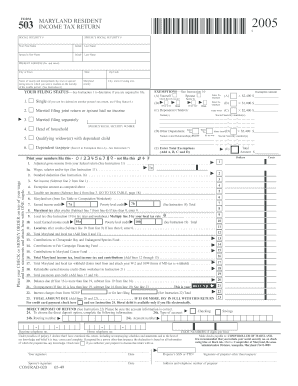

FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name $ SOCIAL SECURITY

What is the FORM 503 Maryland Resident Income Tax Return?

The FORM 503 is a crucial document for Maryland residents filing their income tax returns. This form is specifically designed for individuals who reside in Maryland and need to report their income to the state. It includes essential information such as the taxpayer's name, Social Security number, and details about their spouse, if applicable. The form ensures that the state can accurately assess the taxpayer's income and determine the appropriate tax liability.

Steps to Complete the FORM 503

Completing the FORM 503 involves several key steps to ensure accuracy and compliance with Maryland tax laws. Begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out your personal information at the top of the form, including your name, Social Security number, and your spouse's details if you are filing jointly. Carefully report your total income and any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Legal Use of the FORM 503

The FORM 503 serves as an official declaration of income for Maryland residents. It is legally binding and must be completed accurately to avoid penalties. Taxpayers are required to file this form annually, and it is essential for maintaining compliance with state tax regulations. Failure to submit the FORM 503 or providing false information can lead to legal repercussions, including fines or audits.

Required Documents for FORM 503

To successfully complete the FORM 503, certain documents are necessary. Taxpayers should have their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of any other income sources. Additionally, records of deductions, such as mortgage interest statements or educational expenses, should be collected. Having these documents ready will streamline the process of filling out the form and ensure all income is accurately reported.

Filing Deadlines for FORM 503

It is important to be aware of the filing deadlines associated with the FORM 503. Typically, Maryland residents must submit their income tax returns by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file, which must be requested before the original deadline to avoid penalties.

Form Submission Methods

The FORM 503 can be submitted through various methods to accommodate different taxpayer preferences. Individuals have the option to file their returns online using approved e-filing services, which often provide a faster processing time. Alternatively, taxpayers can mail their completed forms to the designated state tax office. In-person submissions may also be possible at local tax offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete form 503 your first name maryland resident income tax return spouses social security initial last name social security spouses

Manage [SKS] effortlessly on any device

Digital document administration has become increasingly popular with both companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name $ SOCIAL SECURITY

Create this form in 5 minutes!

How to create an eSignature for the form 503 your first name maryland resident income tax return spouses social security initial last name social security spouses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name?

FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name is a tax return form used by Maryland residents. It allows individuals to report their income and calculate their state tax obligations accurately. Completing this form is essential for compliance with Maryland tax laws.

-

How can airSlate SignNow assist in completing the FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN?

airSlate SignNow simplifies the process of filling and eSigning FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN. Our platform provides an intuitive interface that allows users to effortlessly enter their information, including spouse's social security numbers and personal details. This ensures that your tax return is submitted accurately and on time.

-

Are there features in airSlate SignNow specifically for tax-related documents?

Yes, airSlate SignNow includes features that cater specifically to tax-related documents, including FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN. Users can easily upload, fill, and eSign their documents electronically while ensuring they are secure and compliant. This streamlines the overall tax filing process.

-

What are the benefits of using airSlate SignNow for my FORM 503 submission?

Using airSlate SignNow for your FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN offers numerous benefits, such as time-saving automation and secure document handling. This eliminates the need for printing and mailing forms, reducing both time and costs. Furthermore, you can track your submission status and receive notifications directly through the platform.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, there is a subscription fee for using airSlate SignNow, which offers various plans to accommodate different needs. The pricing is cost-effective compared to traditional document signing methods, as it eliminates additional costs like printing and postage. Each plan provides unlimited eSigning for all types of documents, including FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various software applications that cater to tax preparation. This means you can seamlessly use FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN alongside your favorite accounting tools. The integrations enhance efficiency by allowing you to manage everything from a single platform.

-

How does airSlate SignNow ensure the security of my personal information?

airSlate SignNow prioritizes the security of your personal information, utilizing advanced encryption protocols and secure data handling practices. When filling out FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN, you can trust that your spouse's social security numbers and other sensitive data are protected. Our compliance with industry standards ensures your privacy is safeguarded.

Get more for FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name $ SOCIAL SECURITY

Find out other FORM 503 Your First Name MARYLAND RESIDENT INCOME TAX RETURN SPOUSE'S SOCIAL SECURITY # Initial Last Name $ SOCIAL SECURITY

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later