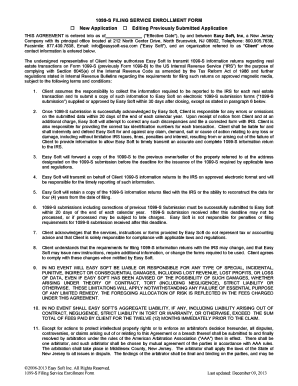

1099 S Filing Service Form

What is the 1099 S Filing Service

The 1099 S Filing Service is a crucial component of tax reporting for businesses and individuals involved in real estate transactions. This service specifically addresses the reporting of proceeds from the sale or exchange of real estate, ensuring compliance with IRS regulations. The form captures essential details, including the seller's information, the buyer's information, and the gross proceeds from the transaction. Utilizing this service helps streamline the tax filing process and ensures that all parties meet their legal obligations.

How to use the 1099 S Filing Service

Using the 1099 S Filing Service involves several straightforward steps. First, gather all necessary information related to the real estate transaction, including the names and addresses of the seller and buyer, as well as the sale price. Next, access the filing service through a digital platform that supports e-signatures and document management. Input the required details into the form, ensuring accuracy to avoid potential issues with the IRS. Finally, review the completed form for correctness before submitting it electronically or via mail, depending on your preference.

Steps to complete the 1099 S Filing Service

Completing the 1099 S Filing Service requires careful attention to detail. Follow these steps for a successful filing:

- Collect all relevant transaction details, including the date of sale and property description.

- Obtain the seller's and buyer's tax identification numbers (TINs) or Social Security numbers (SSNs).

- Fill out the 1099 S form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form electronically using a trusted e-filing service or mail it to the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099 S form is essential for compliance. Typically, the form must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically. Additionally, copies must be provided to the seller and buyer by the same deadlines. Staying informed about these dates helps prevent penalties and ensures that all parties meet their tax obligations in a timely manner.

Required Documents

To complete the 1099 S Filing Service, certain documents are necessary. These include:

- The completed 1099 S form.

- Supporting documentation for the real estate transaction, such as the sales contract and closing statement.

- Tax identification numbers (TINs) or Social Security numbers (SSNs) for both the seller and buyer.

Having these documents ready simplifies the filing process and ensures compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for the 1099 S Filing Service to ensure accurate reporting. These guidelines outline who is required to file the form, the information needed, and the proper submission methods. It is essential to familiarize yourself with these guidelines to avoid errors that could lead to penalties. The IRS website offers detailed resources and instructions that can assist filers in understanding their responsibilities and ensuring compliance with tax laws.

Quick guide on how to complete 1099 s filing service

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the suitable form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hindrances. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] seamlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1099 S Filing Service

Create this form in 5 minutes!

How to create an eSignature for the 1099 s filing service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 S Filing Service offered by airSlate SignNow?

The 1099 S Filing Service by airSlate SignNow is a comprehensive solution that simplifies the process of filing 1099-S forms. It allows users to prepare, eSign, and securely submit these forms electronically. This service not only saves time but also ensures compliance with IRS regulations.

-

How does the 1099 S Filing Service benefit my business?

Using the 1099 S Filing Service helps streamline your tax filing process, minimizing errors and delays. It enhances efficiency by allowing electronic signatures and submissions. Additionally, it provides a cost-effective way to manage your filing needs without the hassle of paper forms.

-

What are the pricing options for the 1099 S Filing Service?

Our 1099 S Filing Service offers several pricing tiers to accommodate different business sizes and filing needs. You can choose a plan that aligns with your filing volume and budget. For a detailed breakdown of our pricing options, please visit our pricing page.

-

Can I integrate the 1099 S Filing Service with my existing software?

Yes, the 1099 S Filing Service by airSlate SignNow seamlessly integrates with popular accounting and finance software such as QuickBooks and Xero. This allows for a smoother experience in managing your financial documents and reporting. Integration enhances efficiency by reducing manual entry and errors.

-

Is the 1099 S Filing Service secure?

Absolutely! Our 1099 S Filing Service utilizes state-of-the-art encryption and security protocols to protect your sensitive data. We adhere to strict compliance standards to ensure that your personal and business information remains confidential throughout the filing process.

-

What steps are involved in using the 1099 S Filing Service?

Using the 1099 S Filing Service is straightforward. First, create an account and enter the necessary information for the forms. Then, you can prepare and eSign the forms before submitting them electronically. The entire process is designed to be quick and user-friendly.

-

Do I need to file 1099 S forms every year?

Yes, if your business engages in real estate transactions that require filing 1099 S forms, it is important to file them annually. This ensures compliance with IRS regulations. Our 1099 S Filing Service makes this process easy and efficient for businesses of all sizes.

Get more for 1099 S Filing Service

Find out other 1099 S Filing Service

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter