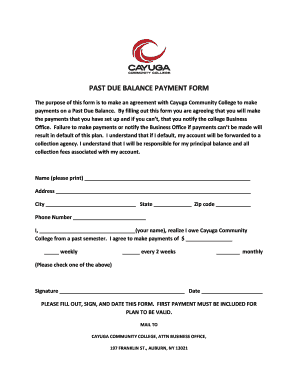

Past Due Balance Form

What is the Past Due Balance

A past due balance refers to an amount owed that has not been paid by its due date. This balance can arise from various financial obligations, including loans, credit card payments, or utility bills. When a payment is not made on time, it may incur additional fees or penalties, and the account may be reported to credit bureaus, affecting the individual's credit score. Understanding the implications of a past due balance is essential for maintaining financial health and avoiding further complications.

How to use the Past Due Balance

To effectively manage a past due balance, individuals should first identify the source of the debt. This involves reviewing account statements and payment history. Once the past due balance is confirmed, the next step is to prioritize repayment. Setting up a payment plan or negotiating with creditors can help in managing the debt more effectively. It is also important to monitor future payments to prevent additional past due balances from occurring.

Steps to complete the Past Due Balance

Addressing a past due balance involves several key steps:

- Review your accounts: Check all relevant statements to confirm the amount owed.

- Contact your creditor: Reach out to discuss your past due balance and explore payment options.

- Set a repayment plan: Determine a feasible payment schedule that fits your budget.

- Make payments: Ensure that you make payments on time to avoid further penalties.

- Monitor your credit report: Regularly check your credit report to ensure that your payments are being reported accurately.

Legal use of the Past Due Balance

The legal implications of a past due balance can vary by state and the type of debt. Creditors may have the right to pursue collection actions, which can include hiring collection agencies or filing lawsuits. It is important to understand consumer protection laws, such as the Fair Debt Collection Practices Act, which regulates how creditors can collect debts. Knowing your rights can help you navigate situations involving past due balances more effectively.

Penalties for Non-Compliance

Failing to address a past due balance can lead to several penalties. These may include late fees, increased interest rates, and potential legal action from creditors. Additionally, a past due balance can negatively impact your credit score, making it more difficult to obtain loans or credit in the future. Understanding these consequences can motivate timely payment and better financial management.

Examples of using the Past Due Balance

Common examples of situations involving a past due balance include:

- Credit card payments that are not made by the due date, resulting in late fees and interest charges.

- Utility bills that remain unpaid, which can lead to service disconnection.

- Loan repayments that are missed, potentially resulting in foreclosure or repossession actions.

Required Documents

When addressing a past due balance, certain documents may be necessary. These can include:

- Account statements showing the past due amount.

- Correspondence with creditors regarding payment terms.

- Proof of income or financial hardship, if negotiating a payment plan.

Quick guide on how to complete past due balance

Complete Past Due Balance effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, as you can access the necessary document and securely save it online. airSlate SignNow provides you with all the tools required to create, amend, and eSign your documents promptly without any holdups. Handle Past Due Balance on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to alter and eSign Past Due Balance seamlessly

- Find Past Due Balance and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the files or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose how you wish to send your document, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign Past Due Balance to ensure superior communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the past due balance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a past due balance and how does it affect my account?

A past due balance refers to any unpaid amount on your account that has exceeded the due date. It's essential to address this balance promptly to avoid interruptions in service and potential late fees. airSlate SignNow provides tools to help you track and manage your payments, ensuring your past due balance is resolved quickly.

-

How can I check if I have a past due balance?

You can easily check for a past due balance by logging into your airSlate SignNow account and navigating to your billing section. Here, all outstanding amounts and their respective due dates will be displayed. Keeping an eye on your account will help you stay informed about your past due balance and maintain smooth operations.

-

What happens if my past due balance isn’t paid?

If your past due balance remains unpaid, it could lead to service interruptions or additional fees. airSlate SignNow recommends settling your balance promptly to prevent any disruptions in your document management workflow. By addressing your past due balance, you ensure continued access to our eSigning and document services.

-

Are there any fees associated with a past due balance?

Yes, there may be late fees applied to your past due balance depending on your account agreement. airSlate SignNow encourages you to review your billing policy to understand any potential charges. Prompt payment can help you avoid these additional fees associated with a past due balance.

-

How can airSlate SignNow help me manage my past due balance?

airSlate SignNow offers comprehensive billing features that allow you to track invoices and payments easily. By using these features, you can set reminders and notifications, helping you stay on top of any past due balance. Our platform provides an organized way to ensure all payments are made on time.

-

Is there an option to set up automatic payments for my past due balance?

Yes, airSlate SignNow provides the option for automatic payments as a convenient way to manage your past due balance. You can set up recurring payments through your account settings, ensuring that your bills are paid on time without manual intervention. This feature is ideal for maintaining financial peace of mind.

-

How does airSlate SignNow’s pricing structure relate to my past due balance?

The pricing structure of airSlate SignNow is transparent, helping you understand any costs that might contribute to a past due balance. By reviewing your subscription plan and usage regularly, you can avoid unexpected charges and keep your past due balance in check. This clarity enables better financial planning for your business.

Get more for Past Due Balance

- Illinois tenant notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497306126 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair illinois form

- Letter tenant notice 497306128 form

- Landlord demand repair form

- Letter tenant repair 497306130 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497306131 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring illinois form

Find out other Past Due Balance

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online