Transfer of Ownership with W9 Form Page 1 of 2 Cu

What is the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu

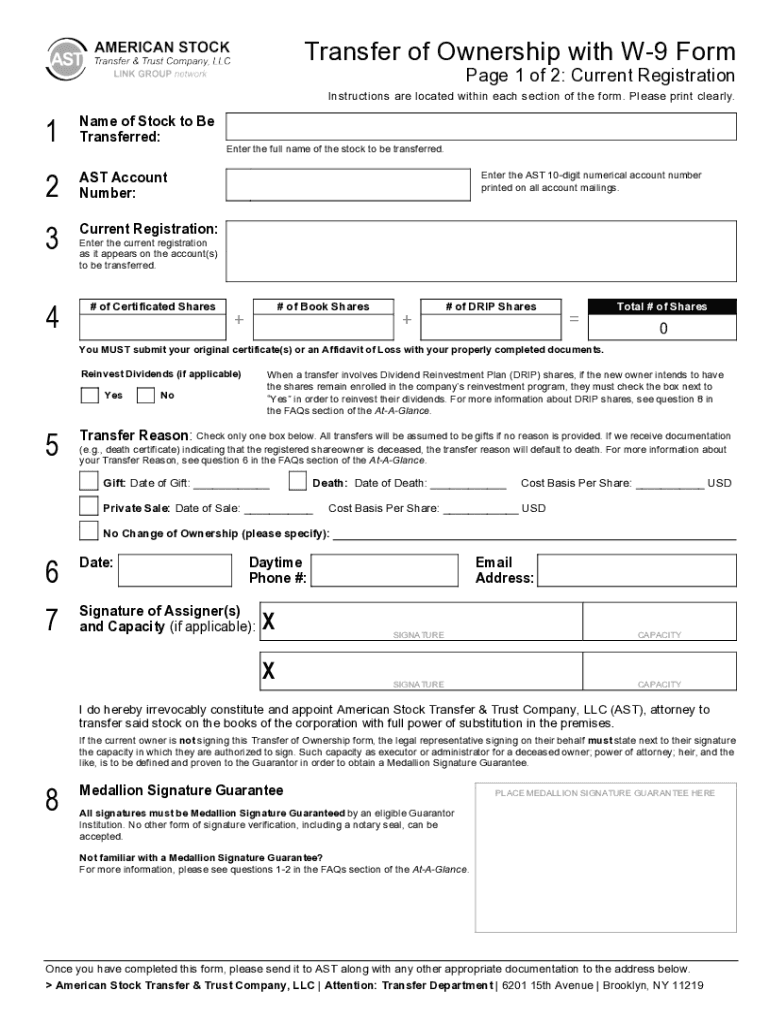

The Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu is a crucial document used in the United States for transferring ownership of assets, such as vehicles or property. This form ensures that the new owner is properly identified for tax purposes. The W-9 component of the form collects information, including the taxpayer's name, address, and taxpayer identification number (TIN), which is essential for reporting income to the Internal Revenue Service (IRS).

How to use the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu

Using the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu involves a few straightforward steps. First, both the current owner and the new owner must fill out their respective sections of the form. The current owner should provide details about the asset being transferred, while the new owner must complete the W-9 section to ensure accurate tax reporting. Once completed, the form should be signed by both parties to validate the transfer.

Steps to complete the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu

Completing the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the IRS website or a legal document provider.

- Fill in the current owner’s information, including their name, address, and TIN.

- Provide details about the asset being transferred, such as make, model, and identification number.

- The new owner must complete the W-9 section, providing their name, address, and TIN.

- Both parties should review the completed form for accuracy.

- Sign and date the form to finalize the transfer.

Key elements of the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu

Several key elements are essential to the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu. These include:

- Current Owner Information: Name, address, and TIN of the person transferring ownership.

- New Owner Information: Name, address, and TIN of the individual receiving ownership.

- Asset Details: Description of the asset being transferred, including identification numbers.

- Signatures: Both parties must sign to validate the transfer.

Legal use of the Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu

The Transfer Of Ownership With W-9 Form Page 1 Of 2 Cu serves a legal purpose in asset transfers. It provides a documented record of ownership change, which is necessary for tax reporting and compliance with IRS regulations. Proper use of this form helps avoid potential legal disputes regarding ownership and ensures that all parties fulfill their tax obligations.

IRS Guidelines

The IRS has specific guidelines regarding the use of the W-9 form within the context of ownership transfers. It is essential to ensure that the information provided is accurate and complete. Failure to adhere to IRS guidelines may result in penalties or issues with tax reporting. Keeping a copy of the completed form for personal records is advisable, as it may be required for future reference or audits.

Quick guide on how to complete transfer of ownership with w9 form page 1 of 2 cu

Finish Transfer Of Ownership With W9 Form Page 1 Of 2 Cu effortlessly on any gadget

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and store it securely in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Transfer Of Ownership With W9 Form Page 1 Of 2 Cu on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign Transfer Of Ownership With W9 Form Page 1 Of 2 Cu with ease

- Find Transfer Of Ownership With W9 Form Page 1 Of 2 Cu and click Retrieve Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Signature tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Finish button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, or a link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Transfer Of Ownership With W9 Form Page 1 Of 2 Cu and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transfer of ownership with w9 form page 1 of 2 cu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

The Transfer Of Ownership With W9 Form Page 1 Of 2 Cu is a document used to officially transfer ownership while ensuring proper tax identification for the new owner. This form is essential for businesses to maintain compliance and accurate records, streamlining the ownership transfer process. Utilizing airSlate SignNow for this form simplifies the eSigning and submission, making it efficient and paperless.

-

How does airSlate SignNow facilitate the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

airSlate SignNow provides an intuitive platform that enables users to complete and eSign the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu effortlessly. The platform allows you to customize the document, gather signatures from multiple parties, and securely store it, ensuring that all steps of the transfer are conducted seamlessly. This efficiency saves time and reduces the chances of errors.

-

Is there a cost associated with using airSlate SignNow for the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers designed to fit different business needs. The cost covers access to a user-friendly platform and all essential features for managing documents, including the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu. Consider starting with a free trial to explore the value before committing.

-

What features does airSlate SignNow offer for the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

airSlate SignNow offers a variety of features, such as customizable templates, multiple signature options, real-time tracking, and cloud storage. These features enhance the process of completing the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu, allowing for a smooth and efficient experience. Additionally, users can automate reminders and gain insights through reporting tools.

-

Can airSlate SignNow integrate with other tools for the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

Absolutely! airSlate SignNow integrates with various applications, including CRM systems, cloud storage services, and productivity tools, facilitating easy access and management of the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu. These integrations help streamline workflows, reduce manual entries, and enhance overall productivity in document management.

-

What are the advantages of using airSlate SignNow for document management, including the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

Using airSlate SignNow for your document management needs enhances efficiency and security. With features like end-to-end encryption and secure storage, you can trust that your Transfer Of Ownership With W9 Form Page 1 Of 2 Cu is handled safely. Moreover, the reduced reliance on paper-based processes can lead to signNow cost savings and a greener operation.

-

How can I ensure my team is trained to use airSlate SignNow for the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu?

airSlate SignNow provides comprehensive resources, including tutorial videos, live training sessions, and a robust help center to help your team understand how to use the platform effectively. With these training materials, your team can quickly become proficient in completing and managing the Transfer Of Ownership With W9 Form Page 1 Of 2 Cu and other documents. Ongoing support is also available for any questions that may arise.

Get more for Transfer Of Ownership With W9 Form Page 1 Of 2 Cu

- Executor deed example fill out and sign printable pdf form

- Fillable online application for funding mcbif fax email form

- Wisconsin deed forms general warranty quit claim and

- Public improvement liens wisconsin department of form

- Wisconsin transfer on death deed formsdeedscom

- Respondentdefendant form

- Wisconsin revocable living trust nupp legal forms

- Estate planner funding your trust green bay press gazette form

Find out other Transfer Of Ownership With W9 Form Page 1 Of 2 Cu

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors