HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct Form

Understanding the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

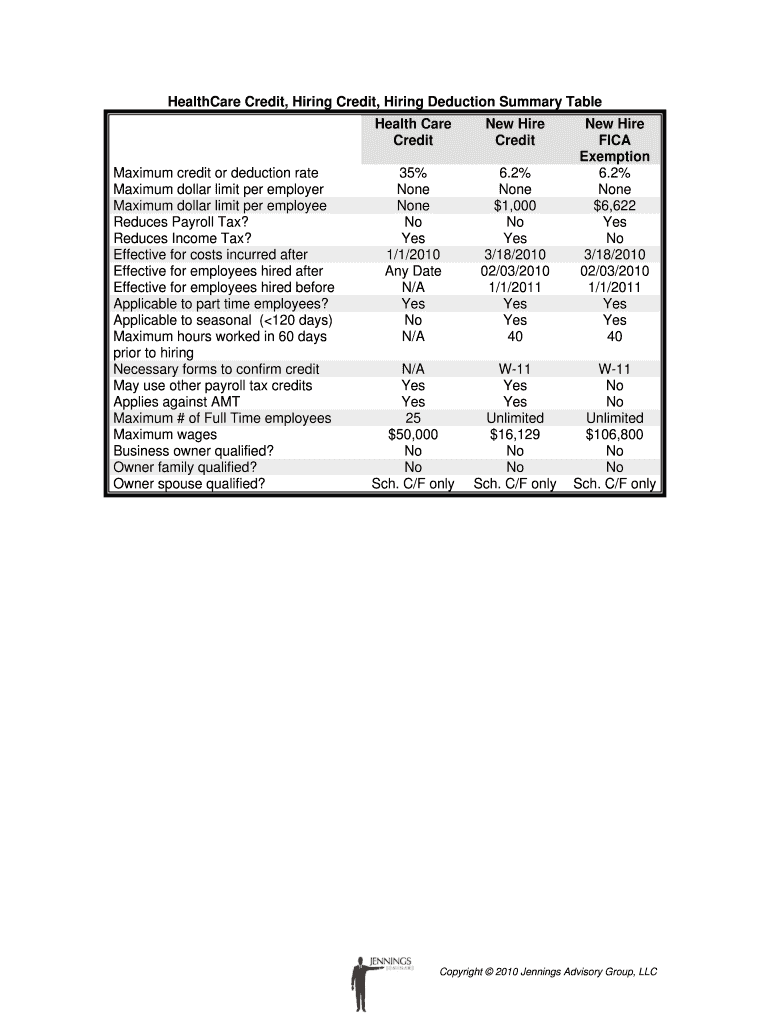

The HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct is a comprehensive document designed to help businesses navigate various tax credits and deductions related to healthcare and hiring practices. This table outlines the eligibility criteria, benefits, and key provisions associated with each credit or deduction, providing a clear overview for employers. It is particularly useful for businesses looking to optimize their tax positions while supporting employee health and job creation.

How to Utilize the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

To effectively use the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct, businesses should first review the eligibility requirements for each credit or deduction listed. Understanding these prerequisites is crucial for determining which benefits apply to your organization. Next, businesses should gather necessary documentation, such as payroll records and employee health insurance details, to support their claims. Finally, the information in the summary table can be used to complete relevant tax forms accurately, ensuring that all credits and deductions are claimed appropriately.

Steps to Complete the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

Completing the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct involves several key steps:

- Review the table to identify applicable credits and deductions based on your business type and employee demographics.

- Gather all required documentation, including employee health coverage details and hiring records.

- Fill out the summary table by entering relevant data for each credit or deduction, ensuring accuracy in all figures.

- Consult with a tax professional if needed to verify that all entries comply with IRS guidelines.

- Submit the completed table along with your tax return or any other required forms.

Key Elements of the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

Several key elements are essential to understanding the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct:

- Eligibility Criteria: Each credit has specific qualifications that businesses must meet to qualify.

- Credit Amounts: The table details the maximum amounts available for each credit or deduction.

- Filing Requirements: Information on how and when to file for these credits is included to ensure compliance.

- Documentation Needed: A list of necessary documents to support claims is provided for clarity.

IRS Guidelines for the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

The IRS provides specific guidelines regarding the use of the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct. Businesses should familiarize themselves with these guidelines to ensure compliance and maximize their benefits. Key points include:

- Understanding the definitions of eligible healthcare expenses and qualifying hires.

- Awareness of any changes to tax laws that may affect the credits and deductions available.

- Following the correct procedures for filing and documentation to avoid penalties.

Examples of Using the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

Practical examples can illustrate how to effectively use the HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct:

- A small business that hires a veteran may qualify for a hiring credit, which can be calculated using the summary table.

- An employer providing health insurance to employees can utilize the healthcare credit, detailed in the table, to offset costs.

- Businesses can compare potential savings from various credits to determine the most beneficial options for their specific situation.

Quick guide on how to complete healthcare credit hiring credit hiring deduction summary table msacct

Effortlessly prepare [SKS] on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, the hassle of tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Adjust and electronically sign [SKS] while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

Create this form in 5 minutes!

How to create an eSignature for the healthcare credit hiring credit hiring deduction summary table msacct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HealthCare Credit and how can it benefit my business?

The HealthCare Credit is a tax incentive designed to help businesses provide health insurance to their employees. By utilizing the HealthCare Credit, you can potentially reduce your overall tax burden while ensuring your staff receives essential health benefits. Understanding how to implement the Hiring Deduction Summary Table Msacct within your financial strategy can enable you to maximize these savings.

-

How does the Hiring Credit work in conjunction with airSlate SignNow?

The Hiring Credit allows businesses to receive tax credits for hiring eligible employees, thus enhancing your overall financial strategy. By using airSlate SignNow, you can easily manage the documentation and e-signing processes required to apply for the Hiring Credit, making it simpler and more efficient to access these benefits.

-

Can airSlate SignNow help me track my Hiring Deduction Summary Table Msacct?

Yes, airSlate SignNow offers features that can assist in tracking your Hiring Deduction Summary Table Msacct efficiently. Our platform enables you to manage and eSign important documents related to your hiring deductions, helping ensure accurate record-keeping and compliance with regulations.

-

What are the pricing options for using airSlate SignNow for documentation related to HealthCare Credit?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Depending on your usage and required features, you can choose a plan that allows you to efficiently manage documentation for the HealthCare Credit and other tax incentives, such as the Hiring Deduction Summary Table Msacct, without breaking the bank.

-

Are there any integrations available with airSlate SignNow for managing HealthCare Credit applications?

Yes, airSlate SignNow integrates with various software solutions that can assist in managing your HealthCare Credit applications. This includes accounting and HR platforms, allowing for seamless documentation and e-signature processes that support your utilization of the Hiring Credit and the Hiring Deduction Summary Table Msacct.

-

What features does airSlate SignNow provide to improve the hiring documentation process?

airSlate SignNow provides features such as customizable templates, bulk sending, and advanced security options to streamline the hiring documentation process. This is particularly beneficial for managing documents related to the Hiring Credit and the Hiring Deduction Summary Table Msacct, ensuring you have efficient and secure operations.

-

How can airSlate SignNow ensure compliance with regulations surrounding HealthCare Credit?

airSlate SignNow emphasizes compliance by providing features like audit trails and customizable workflows, which help in documenting the processes surrounding HealthCare Credit. By utilizing our platform, you can ensure that your hiring documentation meets all necessary legal requirements related to the Hiring Deduction Summary Table Msacct.

Get more for HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

Find out other HealthCare Credit, Hiring Credit, Hiring Deduction Summary Table Msacct

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now