Office of the Assessor's Business Property Statement, Form 571

What is the Office Of The Assessor's Business Property Statement, Form 571

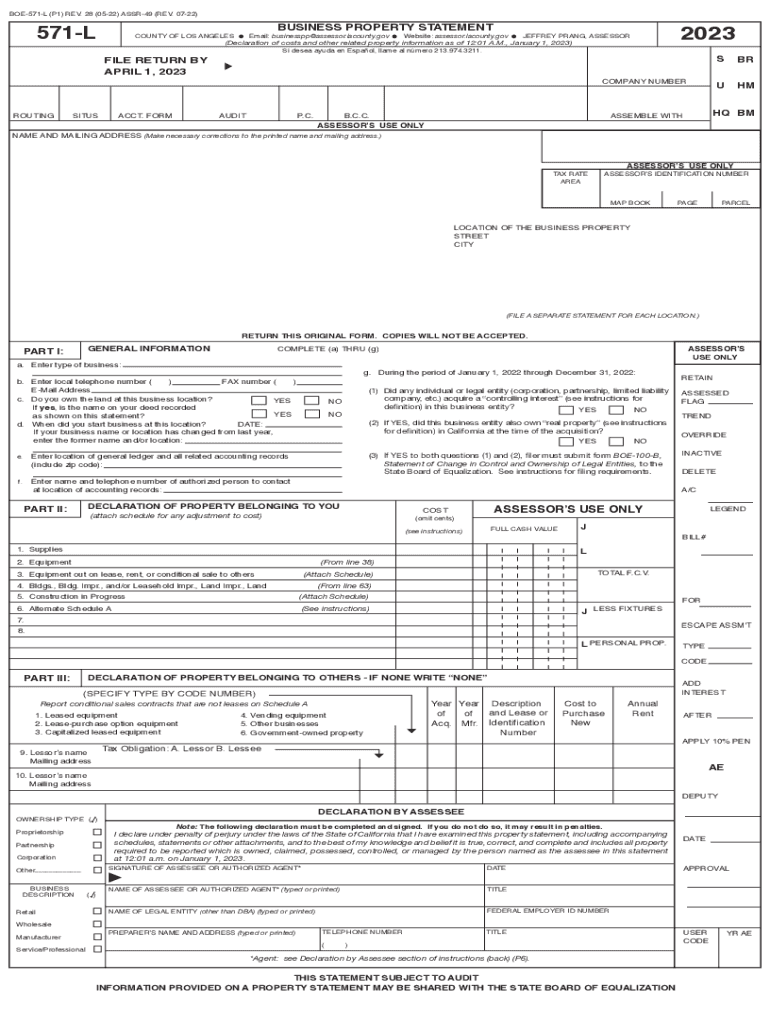

The California BOE 571 L form, also known as the Business Property Statement, is a crucial document used by businesses to report their personal property to the local assessor's office. This form is essential for determining the taxable value of business assets, which may include machinery, equipment, and furniture. By accurately completing the BOE 571 L, businesses ensure compliance with state tax laws and help local governments assess property taxes fairly.

Steps to complete the Office Of The Assessor's Business Property Statement, Form 571

Completing the California BOE 571 L form involves several key steps:

- Gather necessary information about your business assets, including purchase dates and costs.

- Fill out the form with accurate details regarding each asset, ensuring all required sections are completed.

- Review the form for accuracy, checking for any missing information or errors.

- Submit the completed form to your local assessor's office by the specified deadline, which is typically April 1st of each year.

Legal use of the Office Of The Assessor's Business Property Statement, Form 571

The BOE 571 L form is legally required for businesses that own personal property in California. Failing to file this form can result in penalties and additional assessments. The information provided on the form is used by the local assessor to determine property taxes, which are vital for funding local services and infrastructure. It is important for businesses to understand their legal obligations regarding this form to avoid non-compliance.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the California BOE 571 L form. The form can be submitted online through the local assessor's website, which often provides a streamlined process for electronic filing. Alternatively, businesses may choose to mail the completed form to their local assessor's office. In some cases, in-person submission is also an option, allowing for immediate confirmation of receipt. Each method has its advantages, and businesses should select the one that best fits their needs.

Key elements of the Office Of The Assessor's Business Property Statement, Form 571

The California BOE 571 L form includes several key elements that must be accurately reported:

- Business name and address

- Owner's name and contact information

- Detailed listing of all personal property owned, including descriptions and values

- Any applicable exemptions or special circumstances

Providing complete and accurate information in these sections is essential for proper assessment and compliance with tax regulations.

Filing Deadlines / Important Dates

Timely filing of the California BOE 571 L form is critical. The standard deadline for submission is April 1st each year. Businesses that fail to file by this date may incur penalties or face additional assessments. It is advisable to mark this date on your calendar and prepare the necessary documentation in advance to ensure compliance.

Quick guide on how to complete office of the assessors business property statement form 571

Complete Office Of The Assessor's Business Property Statement, Form 571 effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Office Of The Assessor's Business Property Statement, Form 571 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Office Of The Assessor's Business Property Statement, Form 571 with ease

- Find Office Of The Assessor's Business Property Statement, Form 571 and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Office Of The Assessor's Business Property Statement, Form 571 and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the office of the assessors business property statement form 571

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the California BOE 571 L form?

The California BOE 571 L form is a crucial document used for reporting business personal property. Understanding how to properly fill out and submit the California BOE 571 L is essential for compliance with state regulations.

-

How does airSlate SignNow facilitate the signing of the California BOE 571 L?

airSlate SignNow provides an intuitive platform that allows you to securely eSign the California BOE 571 L form online. With easy navigation and various digital signing options, completing your submissions becomes more efficient and streamlined.

-

What are the pricing options for airSlate SignNow when handling documents like the California BOE 571 L?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. These plans provide unlimited access to eSigning features useful for documents, including the California BOE 571 L, ensuring you stay within budget while staying compliant.

-

Can I integrate airSlate SignNow with other software to manage the California BOE 571 L?

Yes, airSlate SignNow supports integrations with a variety of software applications, enabling you to manage the California BOE 571 L efficiently. Seamless integration helps streamline your workflow and ensures your documents are handled effectively.

-

What are the benefits of using airSlate SignNow for the California BOE 571 L?

Using airSlate SignNow offers numerous benefits for handling the California BOE 571 L, including time savings, enhanced security, and improved accuracy. Our platform reduces paper waste and accelerates the signing process, making compliance manageable.

-

Is airSlate SignNow secure for signing sensitive documents like the California BOE 571 L?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and authentication features. You can confidently sign the California BOE 571 L, knowing your sensitive information is protected.

-

What is the process to eSign the California BOE 571 L with airSlate SignNow?

To eSign the California BOE 571 L with airSlate SignNow, simply upload the document, add the necessary fields for signatures, and invite signers. The process is user-friendly and requires just a few clicks to complete.

Get more for Office Of The Assessor's Business Property Statement, Form 571

- Change order for an amount in addition to the contract price form

- Contractor shall not be responsible form

- Specifications or if the work is called for in the specifications but not displayed on the drawings form

- Direct drainage inc contract no 22 cc 015 direct form

- Crawl space ground cover form

- House to refrigerator form

- Steel valley form

- Electric furnace form

Find out other Office Of The Assessor's Business Property Statement, Form 571

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form