Form 941 M Rev March

What is the Form 941 M Rev March

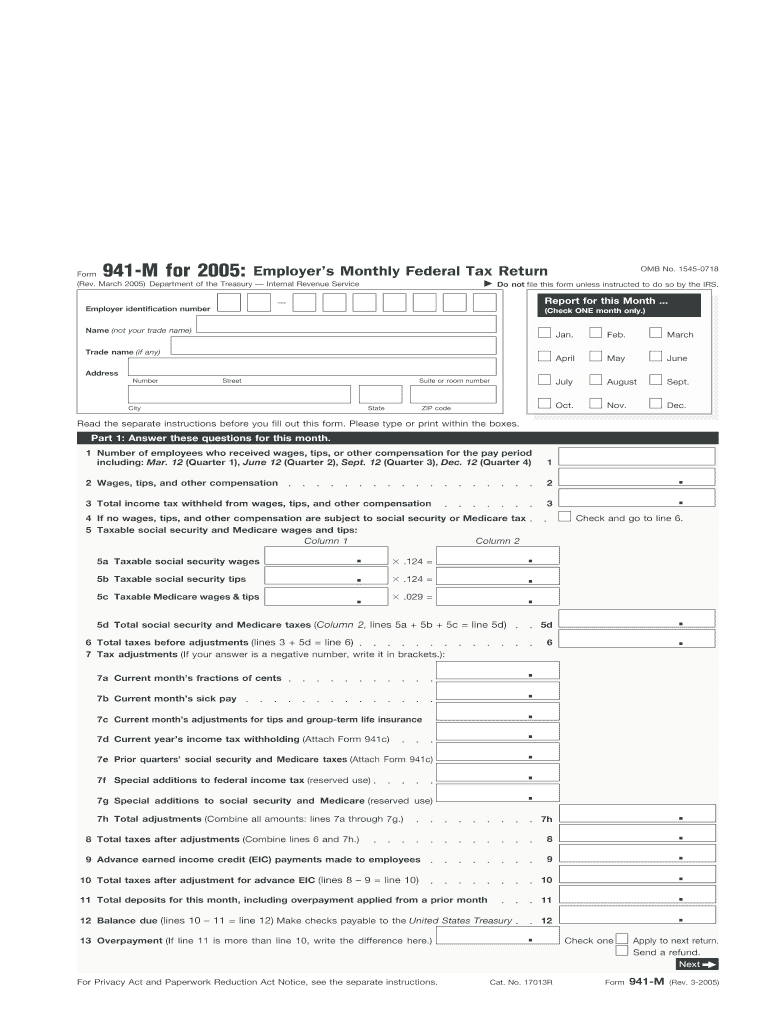

The Form 941 M Rev March is a tax document used by employers in the United States to report payroll taxes. This form is specifically designed for reporting income taxes withheld from employee wages, as well as the employer and employee portions of Social Security and Medicare taxes. It is a crucial component of the federal tax system, ensuring that the correct amounts are reported and paid to the Internal Revenue Service (IRS).

How to use the Form 941 M Rev March

To use the Form 941 M Rev March, employers must complete the form accurately and submit it according to IRS guidelines. The form requires detailed information about the number of employees, total wages paid, and the amount of taxes withheld. Employers should ensure that all calculations are correct to avoid penalties. Once completed, the form can be filed electronically or mailed to the appropriate IRS address.

Steps to complete the Form 941 M Rev March

Completing the Form 941 M Rev March involves several key steps:

- Gather necessary information, including employee wages, tax withholding amounts, and business identification details.

- Fill out the form sections accurately, ensuring all figures are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated filing deadline.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941 M Rev March to avoid penalties. Generally, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Employers should also keep track of any changes to these dates as announced by the IRS.

Penalties for Non-Compliance

Failure to file the Form 941 M Rev March on time or inaccuracies in the form can result in penalties. The IRS may impose fines for late submissions, which can increase the longer the form remains unfiled. Additionally, incorrect information may lead to further scrutiny or audits. Employers are encouraged to file accurately and on time to avoid these consequences.

Digital vs. Paper Version

The Form 941 M Rev March can be submitted in both digital and paper formats. The digital version allows for easier calculations and faster submission, while the paper version may be preferred by those who are not comfortable with electronic filing. Regardless of the method chosen, it is essential to ensure that the form is completed correctly and submitted by the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 941 M Rev March. These guidelines include instructions on how to fill out each section of the form, the types of information required, and the various submission methods available. Employers should refer to the IRS website or consult with a tax professional to ensure compliance with all applicable rules and regulations.

Quick guide on how to complete form 941 m rev march

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction with organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow's applications for Android or iOS and simplify any document-related process today.

How to Alter and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight crucial sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about mislaid or lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Alter and electronically sign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941 M Rev March

Create this form in 5 minutes!

How to create an eSignature for the form 941 m rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 941 M Rev March and why is it important?

Form 941 M Rev March is a crucial tax form used by employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. Understanding this form is essential for compliance and accurate payroll reporting, helping businesses avoid penalties.

-

How does airSlate SignNow assist with Form 941 M Rev March?

airSlate SignNow streamlines the process of completing and submitting Form 941 M Rev March by offering easy eSigning and document management features. This ensures that your tax forms are signed securely and filed on time, enhancing your efficiency.

-

Is there a cost associated with using airSlate SignNow for Form 941 M Rev March?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs when handling Form 941 M Rev March. The solution is cost-effective, ensuring you can manage document workflows without breaking your budget.

-

Can I integrate airSlate SignNow with other tools to manage Form 941 M Rev March?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can help manage your Form 941 M Rev March and other documents easily. This enhances your workflow by allowing data synchronization across multiple applications.

-

What are the key features of airSlate SignNow for handling Form 941 M Rev March?

Key features of airSlate SignNow include secure eSigning, document templates, real-time tracking, and automated reminders specifically for forms like the Form 941 M Rev March. These capabilities simplify the completion and management of essential tax documentation.

-

How secure is airSlate SignNow for submitting Form 941 M Rev March?

airSlate SignNow prioritizes security, implementing advanced encryption protocols to ensure that your Form 941 M Rev March and other documents are protected. You can eSign and send sensitive documents with confidence, knowing your data is safe.

-

What benefits does airSlate SignNow offer for businesses submitting Form 941 M Rev March?

Using airSlate SignNow for Form 941 M Rev March provides several benefits including time savings, enhanced accuracy, and improved organization. Businesses can focus on core operations while ensuring compliance and timely submissions.

Get more for Form 941 M Rev March

- Army will worksheet form

- Mass save electric water heater rebate form

- Interpreting ecological data of populations answer key form

- District award of merit form fillable

- Scotia refund form

- Biodiversity checklist to accompany planning applications form

- X34441 breast milk refrig zer temp log iconnect form

- Hi scan 100100t form

Find out other Form 941 M Rev March

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online