

- Sidbury primary school form

Find out other Do NOT Cut Or Separate Forms On This Page IRS Irs

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself