1 Conversion Rights When Your Group Life Insurance Terminates or Usc Form

Understanding 1 Conversion Rights When Your Group Life Insurance Terminates

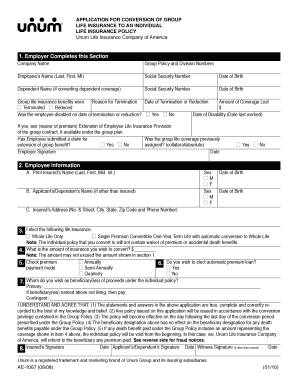

The 1 Conversion Rights refer to the legal provisions that allow individuals to convert their group life insurance policy into an individual policy when their group coverage ends. This right is crucial for maintaining life insurance coverage without undergoing a new medical examination. Typically, this conversion must be initiated within a specified timeframe following the termination of the group policy, ensuring that individuals can secure their insurance needs even after leaving an employer or a group plan.

How to Utilize 1 Conversion Rights When Your Group Life Insurance Terminates

To effectively use your 1 Conversion Rights, begin by reviewing your group life insurance policy documents. These documents often outline the specific terms and conditions related to conversion rights. Once you confirm your eligibility, contact your insurance provider to request the conversion application. Ensure you complete this process promptly, as there is usually a limited window to take advantage of these rights, often ranging from 30 to 60 days after termination.

Key Elements of 1 Conversion Rights When Your Group Life Insurance Terminates

Several key elements define the 1 Conversion Rights. First, the right to convert is typically available only to those who were covered under the group policy for a minimum period, often at least one year. Second, the new individual policy may have different premium rates based on the insured's age and health status at the time of conversion. Lastly, the coverage amount may be limited to a percentage of the original group policy, which is important to consider when planning for future financial needs.

Steps to Complete the 1 Conversion Rights Process

Completing the conversion process involves several straightforward steps:

- Review your group life insurance policy for conversion details.

- Contact your insurance provider to express your intent to convert.

- Obtain and fill out the conversion application form provided by your insurer.

- Submit the completed application within the specified timeframe.

- Await confirmation of your new individual policy and any premium payment details.

Eligibility Criteria for 1 Conversion Rights

Eligibility for 1 Conversion Rights typically includes being an active member of the group plan at the time of termination. Additionally, you must not have been terminated for reasons that would disqualify you from coverage, such as fraud or non-payment of premiums. It is essential to check the specific conditions outlined in your group policy, as they may vary by insurer and state regulations.

Examples of Using 1 Conversion Rights

Consider a scenario where an employee leaves their job and their group life insurance coverage ends. They can exercise their 1 Conversion Rights to convert their existing coverage into an individual policy without needing to provide medical evidence. This ensures they maintain life insurance protection, which is especially important if they have dependents relying on their financial support. Another example could involve a member of a professional organization whose group policy is discontinued; they can still secure coverage through conversion.

Quick guide on how to complete 1 conversion rights when your group life insurance terminates or usc

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tiresome document searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your requirements in document management within a few clicks from a device of your choice. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1 Conversion Rights When Your Group Life Insurance Terminates Or Usc

Create this form in 5 minutes!

How to create an eSignature for the 1 conversion rights when your group life insurance terminates or usc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 1 Conversion Rights When Your Group Life Insurance Terminates Or USC?

1 Conversion Rights When Your Group Life Insurance Terminates Or USC refers to the options available for policyholders to convert their group life insurance into an individual policy upon termination. This ensures that you can maintain coverage even after leaving a job. It's essential to understand these rights to safeguard your financial future.

-

How does airSlate SignNow facilitate the signing of conversion rights documents?

With airSlate SignNow, documenting your 1 Conversion Rights When Your Group Life Insurance Terminates Or USC is streamlined. Our platform allows for easy electronic signatures, ensuring that the conversion documents are executed promptly and securely, eliminating delays often associated with manual processes.

-

What features does airSlate SignNow offer to support group insurance conversions?

AirSlate SignNow offers features like customizable templates and automated workflows that simplify the management of your 1 Conversion Rights When Your Group Life Insurance Terminates Or USC. Users can create, send, and track documents effortlessly, ensuring compliance and reducing potential errors.

-

Is airSlate SignNow cost-effective for managing group life insurance documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your insurance documents, including those related to 1 Conversion Rights When Your Group Life Insurance Terminates Or USC. Our pricing plans are flexible, allowing businesses of all sizes to tailor their usage according to their budget while enjoying essential features.

-

Can airSlate SignNow integrate with other platforms for better management of insurance rights?

Absolutely! AirSlate SignNow integrates seamlessly with various CRM and document management systems, enhancing the process of tracking your 1 Conversion Rights When Your Group Life Insurance Terminates Or USC. These integrations improve workflow efficiency and ensure all your documents are in one place.

-

What benefits can I expect from using airSlate SignNow for my conversion rights documentation?

Using airSlate SignNow offers numerous benefits, including expedited document turnaround time, enhanced security, and the convenience of managing your 1 Conversion Rights When Your Group Life Insurance Terminates Or USC from anywhere. The platform’s user-friendly interface ensures that even those unfamiliar with technology can navigate it easily.

-

How secure is airSlate SignNow when handling sensitive insurance documents?

AirSlate SignNow prioritizes security, employing advanced encryption methods to protect sensitive information related to your 1 Conversion Rights When Your Group Life Insurance Terminates Or USC. Our compliance with industry standards ensures that your data remains safe throughout the document signing process.

Get more for 1 Conversion Rights When Your Group Life Insurance Terminates Or Usc

Find out other 1 Conversion Rights When Your Group Life Insurance Terminates Or Usc

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure