Form 1040 ESPR Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico 2023-2026

Understanding Form 1040 ESPR for Self-Employment and Household Employees in Puerto Rico

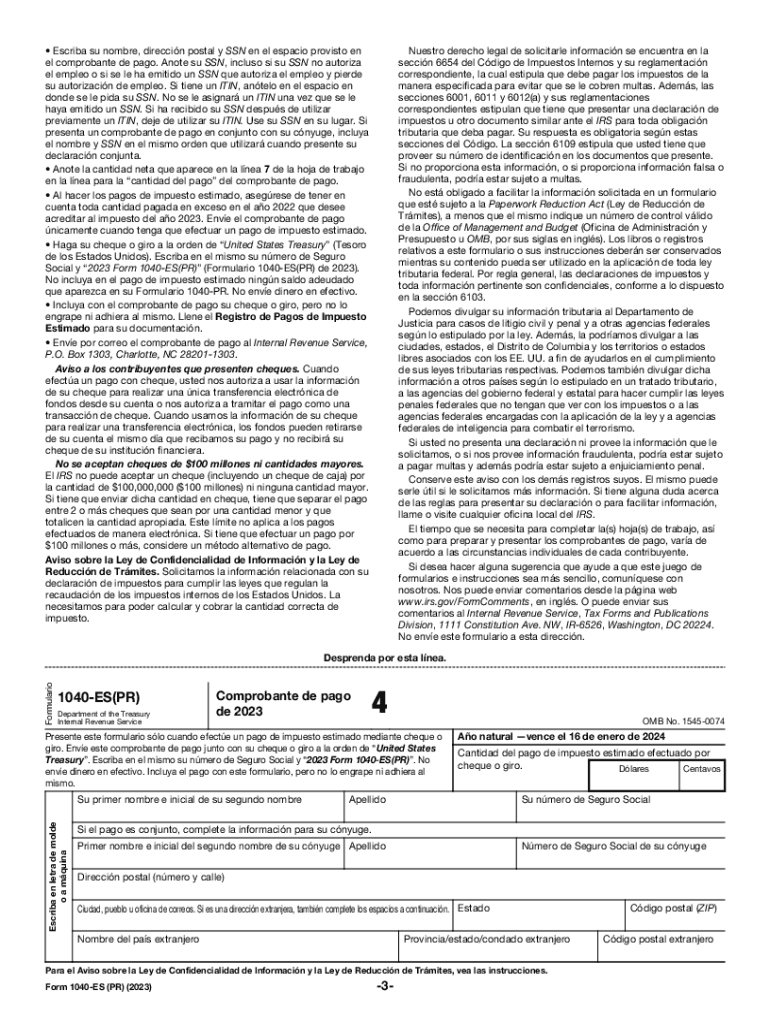

The Form 1040 ESPR is specifically designed for residents of Puerto Rico who need to report estimated federal tax on self-employment income and household employees. This form is crucial for individuals who earn income through self-employment or who employ household workers, as it helps ensure compliance with federal tax obligations. It is important to understand that while Puerto Rico has its own tax system, residents are still required to file federal taxes under certain conditions.

How to Use Form 1040 ESPR

To effectively use the Form 1040 ESPR, individuals must first determine their eligibility based on their income sources. This form should be completed if you are self-employed or have household employees and expect to owe federal taxes. After determining eligibility, gather all necessary financial documents, including income statements and records of expenses. Fill out the form accurately, ensuring all calculations are correct to avoid penalties.

Steps to Complete Form 1040 ESPR

Completing Form 1040 ESPR involves several key steps:

- Gather financial documents, including income statements and expense records.

- Determine your estimated tax liability based on your self-employment income.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form by the appropriate deadline to avoid penalties.

Filing Deadlines for Form 1040 ESPR

It is essential to be aware of the filing deadlines for Form 1040 ESPR to avoid late fees. Typically, the estimated tax payments are due quarterly. For the current tax year, the deadlines usually fall on April 15, June 15, September 15, and January 15 of the following year. However, if these dates fall on a weekend or holiday, the deadline may shift to the next business day. Always check the IRS website for the most current information.

Required Documents for Form 1040 ESPR

When preparing to fill out Form 1040 ESPR, certain documents are necessary:

- Income statements from self-employment activities.

- Records of any household employee wages.

- Documentation of business expenses to support deductions.

- Previous year’s tax returns for reference.

Penalties for Non-Compliance with Form 1040 ESPR

Failure to comply with the requirements of Form 1040 ESPR can result in significant penalties. These may include fines for late payments, interest on unpaid taxes, and potential legal action for continued non-compliance. It is crucial to file the form accurately and on time to avoid these consequences.

Quick guide on how to complete form 1040 espr estimated federal tax on self employment income and on household employees residents of puerto rico

Effortlessly prepare Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can obtain the necessary template and securely lodge it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without holdups. Manage Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

Effortlessly edit and eSign Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico

- Find Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or black out confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to confirm your modifications.

- Select how you wish to send your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and eSign Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 espr estimated federal tax on self employment income and on household employees residents of puerto rico

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico?

Form 1040 ESPR is an essential document for self-employed individuals and employers of household employees in Puerto Rico. It calculates the estimated federal tax owed based on self-employment income and household employment, ensuring compliance with federal tax regulations. Utilizing this form helps avoid penalties and ensures accurate tax filings.

-

How can airSlate SignNow help with Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico?

airSlate SignNow provides a user-friendly platform to securely eSign and manage your tax documents, including Form 1040 ESPR. Our service streamlines the process, ensuring that you can submit your tax forms seamlessly, which is especially important for self-employed residents of Puerto Rico. With airSlate SignNow, you can focus on your business while we simplify your tax management.

-

What are the pricing options for using airSlate SignNow to manage Form 1040 ESPR?

airSlate SignNow offers competitive pricing plans tailored to your needs, ensuring cost-effective solutions for managing your Form 1040 ESPR. You can choose from various subscription options based on the volume of documents and features you require. This flexibility allows both individuals and businesses to access essential tools without overspending.

-

Are there any integrations available for filing Form 1040 ESPR with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software that help manage Form 1040 ESPR. This allows for a smoother workflow, enabling you to import and export data directly, thereby minimizing data entry errors and improving efficiency. These integrations cater to the specific needs of self-employed individuals and household employers in Puerto Rico.

-

What features does airSlate SignNow offer for handling Form 1040 ESPR?

airSlate SignNow includes features such as secure eSigning, document templates, and tracking capabilities specifically designed for handling Form 1040 ESPR. These tools are integral for self-employed individuals and household employers, allowing you to complete and manage tax documents securely and efficiently. Additionally, real-time notifications keep you updated on document status.

-

How does airSlate SignNow ensure the security of my Form 1040 ESPR data?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form 1040 ESPR. Our platform uses advanced encryption protocols and compliance with industry standards to keep your information secure. This ensures that your tax data, including self-employment and household employee information, is protected from unauthorized access.

-

Can I access airSlate SignNow from different devices while managing Form 1040 ESPR?

Absolutely! airSlate SignNow is designed to be accessible from various devices, including desktops, tablets, and smartphones. This flexibility allows you to manage and eSign your Form 1040 ESPR on the go, which is ideal for busy self-employed individuals and household employers in Puerto Rico. Stay productive no matter where you are.

Get more for Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico

- Finders fee agreement template get free sample form

- Acceptance of job offer applicant to business form

- 20 at time at form

- Acceptance of job offer applicant to business reconfirmation of agreements form

- Mutual agreement to arbitrate claims everything you need form

- How to handle employee insubordination form

- Corporation was held on the day of 20 form

- With legal forms

Find out other Form 1040 ESPR Estimated Federal Tax On Self Employment Income And On Household Employees Residents Of Puerto Rico

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format