Employee's Withholding Exemption Certificate Auburnschools Form

What is the Employee's Withholding Exemption Certificate Auburnschools

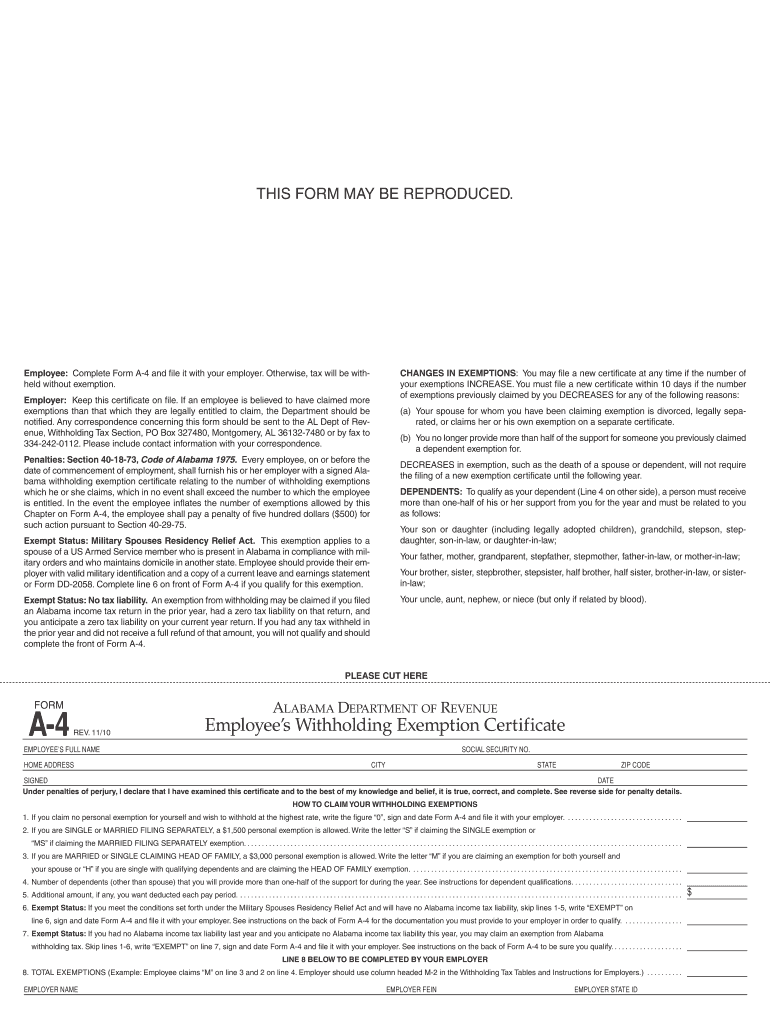

The Employee's Withholding Exemption Certificate Auburnschools is a crucial document used by employees to claim exemption from federal income tax withholding. This certificate allows eligible employees to avoid having federal taxes deducted from their paychecks, provided they meet specific criteria. It is essential for employees who believe they will not owe any federal income tax for the year due to low income or other qualifying reasons. Understanding this form helps employees manage their finances effectively and ensures compliance with tax regulations.

How to use the Employee's Withholding Exemption Certificate Auburnschools

To use the Employee's Withholding Exemption Certificate Auburnschools, employees must complete the form accurately and submit it to their employer. The form should include personal information, such as name, address, and Social Security number, along with the reason for claiming exemption. Once submitted, employers will use the information to adjust the withholding on the employee's paycheck accordingly. It is important to review the form periodically, especially if there are changes in income or tax status, to ensure that the exemption remains valid.

Steps to complete the Employee's Withholding Exemption Certificate Auburnschools

Completing the Employee's Withholding Exemption Certificate Auburnschools involves several straightforward steps:

- Obtain the form from your employer or the appropriate school district office.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the reason for claiming exemption, ensuring you meet the eligibility criteria.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form to your employer's payroll department.

Key elements of the Employee's Withholding Exemption Certificate Auburnschools

The Employee's Withholding Exemption Certificate Auburnschools includes several key elements that are essential for proper completion:

- Personal Information: Name, address, and Social Security number must be accurately filled in.

- Exemption Claim: A clear statement of the reason for claiming exemption, such as low income or other qualifying factors.

- Signature: The employee must sign and date the form to validate the information.

Legal use of the Employee's Withholding Exemption Certificate Auburnschools

Legally, the Employee's Withholding Exemption Certificate Auburnschools must be used in accordance with IRS guidelines. Employees can only claim exemption if they meet specific criteria, such as having no tax liability in the previous year and expecting none in the current year. Misuse of the exemption can lead to penalties, including back taxes and fines. Therefore, it is vital for employees to understand their eligibility and the legal implications of submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the Employee's Withholding Exemption Certificate Auburnschools typically align with the beginning of the tax year. Employees should submit the form as soon as they begin employment or when their tax situation changes. It is advisable to check with the employer for any specific deadlines that may apply, as timely submission ensures the correct withholding amount from the first paycheck of the year.

Quick guide on how to complete employee39s withholding exemption certificate auburnschools

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing users to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your files rapidly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based processes today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors necessitating new printed copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Modify and eSign [SKS] while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Employee's Withholding Exemption Certificate Auburnschools

Create this form in 5 minutes!

How to create an eSignature for the employee39s withholding exemption certificate auburnschools

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Employee's Withholding Exemption Certificate Auburnschools?

The Employee's Withholding Exemption Certificate Auburnschools is a document that allows employees to declare their withholding exemptions for tax purposes. This certificate is essential for ensuring accurate tax deductions from employee salaries, particularly for those working within the Auburn school district.

-

How can airSlate SignNow help with the Employee's Withholding Exemption Certificate Auburnschools?

airSlate SignNow provides an efficient platform for completing and signing the Employee's Withholding Exemption Certificate Auburnschools electronically. Our user-friendly interface simplifies the process, making it easy for employees to manage their tax documents seamlessly and securely.

-

Is there a cost associated with using airSlate SignNow for the Employee's Withholding Exemption Certificate Auburnschools?

Yes, there is a cost associated with using airSlate SignNow, but we provide a variety of pricing plans tailored to fit any business size. Our plans are cost-effective and offer great value, especially considering the benefits of having a streamlined process for the Employee's Withholding Exemption Certificate Auburnschools.

-

What features does airSlate SignNow offer for managing the Employee's Withholding Exemption Certificate Auburnschools?

airSlate SignNow offers robust features such as eSignature capabilities, document templates, and secure storage to help manage the Employee's Withholding Exemption Certificate Auburnschools effortlessly. Additionally, users can track the status of documents and ensure compliance with local regulations.

-

Are there integrations available with airSlate SignNow for processing the Employee's Withholding Exemption Certificate Auburnschools?

Absolutely! airSlate SignNow integrates with various third-party applications, which lets you streamline your workflows. This means you can easily connect systems and processes related to the Employee's Withholding Exemption Certificate Auburnschools to enhance efficiency.

-

How does airSlate SignNow ensure the security of the Employee's Withholding Exemption Certificate Auburnschools?

We take security very seriously at airSlate SignNow. The platform employs robust encryption methods to protect sensitive information, ensuring that the Employee's Withholding Exemption Certificate Auburnschools is safe during storage and transmission.

-

Can I use airSlate SignNow to send reminders for the Employee's Withholding Exemption Certificate Auburnschools?

Yes, airSlate SignNow allows users to set up reminders for documents, including the Employee's Withholding Exemption Certificate Auburnschools. This feature helps ensure that employees complete and submit their certificates promptly, reducing the risk of tax compliance issues.

Get more for Employee's Withholding Exemption Certificate Auburnschools

Find out other Employee's Withholding Exemption Certificate Auburnschools

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter